Accountants Kingston upon Thames: Is the only "reward" for completing your yearly self-assessment form a banging headache? Many other people in Kingston upon Thames have to overcome this very problem. You may instead opt to hire a qualified Kingston upon Thames accountant to take this load off your shoulders. Do you find self-assessment just too taxing to tackle on your own? Regular small business accountants in Kingston upon Thames will probably charge you about two to three hundred pounds for such a service. By utilizing an online service rather than a local Kingston upon Thames accountant you can save quite a bit of cash.

With various different kinds of accountants advertising in Kingston upon Thames it can be a bit confusing. Therefore, choosing the right one for your business is crucial. It is possible that you might prefer to work with an accountant who is working within a local Kingston upon Thames accounting company, as opposed to one that works by himself/herself. The different accounting disciplines can be better covered by an accounting practice with several experts in one office. Some of the principal accountancy posts include the likes of: chartered accountants, tax accountants, accounting technicians, actuaries, investment accountants, bookkeepers, management accountants, financial accountants, forensic accountants, costing accountants and auditors.

In order to have your tax returns done effectively, it's advisable to use an accountant who does have the appropriate qualifications. Ask if they at least have an AAT qualification or higher. If you want your self-assessment forms done properly it is worth paying extra for a qualified professional. Remember that a percentage of your accounting costs can be claimed back on the tax return.

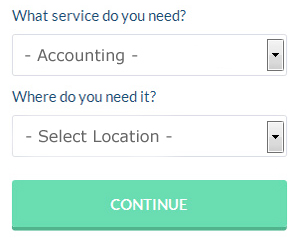

To save yourself a bit of time when searching for a reliable Kingston upon Thames accountant online, you might like to try a service called Bark. It is just a case of ticking some boxes on a form. Sometimes in as little as a couple of hours you will hear from prospective Kingston upon Thames accountants who are keen to get to work for you.

While using a qualified accountant is recommended, you could still opt for an online tax returns service which will be quite a bit cheaper. This kind of service may not suit everyone but could be the answer for your needs. Do a bit of research to find a reputable company. A good method for doing this is to check out any available customer reviews and testimonials. Sorry, but we cannot give any recommendations in this respect.

It is actually not that difficult to do your own tax return, HMRC even has a series of You Tube videos to help you. The process can be simplified even further by the use of software such as CalCal, Ajaccts, GoSimple, Xero, Taxshield, BTCSoftware, Forbes, Basetax, Nomisma, TaxCalc, 123 e-Filing, Gbooks, Andica, Taxforward, Taxfiler, Sage, Absolute Topup, Ablegatio, ACCTAX, Keytime or Capium. If you don't get your self-assessment in on time you will get fined by HMRC. You will receive a fine of £100 if you are up to three months late with your tax return.

Self Improvement for Business Through Better Money Management

Whether you're starting up an online or offline business, it can be one of the most exciting things you'd ever do. When you're a business owner, you're your own boss and in control of your income. It can be kind of scary, can't it? Although it's exhilarating, putting up your own business is also an intimidating process, especially if you're a complete novice. Thus, it can be very helpful if you know a few self-improvement strategies like managing your finances properly. Keep reading this article to learn how to correctly manage your money.

It's best if you have separate account for your personal expenses and business expenses. This will help minimize confusion. You may not have problems in the beginning, but you can expect to have a hard time down the road. And here's the thing -- if you run your business expenses through your personal account, it'll be a lot harder to prove your income. In addition, it will be difficult to sort through your financial record when tax season comes and figure out which expenses are business related and which expenses were personal in nature. It's better if you streamline your finances by separating your business expenses from your personal expenses.

It's a good idea to know where exactly every cent goes in both your business and personal life. You might balk at the idea of this but it does present a number of advantages. With this money management strategy, you can have a clear picture of just what your spending habits are. Nobody likes that feeling of "I know I'm earning money, where is it going?" When you write all your personal and business expenditures, you won't ever have to wonder where your money is going. And when you're creating a budget, you can pinpoint those places where you're spending unnecessarily, cut back on them, and save yourself money in the process. You're also streamlining things when you're completing your tax forms when you have a complete, detailed record of your business and personal expenditures.

If you deal with cash in any capacity, make sure that you deposit that cash every day, as keeping cash on hand is just too tempting. You might need a few extra bucks to pay for lunch and you might think, "oh I'll put this back in a couple of days." It's actually very easy to forget to put the money back in and if you keep doing this, you'll soon screw up your books. So when you close up shop at the end of each day, it's best if you deposit your cash to the bank each time.

Proper money management is one of the best things you can learn both for your own self improvement and for self improvement in your business. Try to implement these tips we've shared because you stand to benefit in the long run. You're in a much better position for business and personal success when you know how to manage your finances better.

Financial Actuaries Kingston upon Thames

An actuary manages, evaluates and advises on financial risks. They apply their wide-ranging knowledge of economics and business, in conjunction with their understanding of probability theory, statistics and investment theory, to provide strategic, commercial and financial guidance. Actuaries provide assessments of financial security systems, with a focus on their mechanisms, mathematics and complexity. (Tags: Actuary Kingston upon Thames, Actuaries Kingston upon Thames, Financial Actuary Kingston upon Thames)

Auditors Kingston upon Thames

An auditor is a person or company brought in to assess and verify the reliability of financial accounts and make certain that organisations or businesses observe tax legislation. They also often undertake a consultative role to advocate potential the prevention of risk and the introduction of cost savings. To act as an auditor, an individual must be approved by the regulating authority for auditing and accounting or possess certain specific qualifications.

Kingston upon Thames accountants will help with estate planning, general accounting services, accounting and financial advice in Kingston upon Thames, accounting services for the construction sector, accounting services for start-ups Kingston upon Thames, financial statements in Kingston upon Thames, limited company accounting, investment reviews, small business accounting in Kingston upon Thames, PAYE, personal tax, bookkeeping Kingston upon Thames, self-employed registration, auditing and accounting in Kingston upon Thames, year end accounts in Kingston upon Thames, partnership registration, capital gains tax Kingston upon Thames, debt recovery, annual tax returns Kingston upon Thames, inheritance tax, retirement advice, accounting support services Kingston upon Thames, business planning and support, mergers and acquisitions in Kingston upon Thames, financial planning, tax investigations, bureau payroll services Kingston upon Thames, litigation support, workplace pensions, taxation accounting services Kingston upon Thames, assurance services Kingston upon Thames, accounting services for media companies and other kinds of accounting in Kingston upon Thames, Greater London. These are just an example of the activities that are conducted by local accountants. Kingston upon Thames companies will tell you about their full range of accounting services.

Kingston upon Thames Accounting Services

- Kingston upon Thames Bookkeeping Healthchecks

- Kingston upon Thames Tax Planning

- Kingston upon Thames Financial Advice

- Kingston upon Thames Account Management

- Kingston upon Thames Chartered Accountants

- Kingston upon Thames VAT Returns

- Kingston upon Thames Tax Services

- Kingston upon Thames Personal Taxation

- Kingston upon Thames Forensic Accounting

- Kingston upon Thames Tax Refunds

- Kingston upon Thames Debt Recovery

- Kingston upon Thames Tax Investigations

- Kingston upon Thames Specialist Tax

- Kingston upon Thames Business Accounting

Also find accountants in: Coldharbour, Billingsgate, Westminster Bridge, Barnsbury, Ealing Common, Tolworth, Brent Cross, Harmondsworth, Avery Hill, St Pauls, East Barnet, Coldblow, Kingsbury, Island Gardens, High Barnet, Sipson, Dalston, Borough, Covent Garden, Bostall Woods, London Wall, Leytonstone, New Southgate, Palmers Green, Brixton, Longford, Holland Park, Peckham Rye, Northwood, Alperton, Kingsland, Golders Hill Park, Marble Hill, Belsize Park, Notting Hill Gate and more.

Accountant Kingston upon Thames

Accountant Kingston upon Thames Accountants Near Me

Accountants Near Me Accountants Kingston upon Thames

Accountants Kingston upon ThamesMore Greater London Accountants: Richmond upon Thames, Enfield, Bexley, Greenwich, London, Bromley, Croydon, Harrow, Hounslow, Kingston upon Thames, Barnet and Ealing.

TOP - Accountants Kingston upon Thames - Financial Advisers

Auditors Kingston upon Thames - Investment Accountant Kingston upon Thames - Financial Accountants Kingston upon Thames - Cheap Accountant Kingston upon Thames - Tax Preparation Kingston upon Thames - Small Business Accountants Kingston upon Thames - Financial Advice Kingston upon Thames - Chartered Accountants Kingston upon Thames - Online Accounting Kingston upon Thames