Accountants Southsea: Do you get little else but a spinning head when filling in your annual tax self-assessment form? This is a frequent predicament for lots of others in Southsea, Hampshire. Is the answer perhaps to find yourself a local Southsea professional to do this task on your behalf? It could be the case that doing your own self-assessment is just too challenging. Regular small business accountants in Southsea will most likely charge you about two to three hundred pounds for this service. By utilizing an online service rather than a local Southsea accountant you can save a certain amount of cash.

When searching for a local Southsea accountant, you will notice that there are lots of different types available. Your aim is to choose one that meets your exact requirements. You might have the choice of an accountant who works within a bigger accountancy firm or one who works independently. Within an accounting company there will be experts in distinct disciplines of accounting. It wouldn't be a big surprise to find investment accountants, management accountants, chartered accountants, tax accountants, cost accountants, financial accountants, bookkeepers, auditors, actuaries, forensic accountants and accounting technicians all offering their services within any decent accounting firm.

You should take care to find a properly qualified accountant in Southsea to complete your self-assessment forms correctly and professionally. Ask if they at least have an AAT qualification or higher. Qualified Southsea accountants might charge a bit more but they may also get you the maximum tax savings. The fees for completing your self-assessment tax return are a legitimate business expense and therefore qualify for a tax deduction.

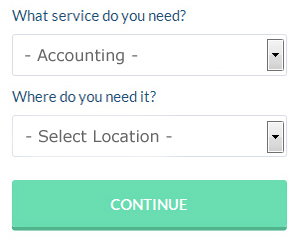

If you don't have the time to do a proper online search for local accountants, try using the Bark website. In no time at all you can fill out the job form and submit it with a single click. Within a few hours you should hear from some local accountants who are willing to help you.

While using a qualified accountant is recommended, you could still opt for an online tax returns service which will be quite a bit cheaper. An increasing number of self-employed people are plumping for this option. Choose a company with a history of good service. Study online reviews so that you can get an overview of the services available.

If you choose to do your own tax returns there is plenty of help available on the HMRC website. To make life even easier there is some intuitive software that you can use. Including BTCSoftware, Ablegatio, ACCTAX, CalCal, Xero, Gbooks, Andica, Sage, Taxfiler, GoSimple, Absolute Topup, Basetax, Keytime, Nomisma, Taxforward, Taxshield, 123 e-Filing, Ajaccts, Capium, TaxCalc and Forbes. Whatever happens you need to get your self-assessment form in on time.

Small Business Accountants Southsea

Doing the yearly accounts can be a fairly stressful experience for anybody running a small business in Southsea. A dedicated small business accountant in Southsea will provide you with a hassle-free means to keep your VAT, annual accounts and tax returns in the best possible order.

A knowledgeable small business accountant in Southsea will consider that it's their responsibility to help develop your business, and offer you reliable financial guidance for peace of mind and security in your specific situation. The vagaries and complex world of business taxation will be clearly explained to you so as to minimise your business costs, while at the same time maximising tax efficiency.

You should also be offered an assigned accountancy manager who understands your business structure, your company's situation and your plans for the future. (Tags: Small Business Accountant Southsea, Small Business Accountants Southsea, Small Business Accounting Southsea).

Financial Actuaries Southsea

An actuary is a business specialist who analyses the managing and measurement of uncertainty and risk. An actuary applies statistical and financial concepts to assess the chance of a specific event occurring and the potential financial implications. Actuaries supply assessments of financial security systems, with a focus on their complexity, their mathematics and their mechanisms. (Tags: Actuary Southsea, Actuaries Southsea, Financial Actuaries Southsea)

You can Improve Yourself and Your Business by Learning How to Manage Your Money Better

When it comes to putting up your own business, it's easy to make the decision but hard to start it up if you have no clue. Even harder is to get your business going. It is most difficult to make your business profitable because there are so many things that can take place along the way that will not just negatively affect your business but your confidence level as well. For instance, if you don't manage your finances properly, this can hurt you and your business. Money management may not be something you've really given much thought too because figuring out your finances is pretty simple -- in the beginning stages of your business. But as you grow your business, the money management aspect is only going to become more complex so it's a good idea to keep the following tips in mind.

Keep separate accounts for your business and personal expenses, as trying to run everything through one account just makes everything confusing. Sure, it may seem easy to manage your finances, personal and business, if you just have one account right now, but when your business really takes off, you're going to wish you had a separate account. When your business expenses are running through your personal account, it can be very confusing and difficult to prove your income. When it's time for you to file your taxes, it'll be a nightmare to sort through your financial records and identifying just which expenses went to your business and which ones went for personal things like groceries, utilities, and such. Streamline your process with two accounts.

Learning a little bit about bookkeeping helps a lot. It's important that you have a system in place for your money -- both for your personal and business finances. You can set up your system using a basic spreadsheet or get yourself a bookkeeping software like QuickBooks or Quicken. You could also try to use a personal budgeting tool like Mint.com. If you need help in managing your bookkeeping, all you need to to is go online and you'll find lots of free resources. Your books are your key to truly understanding your money because they help you see what is happening with your business (and personal) finances. And if you just can't afford to pay for a full-time bookkeeper for your small business, it'll serve you well to take a basic accounting and bookkeeping class at your community college.

Take control of your spending. It's understandable that now you've got money coming in, you'll want to start spending money on things you were never able to afford in the past. However, you need to resist this urge. Instead, spend only on things necessary to keep your business up and running. It's better to build up your business savings so that you can handle unexpected expenses than it is to splurge every time you have the chance. You'll also be able to save money on office supplies if you buy in bulk. Invest in reliable computing equipment so you won't have to replace it all the time. You'll also need to be careful about how much money you spend on entertainment.

There are so many different things that go into helping you properly manage your money. You might think that this is a basic skill and it shouldn't be that complicated, but the truth is that as a small business owner, proper money management is an intricate and often complicated process. Use the tips in this article to help you keep track of everything. One of the secrets to having a successful business is learning proper money management.

Auditors Southsea

An auditor is a person or company brought in by an organisation or firm to complete an audit, which is the official evaluation of an organisation's financial accounts, typically by an independent body. They protect businesses from fraud, discover inaccuracies in accounting techniques and, occasionally, work as consultants, helping firms to determine ways to maximize efficiency. For anybody to become an auditor they need to have certain specified qualifications and be licensed by the regulatory authority for auditing and accounting. (Tags: Auditors Southsea, Auditor Southsea, Auditing Southsea)

Southsea accountants will help with debt recovery, financial statements Southsea, partnership accounts in Southsea, small business accounting, audit and compliance issues in Southsea, PAYE, charities, consulting services, contractor accounts Southsea, HMRC submissions, tax preparation, assurance services, HMRC liaison in Southsea, monthly payroll, business start-ups, cash flow, accounting services for the construction sector, workplace pensions, financial planning Southsea, company secretarial services, consultancy and systems advice, accounting services for buy to let rentals, taxation accounting services Southsea, double entry accounting Southsea, VAT returns Southsea, payslips, estate planning Southsea, employment law, self-employed registration in Southsea, pension forecasts, bookkeeping, VAT payer registration and other kinds of accounting in Southsea, Hampshire. These are just a few of the tasks that are accomplished by nearby accountants. Southsea providers will be happy to inform you of their whole range of accountancy services.

With the world wide web as a useful resource it is of course very easy to find lots of valuable ideas and information concerning self-assessment help, personal tax assistance, auditing & accounting and small business accounting. To illustrate, with a quick search we located this engaging article describing choosing an accountant.

Southsea Accounting Services

- Southsea Tax Planning

- Southsea Tax Returns

- Southsea Account Management

- Southsea Payroll Services

- Southsea Specialist Tax

- Southsea Tax Refunds

- Southsea Self-Assessment

- Southsea PAYE Healthchecks

- Southsea VAT Returns

- Southsea Bookkeepers

- Southsea Tax Advice

- Southsea Tax Services

- Southsea Tax Investigations

- Southsea Auditing

Also find accountants in: Fleet, Langrish, Tangley, Wootton, Sparsholt, Horton Heath, Newtown, Hardway, Minley Manor, Chilbolton, Ripley, Old Basing, North Charford, Hursley, Compton, Bisterne Close, Hazeley, East Tisted, Keyhaven, Fareham, Netley, Leckford, Eversley, Lockerley, Newton Stacey, Fyfield, Picket Post, Breamore, Middleton, Ropley, East Dean, Hedge End, Southwick, Burridge, Upper Wootton and more.

Accountant Southsea

Accountant Southsea Accountants Near Me

Accountants Near Me Accountants Southsea

Accountants SouthseaMore Hampshire Accountants: Hythe, Andover, Basingstoke, Farnborough, Eastleigh, Hedge End, New Milton, Fleet, Waterlooville, Southsea, Yateley, Emsworth, Portsmouth, Horndean, Havant, Winchester, Alton, Totton, Southampton, Fareham, Gosport, Aldershot and Stubbington.

TOP - Accountants Southsea - Financial Advisers

Investment Accountant Southsea - Tax Preparation Southsea - Auditors Southsea - Bookkeeping Southsea - Financial Accountants Southsea - Tax Advice Southsea - Affordable Accountant Southsea - Small Business Accountants Southsea - Chartered Accountant Southsea