Accountants Burnley: Anybody operating a business in Burnley, Lancashire will pretty quickly realise that there are numerous advantages to having an accountant at the end of the phone. The very least you can expect is to gain more time to devote to your core business, while financial concerns are processed by your accountant. The benefits of this kind of professional help far outweighs the additional costs involved. If you've got plans to develop your Burnley business you will find an increasing need for good financial advice.

So, precisely how should you go about finding an accountant in Burnley? In the past the local newspaper or Yellow Pages would have been the first port of call, but these days the internet is a lot more popular. Yet, which accountants can you trust to do a decent job for you? You must always remember that it is possible for anybody in Burnley to say that they are an accountant. They don't even have to hold any qualifications such as A Levels or BTEC's.

It is best to find an accountant who can demostrate that he/she has the desired qualifications. Your minimum requirement should be an AAT qualified accountant. A certified Burnley accountant might be more costly than an untrained one, but should be worth the extra expense. The accountants fees will count as a tax deductable expense, saving you a percentage of the costs. If your business is small or you are a sole trader you could consider using a bookkeeper instead.

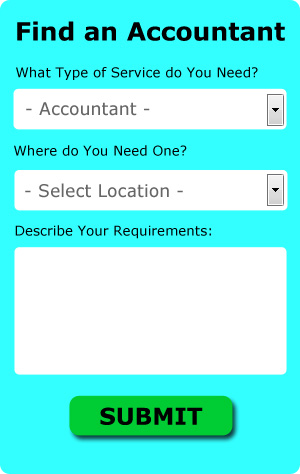

There is an online company called Bark who will do much of the work for you in finding an accountant in Burnley. With Bark it is simply a process of ticking a few boxes and submitting a form. Within a few hours you should hear from some local accountants who are willing to help you.

If your accounting needs are pretty basic, you could consider using one of the cheaper online tax returns providers. More accountants are offering this modern alternative. Choose a company with a history of good service. Reading through reviews for any potential online services is a good way to get a feel for what is out there. Recommending any specific services is beyond the scope of this short article.

The most qualified of all are chartered accountants, they have the most training and the most expertise. Accountants must be members of the ICAEW (or ICAS in Scotland) to work as a chartered accountant. The choice, so they say, is all yours.

Of course, completing and sending in your own self-assessment form is the cheapest solution. Using accounting software like Taxfiler, Taxforward, Capium, CalCal, Taxshield, Keytime, Gbooks, 123 e-Filing, Xero, Sage, Ablegatio, ACCTAX, TaxCalc, BTCSoftware, GoSimple, Andica, Forbes, Nomisma, Basetax, Absolute Topup or Ajaccts will make it even simpler to do yourself. Getting your self-assessment form submitted on time is the most important thing.

Improving Yourself and Your Business with the Help of the Top Money Management Techniques

It can be a very exciting thing to start your own business -- whether your business is online of offline. When you're a business owner, you're your own boss and in control of your income. It's a bit scary, isn't it? In addition to the excitement of being your own boss, it can be a bit intimidating particularly if you have no business experience. This is where you'll find it very helpful to know a few self-improvement techniques such as properly managing your finances. So if you wish to know how you can manage your money correctly, keep reading.

Find yourself an accountant who's competent. An accountant is well worth the business expense because she can manage your books for you full time. There are many things that an accountant can help you with, including keeping track of your cash flow, paying yourself, and meeting your tax obligations. The best part is that you won't have to deal with the paperwork because your accountant will take care of that for you. You, then, are free to concentrate on the other areas of building your business, like taking care of your clients, marketing, etc. An accountant can save you days of time and quite a lot of headaches.

You may be your own boss, but it's still a good idea to give yourself a regular paycheck. This makes the process of accounting your personal and business life so much easier. So how do you do this exactly? First, any payments you get from the sale of your products or services should go to your business account. Next, decide how often you want to receive a salary. Let's say you want to pay yourself once every month, such as on the 15th. When the 15th comes around, write yourself a check. Just how much money you pay yourself is completely up to you. Your salary can be a portion of how much your business brought in for the month or it can be based on how many hours you worked.

Make sure you account for every penny your business brings in. Keep a record of every payment you get from customers or clients. This is important for two reasons: one, you need to know how much money you have coming in, and two, you need to be able to track who has paid you and who still needs to pay you. When you know what your income is, you'll also be able to figure out how much taxes you can expect to pay and even how much money you should pay yourself.

Every adult should learn the proper way of managing their money. Knowing what you have coming in, what you have going out, and what exactly is going on with your money can be a huge boost to your confidence and success. Use the tips in this article to help you get started. If you want your business to be a success, it's important that you develop money management skills.

Financial Actuaries Burnley

Actuaries work with government departments and businesses, to help them anticipate long-term fiscal expenditure and investment risks. Actuaries use their mathematical expertise to determine the probability and risk of future events and to predict their ramifications for a business and their customers. Actuaries provide judgements of fiscal security systems, with an emphasis on their complexity, their mathematics and their mechanisms. (Tags: Actuary Burnley, Actuaries Burnley, Financial Actuaries Burnley)

Burnley accountants will help with accounting support services, PAYE in Burnley, limited company accounting in Burnley, self-assessment tax returns, capital gains tax, bureau payroll services Burnley, investment reviews, HMRC submissions, workplace pensions, estate planning, tax preparation, sole traders, consulting services, tax investigations, business support and planning in Burnley, charities Burnley, monthly payroll, contractor accounts, management accounts, company secretarial services Burnley, accounting services for landlords, year end accounts Burnley, inheritance tax, accounting and auditing, partnership accounts, employment law, double entry accounting, VAT registration Burnley, general accounting services, financial statements, accounting services for the construction industry in Burnley, corporate tax and other types of accounting in Burnley, Lancashire. Listed are just a small portion of the duties that are handled by nearby accountants. Burnley companies will keep you informed about their full range of services.

Burnley Accounting Services

- Burnley VAT Returns

- Burnley PAYE Healthchecks

- Burnley Tax Services

- Burnley Self-Assessment

- Burnley Forensic Accounting

- Burnley Taxation Advice

- Burnley Tax Refunds

- Burnley Account Management

- Burnley Tax Planning

- Burnley Chartered Accountants

- Burnley Payroll Management

- Burnley Personal Taxation

- Burnley Specialist Tax

- Burnley Tax Returns

Also find accountants in: Hambleton, Hesketh Bank, Lee, Ryal Fold, Westhead, Melling, Whitechapel, Churchtown, Worston, Chatburn, Sandylands, Little Bispham, Sollom, Newby, Oakenclough, Eccleston, Huncoat, Hoghton, Mill Houses, Cowan Bridge, Aughton, Bescar, Scotforth, Borwick, St Annes, Pinfold, Cuddy Hill, Higher Ballam, Moss Side, Gisburn, Stonyhurst College, Colne, Out Rawcliffe, Crossgill, Sabden and more.

Accountant Burnley

Accountant Burnley Accountants Near Burnley

Accountants Near Burnley Accountants Burnley

Accountants BurnleyMore Lancashire Accountants: Burnley, Penwortham, Bacup, Fleetwood, Preston, Heysham, Fulwood, Lancaster, Accrington, Poulton, Lytham St Annes, Morecambe, Haslingden, Chorley, Nelson, Blackburn, Leyland, Darwen, Colne, Rawtenstall, Clitheroe, Ormskirk, Skelmersdale and Blackpool.

TOP - Accountants Burnley - Financial Advisers

Online Accounting Burnley - Self-Assessments Burnley - Chartered Accountant Burnley - Cheap Accountant Burnley - Auditing Burnley - Tax Accountants Burnley - Bookkeeping Burnley - Financial Accountants Burnley - Financial Advice Burnley