Accountants West Kingsdown: Having an accountant on board can be extremely beneficial to anybody who is self-employed or running a business in West Kingsdown. Your accountant should at the minimum be able to free up some time for you by handling aspects like payroll, self-assessment tax returns and bookkeeping. Businesses of all types and sizes can benefit from an accountant's expertise but for newer businesses it could be even more important. Having regular access to this sort of professional assistance should permit you to grow your West Kingsdown business.

You'll find many different types of accountants in the West Kingsdown area. Therefore, picking the right one for your company is important. Yet another decision that you'll need to make is whether to go for an accounting firm or a lone wolf accountant. The advantage of accounting firms is that they've got many fields of expertise under one roof. The level of specialization within an accountancy firm could include financial accountants, auditors, accounting technicians, tax preparation accountants, management accountants, costing accountants, forensic accountants, bookkeepers, chartered accountants, investment accountants and actuaries.

If you want your tax returns to be correct and error free it might be better to opt for a professional West Kingsdown accountant who is appropriately qualified. For basic tax returns an AAT qualified accountant should be sufficient. You can then have peace of mind knowing that your tax affairs are being handled professionally. Remember that a percentage of your accounting costs can be claimed back on the tax return.

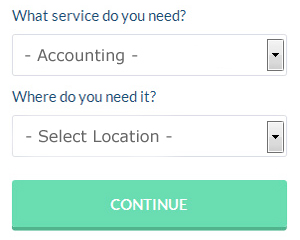

There is an online company called Bark who will do much of the work for you in finding an accountant in West Kingsdown. It is just a case of ticking some boxes on a form. Sometimes in as little as a couple of hours you will hear from prospective West Kingsdown accountants who are keen to get to work for you.

If you are not worried about dealing with someone face to face, using an online tax returns service might be suitable and cheaper for you. Services like this are convenient and cost effective. There is no reason why this type of service will not prove to be as good as your average High Street accountant. Reading through reviews for any potential online services is a good way to get a feel for what is out there.

Chartered accountants are the most qualified and highly trained individuals within the profession. Their usual clients are big businesses and large limited companies. With a chartered accountant you will certainly have the best on your side.

In the final analysis you may decide to do your own tax returns. To make life even easier there is some intuitive software that you can use. Including Taxforward, Capium, Basetax, Taxshield, BTCSoftware, TaxCalc, Gbooks, Ajaccts, Taxfiler, Andica, Forbes, Xero, GoSimple, CalCal, ACCTAX, Absolute Topup, Sage, Nomisma, Keytime, Ablegatio and 123 e-Filing. Whatever happens you need to get your self-assessment form in on time.

Forensic Accounting West Kingsdown

You may well come across the phrase "forensic accounting" when you're looking to find an accountant in West Kingsdown, and will doubtless be interested to know about the difference between forensic accounting and normal accounting. The word 'forensic' is the thing that gives a clue, meaning "suitable for use in a court of law." Using accounting, auditing and investigative skills to identify irregularities in financial accounts that have resulted in theft or fraud, it is also sometimes known as 'forensic accountancy' or 'financial forensics'. Some of the bigger accountancy companies in and near to West Kingsdown have even got specialist sections addressing personal injury claims, money laundering, insolvency, professional negligence, tax fraud, bankruptcy and insurance claims.

Auditors West Kingsdown

Auditors are experts who review the fiscal accounts of companies and organisations to verify the legality and validity of their current financial records. They sometimes also act as consultants to encourage potential the prevention of risk and the application of cost savings. To act as an auditor, an individual has to be approved by the regulatory body for accounting and auditing and have certain qualifications. (Tags: Auditing West Kingsdown, Auditors West Kingsdown, Auditor West Kingsdown)

Proper Money Management Tips for Small Business Owners

Are you thinking of going into business yourself? You'll find that many like being their own boss because they're in charge of how much they make and how much they get to spend. Then again, managing business finances isn't exactly a simple matter. In fact, even those who've successfully lived by sticking to a budget in their personal lives can have a tough time managing the finances of their business. Luckily there are plenty of things that you can do to make it easier on yourself. If you'd like to be able to manage your business funds, keep reading.

Number your invoices. Many business owners don't think much about this, but it's one of those things that are important if you want to run your business smoothly and even keep your sanity! When your invoices are numbered, you won't have a difficult time tracking things down. It doesn't just help you track who owes you what, it helps you track who has paid you what as well. There are going to come times when a client will insist that he has paid you and having a numbered invoice to look up can be very helpful in that situation. In business, errors will happen and numbered invoices is one simple strategy to identify those problems when they take place.

Balance your books at least once a week. However, you should balance your books at the end of business day every day if what you have is a traditional store with cash registers or takes in multiple payments throughout the day every day. You need to record all of the payments you receive and make. At the end of the day or week, you need to make sure that the amount you have on hand and in the bank tallies with the amount you have in your records. This way you won't have to track down a bunch of discrepancies at the end of the month (or quarter). Besides, it will only take you a few minutes if you balance your books regularly, whereas if you balance your books once a month, that would take you hours to do.

If you receive cash payments, it's a good idea to deposit it to your bank account daily or as soon as you can to eliminate the temptation. It could be that you need cash when you're out for lunch and you end up getting money from your register and telling yourself you'll return the money later. But with cash, it is easy to forget about things like that, so remove the temptation to screw up your book keeping and accounting. So avoid this problem altogether by depositing your cash in the bank at the end of each business day.

Proper money management involves a lot of things. It's a lot more than simply keeping a list of your expenditures. There are different things to keep track of and different ways to track them. With the tips above, you'll have an easier time tracking your money. And as you continue to hone your skills in proper money management, you'll be able to find ways of streamlining your financial activities.

Small Business Accountants West Kingsdown

Doing the accounts can be a pretty stressful experience for anybody running a small business in West Kingsdown. Retaining a small business accountant in West Kingsdown will enable you to operate your business knowing that your annual accounts, tax returns and VAT, and various other business tax requirements, are being fully met.

Offering advice, ensuring that your business adheres to the best financial practices and providing ways to help your business achieve its full potential, are just some of the responsibilities of a decent small business accountant in West Kingsdown. An accountancy firm in West Kingsdown should provide you with a dedicated small business accountant and adviser who will clear away the fog that veils business taxation, so as to optimise your tax efficiences.

It is also critical that you clarify your plans for the future, the structure of your business and your company's financial situation truthfully to your small business accountant. (Tags: Small Business Accounting West Kingsdown, Small Business Accountant West Kingsdown, Small Business Accountants West Kingsdown).

Payroll Services West Kingsdown

For any business in West Kingsdown, from large scale organisations down to independent contractors, staff payrolls can be stressful. Handling company payrolls demands that all legal obligations in relation to their openness, exactness and timing are followed to the minutest detail.

A small business may well not have the advantage of an in-house financial specialist and a simple way to work with staff payrolls is to hire an external payroll company in West Kingsdown. The payroll management service will work along with HMRC and pension scheme administrators, and set up BACS payments to ensure timely and accurate wage payment to all staff.

It will also be necessary for a dedicated payroll accountant in West Kingsdown to provide an accurate P60 tax form for all personnel at the end of the financial year (by 31st May). At the end of a staff member's contract, the payroll accountant should also provide a current P45 relating to the tax paid in the previous financial period. (Tags: Payroll Accountants West Kingsdown, Payroll Services West Kingsdown, Company Payrolls West Kingsdown).

West Kingsdown accountants will help with payslips, charities West Kingsdown, HMRC submissions, taxation accounting services West Kingsdown, partnership accounts in West Kingsdown, HMRC submissions, company secretarial services West Kingsdown, pension forecasts West Kingsdown, financial and accounting advice West Kingsdown, business outsourcing in West Kingsdown, PAYE, tax preparation, year end accounts West Kingsdown, assurance services in West Kingsdown, bureau payroll services, audit and compliance reports, debt recovery, financial planning, National Insurance numbers in West Kingsdown, personal tax in West Kingsdown, sole traders in West Kingsdown, inheritance tax, tax returns West Kingsdown, estate planning, business start-ups, partnership registrations in West Kingsdown, consulting services, bookkeeping, contractor accounts, accounting services for media companies, workplace pensions West Kingsdown, litigation support and other professional accounting services in West Kingsdown, Kent. Listed are just some of the duties that are undertaken by nearby accountants. West Kingsdown professionals will inform you of their whole range of services.

West Kingsdown Accounting Services

- West Kingsdown Debt Recovery

- West Kingsdown PAYE Healthchecks

- West Kingsdown Specialist Tax

- West Kingsdown Chartered Accountants

- West Kingsdown Forensic Accounting

- West Kingsdown Auditing

- West Kingsdown Account Management

- West Kingsdown Tax Returns

- West Kingsdown Business Planning

- West Kingsdown Bookkeeping

- West Kingsdown Tax Refunds

- West Kingsdown Financial Advice

- West Kingsdown Self-Assessment

- West Kingsdown Payroll Management

Also find accountants in: Five Oak Green, Heaverham, Kingswood, Challock, Staple, Rochester, Sandway, Fairseat, Capel Le Ferne, Aldington, Hever, Leigh, Lane End, Kilndown, Barfreston, Hinxhill, Sutton At Hone, Curtisden Green, Shorne, Bough Beech, St Margarets At Cliffe, Four Throws, East Stourmouth, Conyer, Uplees, Highstead, Betteshanger, Pembury, Whitstable, Stowting, Penshurst, Sevenoaks, Broad Street, Stone, Birling and more.

Accountant West Kingsdown

Accountant West Kingsdown Accountants Near West Kingsdown

Accountants Near West Kingsdown Accountants West Kingsdown

Accountants West KingsdownMore Kent Accountants: Edenbridge, Gillingham, Swanley, Walmer, Swanscombe, Sandwich, Dover, Hartley, Folkestone, Sevenoaks, Lydd, Strood, Northfleet, Wilmington, Sheerness, Sittingbourne, Bearsted, Broadstairs, Pembury, Tonbridge, Sturry, Chatham, Canterbury, East Malling, Margate, Rochester, Paddock Wood, Boxley, Deal, Cranbrook, Meopham, Whitstable, Minster, Staplehurst, Snodland, Westgate-on-Sea, Dartford, Ramsgate, Southborough, Faversham, Maidstone, New Romney, Tunbridge Wells, Herne Bay, Biggin Hill, Westerham, West Kingsdown, Birchington-on-Sea, Tenterden, Kingsnorth, Aylesford, Gravesend and Ashford.

TOP - Accountants West Kingsdown - Financial Advisers

Tax Preparation West Kingsdown - Financial Advice West Kingsdown - Investment Accounting West Kingsdown - Small Business Accountants West Kingsdown - Bookkeeping West Kingsdown - Financial Accountants West Kingsdown - Self-Assessments West Kingsdown - Auditing West Kingsdown - Tax Advice West Kingsdown