Accountants Manningtree: Filling in your self-assessment form each year can really put your head in a spin. This will be an issue for you, as well as countless other people in Manningtree, Essex. Is it a better idea to get someone else to do this task for you? If you find self-assessment too taxing, this could be much better for you. You can typically get this done by Manningtree High Street accountants for something like £200-£300. By making use of one of the many online services you should be able to get a cheaper deal.

Now you have to work out where to find an accountant, what to expect, and how much should you pay? The internet is definitely the "in" place to look these days, so that would certainly be a good place to begin. But, are they all trustworthy? Don't forget that anybody who is so inclined can set themselves up as an accountant in Manningtree. No formal qualifications are required in order to do this.

If you want your tax returns to be correct and error free it might be better to opt for a professional Manningtree accountant who is appropriately qualified. You don't need a chartered accountant but should get one who is at least AAT qualified. Qualified accountants may come with higher costs but may also save you more tax. Make sure that you include the accountants fees in your expenses, because these are tax deductable. Sole traders in Manningtree may find that qualified bookkeepers are just as able to do their tax returns.

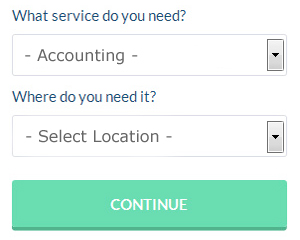

To save yourself a bit of time when searching for a reliable Manningtree accountant online, you might like to try a service called Bark. Filling in a clear and simple form is all that you need to do to set the process in motion. Shortly you can expect to be contacted by suitable accountants who can help you with your self-assessment. Why not give Bark a try since there is no charge for this useful service.

A more cost-effective solution for those with straightforward tax returns would be to use an online self-assessment service. While not recommended in every case, it could be the ideal solution for you. You still need to do your homework to pick out a company you can trust. It should be a simple task to find some online reviews to help you make your choice.

There is always the option of using a chartered accountant, but expect to pay top wack for these high flyers. The services these specialists provide are perhaps beyond the needs of the smaller business in Manningtree. Some people might say, you should hire the best you can afford.

If you decide to bite the bullet and tackle the process by yourself there is lots of help on offer. To make life even easier there is some intuitive software that you can use. Including ACCTAX, Forbes, TaxCalc, Nomisma, Capium, Keytime, Ajaccts, 123 e-Filing, Andica, Xero, Taxforward, Ablegatio, Absolute Topup, Sage, BTCSoftware, Gbooks, Basetax, Taxshield, Taxfiler, GoSimple and CalCal. The most important thing is to make sure your self-assessment is sent in promptly. The standard fine for being up to three months late is £100.

Forensic Accountant Manningtree

You might well run into the phrase "forensic accounting" when you're looking for an accountant in Manningtree, and will no doubt be wondering what is the distinction between regular accounting and forensic accounting. With the word 'forensic' literally meaning "appropriate for use in a court of law", you will get a clue as to exactly what is involved. Also often known as 'financial forensics' or 'forensic accountancy', it uses auditing, investigative skills and accounting to detect inconsistencies in financial accounts which have resulted in fraud or theft. There are a few bigger accountants firms in Essex who have specialist sections for forensic accounting, investigating professional negligence, personal injury claims, tax fraud, money laundering, false insurance claims, insolvency and bankruptcy. (Tags: Forensic Accountant Manningtree, Forensic Accounting Manningtree, Forensic Accountants Manningtree)

Self Improvement for Your Business Through Proper Money Management

If you're a new business owner, you'll discover that managing your money properly is one of those things you will struggle with sooner or later. Your self-confidence could be hard hit and should your business have some cash flow issues, you just might find yourself contemplating about going back to a regular job. When this happens, it stops you from achieving the kind of success you want for yourself and your business. You can be a good money manager with the help of the following tips.

Have an account that's just for your business expenses and another for your personal expenses. Sure, it may seem easy to manage your finances, personal and business, if you just have one account right now, but when your business really takes off, you're going to wish you had a separate account. And here's the thing -- if you run your business expenses through your personal account, it'll be a lot harder to prove your income. Moreover, come tax season, you'll be in for a tough time proving which expenses were business related and which ones were personal. Streamline your process with two accounts.

Offer your clients payment plans. Besides making it more appealing for potential clients to do business with you, this strategy will have money coming in on a regular basis. Steady, regular payments, even if they're small, is a lot better than big payments that come in sporadically and you don't know when exactly they're going to come. Basically, you can easily make a budget and pay your bills promptly if you've got reliable income. This can actually help build your confidence.

Make sure you deposit any money you receive at the end of the day if your business deals with cash on a fairly regular basis. This will help you eliminate the temptation of using money for non-business related things. You might need a few extra bucks to pay for lunch and you might think, "oh I'll put this back in a couple of days." But with cash, it is easy to forget about things like that, so remove the temptation to screw up your book keeping and accounting. So when you close up shop at the end of each day, it's best if you deposit your cash to the bank each time.

You can improve yourself in many ways when you're managing your own business. Having a business can help you hone your money management skills. Everybody wishes that they could be better with money. Learning how to manage, plan a budget your money can do quite a lot for your confidence. In addition, it becomes easier to organize most areas of your professional and personal life. Managing your money for your business shouldn't be a difficult or overwhelming task. Try to use the tips we've shared in this article.

Auditors Manningtree

An auditor is an individual sanctioned to evaluate and authenticate the accuracy of financial records to ensure that businesses adhere to tax laws. They also often take on a consultative role to encourage potential risk prevention measures and the implementation of cost reductions. Auditors have to be authorised by the regulatory body for accounting and auditing and also have the required qualifications. (Tags: Auditors Manningtree, Auditing Manningtree, Auditor Manningtree)

Payroll Services Manningtree

For any business in Manningtree, from independent contractors to large scale organisations, dealing with staff payrolls can be stressful. The legislation concerning payrolls and the legal obligations for accuracy and transparency means that dealing with a business's payroll can be a daunting task.

Small businesses may not have their own in-house financial experts, and an easy way to manage employee payrolls is to retain the services of an outside Manningtree accounting firm. The payroll service will work alongside HMRC and pension providers, and oversee BACS transfers to ensure accurate and timely wage payment to all staff.

Following current regulations, a dedicated payroll management accountant in Manningtree will also present each of your staff members with a P60 at the conclusion of each financial year. They'll also provide P45 tax forms at the end of an employee's contract. (Tags: Payroll Companies Manningtree, Payroll Services Manningtree, Payroll Accountants Manningtree).

Manningtree accountants will help with employment law, tax returns, tax preparation in Manningtree, litigation support, corporate tax, HMRC submissions, personal tax Manningtree, financial planning, business support and planning in Manningtree, charities in Manningtree, business outsourcing Manningtree, VAT returns Manningtree, consulting services, company secretarial services in Manningtree, sole traders, small business accounting, accounting and financial advice, audit and compliance issues, corporate finance Manningtree, National Insurance numbers, audit and auditing Manningtree, VAT registration, self-employed registration, PAYE Manningtree, tax investigations Manningtree, financial statements, company formations, assurance services, capital gains tax Manningtree, consultancy and systems advice, accounting services for buy to let rentals, mergers and acquisitions in Manningtree and other kinds of accounting in Manningtree, Essex. These are just a selection of the duties that are carried out by nearby accountants. Manningtree companies will be happy to inform you of their full range of services.

Manningtree Accounting Services

- Manningtree Tax Returns

- Manningtree Tax Refunds

- Manningtree VAT Returns

- Manningtree Payroll Services

- Manningtree Bookkeeping Healthchecks

- Manningtree Chartered Accountants

- Manningtree Business Planning

- Manningtree Auditing

- Manningtree PAYE Healthchecks

- Manningtree Business Accounting

- Manningtree Personal Taxation

- Manningtree Bookkeeping

- Manningtree Self-Assessment

- Manningtree Specialist Tax

Also find accountants in: Ashen, Fobbing, Great Totham, Cock Clarks, Vange, Earls Colne, Weir, Stones Green, Ranks Green, Writtle, Horsleycross Street, Little End, Shelley, Wimbish, Hardys Green, Langham, Pebmarsh, Lower Nazeing, Pickerells, Little Sampford, Baythorn End, Hope End Green, Sewards End, Hawkwell, Little Baddow, Shrub End, Wickham Bishops, Steeple, Thorpe Bay, Horkesley Heath, Middleton, Great Clacton, Little Walden, High Ongar, Old Heath and more.

Accountant Manningtree

Accountant Manningtree Accountants Near Manningtree

Accountants Near Manningtree Accountants Manningtree

Accountants ManningtreeMore Essex Accountants: Epping, Danbury, Galleywood, Great Baddow, Chigwell, Southchurch, Parkeston, Coggeshall, Burnham-on-Crouch, Billericay, Stanway, Chafford Hundred, Tiptree, Southend-on-Sea, Shoeburyness, Holland-on-Sea, West Thurrock, Purfleet, Upminster, Leigh-on-Sea, Clacton-on-Sea, Westcliff-on-Sea, Wivenhoe, Brightlingsea, South Woodham Ferrers, Halstead, South Ockendon, Harlow, South Benfleet, Buckhurst Hill, Laindon, Harwich, Grays, Barking, Stansted Mountfitchet, Chelmsford, Waltham Abbey, Manningtree, Rayleigh, Braintree, Great Wakering, Chipping Ongar, Canvey Island, Rainham, Dagenham, Ilford, Chingford, Langdon Hills, Saffron Walden, Brentwood, Loughton, Rochford, Hadleigh, Hullbridge, Great Dunmow, Tilbury, Southminster, Stanford-le-Hope, Colchester, Heybridge, Witham, Frinton-on-Sea, Maldon, Writtle, Pitsea, Wickford, Hockley, North Weald Bassett, West Mersea, Corringham, Walton-on-the-Naze, Basildon, Ingatestone, Hornchurch, Romford and Hawkwell.

TOP - Accountants Manningtree - Financial Advisers

Chartered Accountants Manningtree - Cheap Accountant Manningtree - Online Accounting Manningtree - Financial Accountants Manningtree - Tax Preparation Manningtree - Small Business Accountants Manningtree - Tax Advice Manningtree - Bookkeeping Manningtree - Auditing Manningtree