Accountants Rawtenstall: Do you find that filling in your annual self-assessment form gives you nightmares? This can be a challenge for you and a multitude of other Rawtenstall folks in self-employment. Is it easy to find a local professional in Rawtenstall to handle this for you? Maybe self-assessment is simply too challenging for you? This service will usually cost about £200-£300 if you use a regular accountant in Rawtenstall. If you don't have any issues with online services you should be able to get it done for a lower price than this.

So, what sort of accounting service should you search for and how much should you expect to pay? A long list of potential Rawtenstall accountants can be found with one swift search on the web. However, which of these candidates will you be able to put your trust in? The fact that somebody in Rawtenstall claims to be an accountant is no real guarantee of quality. They don't need a degree or even relevant qualifications like BTEC's or A Levels. Which, like me, you may find astounding.

In order to have your tax returns done effectively, it's advisable to use an accountant who does have the appropriate qualifications. Basic self-assessment tax returns do not require the services of a chartered accountant and an AAT qualification should suffice. You can then be sure your tax returns are done correctly. Your accountant's fees are tax deductable.

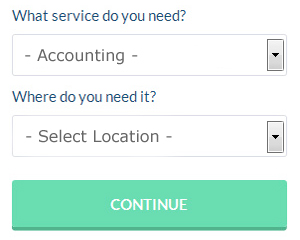

By using an online service such as Bark.com you could be put in touch with a number of local accountants. A couple of minutes is all that is needed to complete their simple and straighforward search form. Within a few hours you should hear from some local accountants who are willing to help you.

A more cost-effective solution for those with straightforward tax returns would be to use an online self-assessment service. Services like this are convenient and cost effective. If you decide to go with this method, pick a company with a decent reputation. It should be a simple task to find some online reviews to help you make your choice. We feel it is not appropriate to list any individual services here.

If you choose to do your own tax returns there is plenty of help available on the HMRC website. There is also lots of software available to help you with your returns. These include Basetax, Forbes, Taxfiler, Keytime, TaxCalc, Ajaccts, BTCSoftware, Nomisma, CalCal, Absolute Topup, Ablegatio, Xero, Gbooks, GoSimple, Taxshield, Sage, 123 e-Filing, Andica, Capium, ACCTAX and Taxforward. Getting your self-assessment form submitted on time is the most important thing. Penalties are £100 for being 3 months late and an extra £10 per day after that, so don't be late.

Learn How to Manage Your Business Budget Properly

One of the most difficult parts of starting your own business is learning how to use proper money management techniques. It can seem like money management is something anyone should be able to do already by the time they get their business up and running. The reality, however, is that budgeting and financial planning for your business is a lot different from budgeting and financial planning for your personal life. It does help a lot if you have some experience in the latter. Your self-confidence could very well take a huge dive should you accidentally ruin your business finances. In this article, we'll share a few tips you can apply to help you be a better money manager for your business.

Number your invoices. This is one of those things that you probably think isn't that big of a deal but it really is. It makes it easy to track invoices if you have them numbered. You'll be able to easily track who has paid you and who still owes you. There will be times when a client will tell you that his invoice is all paid up and this can be easily resolved if you have a numbered invoice. Keep in mind that mistakes are bound to happen in business, but if you've got an invoicing system, no matter how simple it is, you'll be able to quickly find those mistakes and correct them should they happen.

Try to learn bookkeeping. You need to have a system set up for your money -- both personally and professionally. You can set up your system using a basic spreadsheet or get yourself a bookkeeping software like QuickBooks or Quicken. Budgeting tools like Mint.com are also an option. There are also many no-cost resources for those who own a small business to help them properly manage their bookkeeping. Your books are the key to you knowing precisely how and where your money (personal and business) is being spent. And if you just can't afford to pay for a full-time bookkeeper for your small business, it'll serve you well to take a basic accounting and bookkeeping class at your community college.

Take control of your spending. When your business is steadily pulling in a nice income, you may be tempted to go on a buying spree and buy all those things you've always wanted to buy but couldn't afford. It's best if you spend money on things that will benefit your business. It's better to build up your business savings so that you can handle unexpected expenses than it is to splurge every time you have the chance. Buy your office supplies in bulk. For computing equipment, go for quality even if it's a little more expensive. This will actually save you more money because you'll get more years out of the equipment and you won't have to replace them as often. Avoid spending too much on your entertainment as well; be moderate instead.

Not only does learning how to properly manage your money help you improve yourself, it helps improve your business too. Try to implement these tips we've shared because you stand to benefit in the long run. When you've got your finances under control, you can expect your business and personal life to be a success.

Forensic Accountant Rawtenstall

While engaged on your search for an experienced accountant in Rawtenstall there's a fair chance that you will stumble on the phrase "forensic accounting" and be curious about what it is, and how it is different from regular accounting. The actual word 'forensic' is the thing that gives it away, meaning basically "appropriate for use in a law court." Using accounting, investigative skills and auditing to discover discrepancies in financial accounts that have resulted in theft or fraud, it's also often known as 'financial forensics' or 'forensic accountancy'. Some larger accounting companies in the Rawtenstall area may have independent forensic accounting divisions with forensic accountants concentrating on particular forms of fraud, and could be addressing tax fraud, false insurance claims, bankruptcy, personal injury claims, money laundering, professional negligence and insolvency.

Actuary Rawtenstall

Analysts and actuaries are professionals in the management of risk. These risks can impact both sides of a company balance sheet and require expert liability management, valuation and asset management skills. To be an actuary it's vital to have a mathematical, economic and statistical knowledge of real-life situations in the financial world.

Rawtenstall accountants will help with business acquisition and disposal, accounting services for buy to let landlords, corporate finance, financial and accounting advice, debt recovery Rawtenstall, workplace pensions, consulting services, tax preparation, audit and compliance issues, assurance services, double entry accounting in Rawtenstall, taxation accounting services, business outsourcing, audit and auditing, management accounts, accounting support services, VAT returns, investment reviews, business advisory services Rawtenstall, partnership registrations, tax investigations, corporation tax, HMRC submissions, employment law, accounting services for the construction industry, partnership accounts in Rawtenstall, capital gains tax, business start-ups, cashflow projections Rawtenstall, consultancy and systems advice, financial statements, company formations and other accounting services in Rawtenstall, Lancashire. These are just a small portion of the duties that are handled by nearby accountants. Rawtenstall professionals will let you know their entire range of services.

Rawtenstall Accounting Services

- Rawtenstall Bookkeeping Healthchecks

- Rawtenstall Self-Assessment

- Rawtenstall Auditing Services

- Rawtenstall Tax Advice

- Rawtenstall Tax Refunds

- Rawtenstall Bookkeeping

- Rawtenstall Payroll Management

- Rawtenstall PAYE Healthchecks

- Rawtenstall Specialist Tax

- Rawtenstall Forensic Accounting

- Rawtenstall Financial Advice

- Rawtenstall VAT Returns

- Rawtenstall Tax Planning

- Rawtenstall Tax Services

Also find accountants in: Churchtown, Swillbrook, Dunsop Bridge, Paythorne, Ansdell, Langho, Saltcotes, Holme Chapel, Water, Digmoor, Shirdley Hill, Healey, Ryal Fold, Rivington, Accrington, Acre, Salterforth, Feniscowles, Pilling Lane, Lancaster, Dolphinholme, Common Edge, Brown Edge, Fishers Row, Eccleston, Winmarleigh, New Lane, St Annes, Greystone, Oakenclough, Kirkham, Haslingden, Longton, Haskayne, Mere Brow and more.

Accountant Rawtenstall

Accountant Rawtenstall Accountants Near Me

Accountants Near Me Accountants Rawtenstall

Accountants RawtenstallMore Lancashire Accountants: Ormskirk, Haslingden, Lancaster, Fulwood, Chorley, Nelson, Accrington, Clitheroe, Rawtenstall, Fleetwood, Skelmersdale, Darwen, Burnley, Bacup, Heysham, Preston, Penwortham, Lytham St Annes, Leyland, Poulton, Morecambe, Colne, Blackpool and Blackburn.

TOP - Accountants Rawtenstall - Financial Advisers

Tax Advice Rawtenstall - Investment Accountant Rawtenstall - Auditing Rawtenstall - Online Accounting Rawtenstall - Financial Advice Rawtenstall - Chartered Accountants Rawtenstall - Tax Return Preparation Rawtenstall - Bookkeeping Rawtenstall - Small Business Accountant Rawtenstall