Accountants Heysham: Filling in your self-assessment form each year can really give you nightmares. Lots of others in Heysham have to overcome this very same problem. You may prefer to obtain a local Heysham accountant to accomplish this task for you. Is self-assessment a bit too complicated for you to do on your own? Regular small business accountants in Heysham will probably charge you about two to three hundred pounds for this service. By utilizing an online service instead of a local Heysham accountant you can save a fair bit of money.

In your search for an accountant in the Heysham area, you could be baffled by the different types available. Consequently, it is vital to find an accountant who can fulfil your requirements. Some Heysham accountants work alone, some within larger practices. An accounting company will offer a broader range of services, while an independent accountant may offer a more personal service. You should be able to find an accountancy firm offering cost accountants, investment accountants, chartered accountants, financial accountants, accounting technicians, tax accountants, bookkeepers, auditors, management accountants, actuaries and forensic accountants.

Finding a properly qualified Heysham accountant should be your priority. For basic tax returns an AAT qualified accountant should be sufficient. You can then be sure your tax returns are done correctly. The accountants fees will count as a tax deductable expense, saving you a percentage of the costs. If your business is small or you are a sole trader you could consider using a bookkeeper instead.

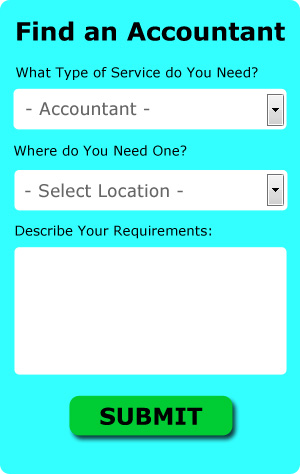

By using an online service such as Bark.com you could be put in touch with a number of local accountants. Little is required other than ticking a few boxes on the search form. Sometimes in as little as a couple of hours you will hear from prospective Heysham accountants who are keen to get to work for you. Why not give Bark a try since there is no charge for this useful service.

Making use of an online tax returns service is worth a try if your accounting needs are relatively simple. Services like this are convenient and cost effective. Even if you do decide to go down this route, take some time in singling out a trustworthy company. Study reviews and customer feedback.

Although filling in your own tax return may seem too complicated, it is not actually that hard. To make life even easier there is some intuitive software that you can use. Including Capium, ACCTAX, Taxforward, Ablegatio, Absolute Topup, TaxCalc, Nomisma, Xero, BTCSoftware, Keytime, CalCal, Gbooks, Taxfiler, Basetax, Andica, GoSimple, 123 e-Filing, Forbes, Ajaccts, Sage and Taxshield. The most important thing is that you get your self-assessment tax return to HMRC in good time to avoid a penalty. You can expect to pay a minimum penalty of £100 for being late.

Forensic Accounting Heysham

When you're looking for an accountant in Heysham you will probably come across the expression "forensic accounting" and be curious about what the differences are between a normal accountant and a forensic accountant. The hint for this is the word 'forensic', which essentially means "denoting or relating to the application of scientific methods and techniques for the investigation of a crime." Using investigative skills, accounting and auditing to identify irregularities in financial accounts that have resulted in fraud or theft, it is also occasionally called 'forensic accountancy' or 'financial forensics'. Some larger accounting companies in the Heysham area could even have independent forensic accounting divisions with forensic accountants focusing on particular sorts of fraud, and might be dealing with insolvency, tax fraud, money laundering, false insurance claims, personal injury claims, bankruptcy and professional negligence.

Staying on Top of Your Finances When You're a Business Owner

Proper money management is something that many small business owners have to struggle with, especially when they are still trying to get their feet wet as a business owner. Poor money management can be a real drag on your confidence, and when you are having money problems, you are more willing to take on any old job. This, believe it or not, can keep you from reaching the level of success that you want to reach. You can be a good money manager with the help of the following tips.

It can be tempting to wait to pay your taxes until they are due, but if you are not good at managing your money, you may not have the funds on hand to actually pay your estimated tax payments and other fees. Try saving a portion of your daily or even weekly earnings and depositing it in a separate bank account. This way, when it comes time to pay your taxes for the quarter, you'll already have the money on hand and won't have to worry about coming up with it on time. You want to be able to pay taxes promptly and in full and being able to do so every quarter is a great feeling.

Offer your clients payment plans. Not only will this drum up more business for you, this will ensure that money is coming in regularly. It's certainly a lot easier than having money coming in irregularly and you've got long, dry spells. Reliable income makes it a lot easier for you to budget, makes it easier to keep your bills paid, and makes it much simpler to properly manage your money. This is a great boost to your confidence.

Of course, if you're keeping track of every penny you're spending, you should keep track of every penny you're getting as well. Keep a record of every payment you get from customers or clients. This is important for two reasons: one, you need to know how much money you have coming in, and two, you need to be able to track who has paid you and who still needs to pay you. It also makes it easy to figure out what you owe in taxes and how much you should pay yourself for that week or month.

Proper money management is something that everyone should develop, no matter if they own a business or not. As a business owner, you're a lot more likely to succeed if you know how much money your business is generating, how much money you're spending, and basically what's happening with your money. Use the tips in this article to help you get started. If you want your business to be a success, it's important that you develop money management skills.

Payroll Services Heysham

Payrolls for staff can be a complicated area of running a business enterprise in Heysham, no matter its size. The laws relating to payroll requirements for accuracy and openness mean that running a company's payroll can be a formidable task for those not trained in this discipline.

A small business may not have the luxury of an in-house financial specialist and the easiest way to deal with the issue of employee payrolls is to employ an independent accountant in Heysham. Working with HMRC and pension scheme administrators, a payroll service accountant will also deal with BACS payments to personnel, ensuring they're paid on time each month, and that all mandatory deductions are done accurately.

Adhering to current regulations, a decent payroll management accountant in Heysham will also present each of your workers with a P60 tax form at the conclusion of each fiscal year. They will also be responsible for providing P45 tax forms at the end of an employee's working contract. (Tags: Company Payrolls Heysham, Payroll Accountant Heysham, Payroll Services Heysham).

Heysham accountants will help with contractor accounts, employment law, business advisory, accounting support services, consultancy and systems advice, sole traders, limited company accounting in Heysham, financial statements, self-employed registration Heysham, partnership registration, HMRC submissions in Heysham, inheritance tax, partnership accounts, company secretarial services in Heysham, debt recovery Heysham, accounting services for the construction sector in Heysham, charities, VAT returns, capital gains tax, business acquisition and disposal, year end accounts Heysham, accounting and financial advice, self-assessment tax returns in Heysham, business start-ups Heysham, business planning and support, investment reviews, personal tax, financial planning, National Insurance numbers, small business accounting, bureau payroll services, taxation accounting services in Heysham and other professional accounting services in Heysham, Lancashire. Listed are just a selection of the duties that are handled by nearby accountants. Heysham specialists will be happy to tell you about their whole range of accounting services.

With the web as a resource it is of course quite easy to uncover plenty of valuable ideas and information relating to self-assessment help, small business accounting, auditing & accounting and personal tax assistance. To illustrate, with a quick search we found this informative article on the subject of choosing an accountant.

Heysham Accounting Services

- Heysham Specialist Tax

- Heysham VAT Returns

- Heysham Forensic Accounting

- Heysham Tax Refunds

- Heysham PAYE Healthchecks

- Heysham Chartered Accountants

- Heysham Bookkeeping Healthchecks

- Heysham Payroll Management

- Heysham Taxation Advice

- Heysham Business Accounting

- Heysham Account Management

- Heysham Self-Assessment

- Heysham Business Planning

- Heysham Tax Services

Also find accountants in: Walker Fold, Garstang, Downholland Cross, Haslingden, Newton, Waterfoot, Newby, Bolton By Bowland, Westby, Eagland Hill, Chapeltown, Salterforth, Staining, Tardy Gate, Snape Green, Lower Green Bank, Barley, Goosnargh, Upper Thurnham, Kelbrook, Torrisholme, Winewall, Town Green, Whalley, Hambleton, Holme Chapel, Ormskirk, Quernmore, Pilling, Coppull Moor, Earby, Dalton, Chipping, Hurstwood, Scorton and more.

Accountant Heysham

Accountant Heysham Accountants Near Me

Accountants Near Me Accountants Heysham

Accountants HeyshamMore Lancashire Accountants: Nelson, Blackpool, Ormskirk, Darwen, Leyland, Fulwood, Colne, Haslingden, Lancaster, Burnley, Skelmersdale, Penwortham, Clitheroe, Poulton, Blackburn, Fleetwood, Accrington, Bacup, Preston, Rawtenstall, Heysham, Chorley, Morecambe and Lytham St Annes.

TOP - Accountants Heysham - Financial Advisers

Small Business Accountants Heysham - Investment Accountant Heysham - Financial Accountants Heysham - Tax Preparation Heysham - Online Accounting Heysham - Tax Accountants Heysham - Self-Assessments Heysham - Auditors Heysham - Chartered Accountants Heysham