Accountants Hull: For those of you who are running a business or are self-employed in the Hull area, using the expert services of an accountant can have numerous benefits. Among the many benefits are the fact that you should have extra time to focus on core business operations whilst time consuming and routine bookkeeping can be expertly handled by your accountant. This kind of financial help is vital for any business, but is particularly helpful for start-up businesses. If you've got plans to grow your Hull business you will find an increasing need for good financial advice.

In the Hull area you'll find that there are different sorts of accountant. Check that any potential Hull accountant is suitable for the services that you need. You may have the choice of an accountant who works within a bigger accountancy practice or one who works independently. A firm may employ a number of accountants, each specialising in different disciplines of accounting. With an accountancy company you'll have the choice of: management accountants, accounting technicians, auditors, investment accountants, actuaries, cost accountants, financial accountants, chartered accountants, tax preparation accountants, bookkeepers and forensic accountants.

Finding a properly qualified Hull accountant should be your priority. For basic tax returns an AAT qualified accountant should be sufficient. If you want your self-assessment forms done properly it is worth paying extra for a qualified professional. Your accounting fees can also be claimed as a business expense, thus reducing the cost by at least 20 percent.

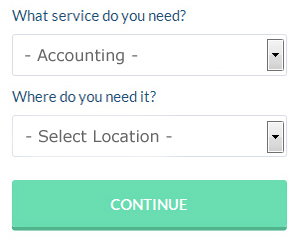

There is an online company called Bark who will do much of the work for you in finding an accountant in Hull. You simply answer a few relevant questions so that they can find the most suitable person for your needs. Then you just have to wait for some prospective accountants to contact you. Bark do not charge people looking for services.

If you think your needs are comparatively simple, using an online tax returns service will be your cheapest option. A number of self-employed people in Hull prefer to use this simple and convenient alternative. Make a short list of such companies and do your homework to find the most reputable. It should be a simple task to find some online reviews to help you make your choice.

If you choose to do your own tax returns there is plenty of help available on the HMRC website. It is also a good idea to make use of some self-assessment software such as Capium, Ajaccts, Ablegatio, Keytime, Taxforward, Forbes, BTCSoftware, Absolute Topup, Andica, Basetax, CalCal, TaxCalc, Gbooks, Xero, GoSimple, Nomisma, ACCTAX, Taxshield, Taxfiler, Sage or 123 e-Filing to simplify the process. You'll receive a fine if your self-assessment is late.

Be Better at Managing Your Money

Business owners, especially the new ones, will find it a struggle to manage their money properly in the early stages of their business. Your confidence can plummet if you fail to manage your money properly. If your business experience cash flow problems, you might find yourself thinking about throwing in the towel and going back to your old job. This, believe it or not, can keep you from reaching the level of success that you want to reach. Use the following tips to help you manage your money better.

Don't wait for the due date to pay your taxes because you may not have the funds to pay by then, especially if you're not a good money manager. You can save yourself the headache by putting a portion of each payment you get in a separate account. Thus, when it's time for you to pay your quarterly taxes, you only need to take the money out from this account and not your current account. You actually save yourself the trouble of wondering where or how you're going to come up with the money. As a business owner, you'll be able to breathe easily each time knowing that you're able to pay your taxes fully and promptly.

Track your expenditures to the penny, and do this in both your personal and professional life. Sure, it's annoying to have to track everything you spend money on but doing this actually has a lot of benefits. This way, you'll be able to see your spending habits. You wouldn't want to be like those people who wonder where their money went. Writing it down helps you see exactly where it is going, and if you are on a tight budget, it can help you identify areas in which you have the potential to save quite a lot. Then there's the benefit of streamlining things when you're completing tax forms.

Be a prompt tax payer. Small business generally have to pay taxes every three months. Taxes can be quite confusing so you might want to make an appointment with your local small business center or even at the IRS so you can get accurate information. Additionally, you can have a professional set up a payment plan for you to ensure that you're paying your taxes promptly and that you're meeting all your business obligation as required by the law. You wouldn't want the IRS to come knocking on your door because you were remiss in paying your taxes.

A lot of things go into proper money management. Proper money management isn't really a simple or basic skill you can master over the weekend. It's something you have to constantly learn over time, particularly if you have a small business. The tips we've shared should help you get started in managing your finances properly. Really, when it comes to self improvement for business, it doesn't get much more basic than learning how to stay on top of your finances.

Auditors Hull

Auditors are professionals who review the fiscal accounts of companies and organisations to substantiate the validity and legality of their financial reports. They offer businesses from fraud, highlight irregularities in accounting methods and, every so often, work as consultants, helping firms to identify ways to boost operational efficiency. For anybody to become an auditor they need to have specified qualifications and be approved by the regulating body for accounting and auditing.

Actuary Hull

Actuaries work within businesses and government departments, to help them foresee long-term financial costs and investment risks. They apply their mathematical expertise to gauge the probability and risk of future happenings and to calculate their effect on a business. An actuary uses mathematics and statistics to assess the fiscal impact of uncertainty and help customers minimise potential risks.

Payroll Services Hull

Staff payrolls can be a challenging area of running a business enterprise in Hull, irrespective of its size. Dealing with staff payrolls requires that all legal requirements in relation to their timing, openness and exactness are observed in all cases.

Not all small businesses have their own in-house financial experts, and a good way to manage employee payrolls is to employ an external Hull accounting company. A payroll accountant will work alongside HMRC, with pensions scheme administrators and oversee BACS payments to make sure your employees are paid punctually, and all mandatory deductions are accurate.

A qualified payroll accountant in Hull will also, in keeping with current legislations, provide P60's at the end of the financial year for every one of your employees. They'll also provide P45 tax forms at the termination of a staff member's contract with your company. (Tags: Payroll Outsourcing Hull, Payroll Accountant Hull, Payroll Services Hull).

Forensic Accountant Hull

When you are looking for an accountant in Hull you'll possibly encounter the phrase "forensic accounting" and be curious about what the differences are between a forensic accountant and a standard accountant. With the word 'forensic' meaning literally "suitable for use in a court of law", you ought to get a clue as to what is involved. Also often known as 'financial forensics' or 'forensic accountancy', it uses investigative skills, accounting and auditing to discover inconsistencies in financial accounts that have been involved in fraud or theft. A few of the larger accounting firms in the Hull area may have independent forensic accounting departments with forensic accountants concentrating on certain kinds of fraud, and may be addressing personal injury claims, bankruptcy, money laundering, insolvency, tax fraud, professional negligence and insurance claims.

Hull accountants will help with partnership registrations, consultancy and systems advice, accounting services for the construction sector, HMRC liaison, debt recovery Hull, pension advice, taxation accounting services in Hull, corporate finance, accounting services for media companies Hull, small business accounting, audit and auditing, mergers and acquisitions, bookkeeping, assurance services Hull, VAT payer registration, management accounts, limited company accounting in Hull, charities, year end accounts Hull, corporation tax, personal tax, consulting services Hull, general accounting services, business planning and support in Hull, partnership accounts, estate planning in Hull, tax preparation Hull, bureau payroll services, National Insurance numbers, VAT returns, cash flow Hull, business advisory and other accounting services in Hull, East Yorkshire. Listed are just an example of the duties that are conducted by local accountants. Hull companies will let you know their entire range of accounting services.

Hull Accounting Services

- Hull Tax Refunds

- Hull Account Management

- Hull Tax Services

- Hull Financial Advice

- Hull Business Accounting

- Hull Bookkeeping

- Hull PAYE Healthchecks

- Hull Personal Taxation

- Hull Tax Investigations

- Hull Tax Returns

- Hull Chartered Accountants

- Hull Debt Recovery

- Hull Tax Advice

- Hull Specialist Tax

Also find accountants in: Wadworth Hill, Sewerby, North Frodingham, Bubwith, Tickton, Ottringham, Youlthorpe, Lelley, Little Weighton, Bielby, Sancton, Haisthorpe, Newport, North Cliffe, Millington, Spaldington, North Ferriby, Anlaby, Winestead, Eastrington, South Cave, Hotham, Kilham, Gribthorpe, Mappleton, Allerthorpe, Wetwang, Great Cowden, Ellerton, Lockington, Everthorpe, Rudston, Wilberfoss, Knedlington, Great Givendale and more.

Accountant Hull

Accountant Hull Accountants Near Me

Accountants Near Me Accountants Hull

Accountants HullMore East Yorkshire Accountants: Cottingham, Bridlington, Goole, Driffield, Hull, Hessle and Beverley.

TOP - Accountants Hull - Financial Advisers

Tax Accountants Hull - Financial Advice Hull - Auditing Hull - Online Accounting Hull - Tax Return Preparation Hull - Self-Assessments Hull - Chartered Accountants Hull - Small Business Accountant Hull - Affordable Accountant Hull