Accountants Yarm: For those of you who are self-employed in Yarm, a major nightmare every year is filling out your annual self-assessment form. You and lots of other people in Yarm have to face this every year. But how can you find a local accountant in Yarm to do it for you? Maybe self-assessment is just too challenging for you? Regular small business accountants in Yarm will likely charge approximately two to three hundred pounds for this service. Those looking for cheaper rates normally look to online tax return services.

So, where is the best place to locate a professional Yarm accountant and what sort of service should you expect to receive? These days most folks start their search for an accountant or any other service on the net. However, which of these prospects will you be able to put your trust in? In the British Isles there aren't any legal restrictions on who can and can't offer accounting and bookkeeping services. They don't need a degree or even appropriate qualifications like BTEC's or A Levels. Which, when considering the importance of the work would appear a tad crazy.

It is best to find an accountant who can demostrate that he/she has the desired qualifications. An AAT qualified accountant should be adequate for sole traders and small businesses. Even if you have to pay a bit more for the priviledge, you can be confident that your self-assessment form is being completed accurately. The accountants fees will count as a tax deductable expense, saving you a percentage of the costs. It is perfectly acceptable to use a qualified bookkeeper in Yarm if you are a sole trader or a smaller business.

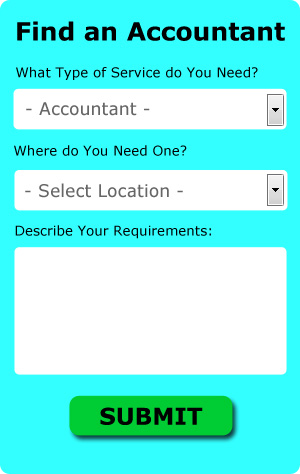

Not to be confused with online services who will do your tax returns for you, a company called Bark will assist you in finding a decent Yarm accountant. With Bark it is simply a process of ticking a few boxes and submitting a form. All you have to do then is wait for some responses.

If you feel comfortable doing everything by post and email you might consider using one of the many online tax returns services. This may save time and be more cost-effective for self-employed people in Yarm. Do some homework to single out a company with a good reputation. Study reviews and customer feedback.

Self-assessment really isn't as difficult as most people think it is, so why not try doing it yourself? There is also lots of software available to help you with your returns. These include Ajaccts, Taxfiler, ACCTAX, 123 e-Filing, GoSimple, BTCSoftware, Forbes, Xero, Taxforward, Keytime, Capium, Absolute Topup, Nomisma, Ablegatio, CalCal, Taxshield, Basetax, Gbooks, Andica, TaxCalc and Sage. The deadline for self-assessment is October 31st for paper returns and January 31st for online returns. You can expect a fine of £100 if your assessment is in even 1 day late.

Self Improvement for Your Business Through Proper Money Management

If you've just launched your business, you'll find out soon enough that properly using money management strategies is not that easy to learn. Money management seems like one of those things that you should have the ability to do already. The truth is that business budgeting and financial planning is quite a lot different from personal budgeting and financial planning (though having experience in the latter can help with the former). Many business owners who have ruined their financial situation accidentally end up having no self-confidence at all. There are many things you can do to properly manage business finances and we'll share just a few of them in this article.

It could be that you use your credit card to pay many of your regular expenditures like web hosting, recurring membership fees, advertising accounts, and so on. With this method, you don't need to make multiple payment and risk forgetting to pay any one of them on time. But then again, there's a risk to using credit cards because you'll end up paying interest if you don't pay the balance off in full every month. Sure, you can keep putting your monthly expenditures on your credit card, but if you do, you should pay the balance in full each month. In addition to making it simpler for you to pay your expenses and avoid paying interest, you're building your credit rating.

Even if you're the only person running your business, earmark a salary for yourself and then issue yourself a paycheck regularly. This makes the process of accounting your personal and business life so much easier. Your business account should be where all the payments you get for the sale of your products or services should go. Then on a weekly, bi-weekly, or monthly basis, you can pay yourself out of your business account. You decide the salary for yourself. Your salary can be a portion of how much your business brought in for the month or it can be based on how many hours you worked.

Control your spending. When your business is steadily pulling in a nice income, you may be tempted to go on a buying spree and buy all those things you've always wanted to buy but couldn't afford. However, you need to resist this urge. Instead, spend only on things necessary to keep your business up and running. You'll be better off building your business savings than splurging whenever you get the chance. This way, you're in a better position to deal with unexpected expenses in a timely manner. You should also try buying your business supplies in bulk. Invest in reliable computing equipment so you won't have to replace it all the time. You'll also need to be careful about how much money you spend on entertainment.

When you know the right way to manage your finances, you can expect not just your business to improve but yourself overall as well. The ones we've mentioned in this article are only a few of many other proper money management tips out there that will help you in keeping track of your finances better. You're in a much better position for business and personal success when you know how to manage your finances better.

Forensic Accounting Yarm

When you are searching for an accountant in Yarm you will possibly run into the term "forensic accounting" and be curious about what the differences are between a standard accountant and a forensic accountant. The word 'forensic' is the thing that gives a clue, meaning literally "relating to or denoting the application of scientific methods and techniques to the investigation of criminal activity." Sometimes also known as 'financial forensics' or 'forensic accountancy', it uses investigative skills, auditing and accounting to dig through financial accounts so as to identify criminal activity and fraud. There are even several larger accountants firms throughout North Yorkshire who've got dedicated sections for forensic accounting, investigating money laundering, insurance claims, tax fraud, professional negligence, bankruptcy, insolvency and personal injury claims. (Tags: Forensic Accountants Yarm, Forensic Accountant Yarm, Forensic Accounting Yarm)

Auditors Yarm

An auditor is a person or a firm appointed by a company or organisation to complete an audit, which is the official evaluation of an organisation's financial accounts, usually by an unbiased body. They also often act as advisors to encourage potential the prevention of risk and the implementation of financial savings. Auditors have to be licensed by the regulatory authority for accounting and auditing and also have the necessary qualifications.

Yarm accountants will help with investment reviews Yarm, estate planning in Yarm, HMRC liaison, VAT registration, capital gains tax, business outsourcing, small business accounting Yarm, corporation tax Yarm, management accounts, PAYE, accounting services for the construction industry Yarm, taxation accounting services in Yarm, tax investigations, partnership accounts, business acquisition and disposal in Yarm, business advisory services, National Insurance numbers, audit and compliance reports in Yarm, corporate finance in Yarm, financial statements, litigation support, charities in Yarm, company formations, tax returns, mergers and acquisitions, bureau payroll services, auditing and accounting in Yarm, general accounting services, business support and planning, sole traders, tax preparation, year end accounts Yarm and other professional accounting services in Yarm, North Yorkshire. These are just a handful of the duties that are undertaken by local accountants. Yarm companies will inform you of their full range of services.

Using the world wide web as a powerful resource it is of course quite easy to uncover plenty of invaluable ideas and information relating to accounting for small businesses, personal tax assistance, self-assessment help and accounting & auditing. For instance, with a quick search we located this interesting article about how to find a reliable accountant.

Yarm Accounting Services

- Yarm Tax Planning

- Yarm PAYE Healthchecks

- Yarm Payroll Management

- Yarm Tax Advice

- Yarm Tax Returns

- Yarm Forensic Accounting

- Yarm Account Management

- Yarm Chartered Accountants

- Yarm Bookkeeping

- Yarm Tax Services

- Yarm Personal Taxation

- Yarm VAT Returns

- Yarm Financial Advice

- Yarm Bookkeeping Healthchecks

Also find accountants in: Brawby, Yockenthwaite, Little Ouseburn, Oaktree Hill, Wharram Percy, West Tanfield, Hackforth, Langton, Goathland, Hutton Rudby, Ilton, Streetlam, Upsall, Hunmanby, Thirn, Whenby, Kirby Hill, West Heslerton, Ormesby, Summer Bridge, Thoralby, Silpho, Scotch Corner, Little Barugh, Kirby Sigston, Appleton Le Moors, Newsham, Kirkby Overblow, Butterwick, Healaugh, Whitley, Kirby Knowle, Hanlith, Netherby, Ugthorpe and more.

Accountant Yarm

Accountant Yarm Accountants Near Yarm

Accountants Near Yarm Accountants Yarm

Accountants YarmMore North Yorkshire Accountants: Knaresborough, York, Ripon, Thornaby, Harrogate, Selby, Whitby, Yarm, Northallerton, Middlesbrough, Scarborough, Redcar, Guisborough and Skipton.

TOP - Accountants Yarm - Financial Advisers

Bookkeeping Yarm - Self-Assessments Yarm - Small Business Accountant Yarm - Auditing Yarm - Tax Return Preparation Yarm - Chartered Accountants Yarm - Financial Accountants Yarm - Tax Accountants Yarm - Financial Advice Yarm