Accountants Fleet: Filling in your self-assessment form every year can really give you nightmares. You are not alone in Fleet if this predicament worries you every year. Tracking down a local Fleet professional to do this for you might be the answer. It could be the case that doing your own self-assessment is simply too challenging. You should expect to pay about £200-£300 when using the services of a regular Fleet accountant or bookkeeper. Those who consider this too expensive have the alternative option of using an online tax return service.

In the Fleet area you'll find that there are different types of accountant. Your goal is to pick one that matches your precise requirements. You may have the choice of an accountant who works within a bigger accountancy firm or one who works for themselves. A firm may employ a team of accountants, each with expertise in differing areas of accountancy. The primary positions which will be covered by an accounting practice include: accounting technicians, bookkeepers, chartered accountants, actuaries, tax accountants, financial accountants, auditors, costing accountants, investment accountants, management accountants and forensic accountants.

You would be best advised to find a fully qualified Fleet accountant to do your tax returns. Look for an AAT qualified accountant in the Fleet area. Even if you have to pay a bit more for the priviledge, you can be confident that your self-assessment form is being completed accurately. You will be able to claim the cost of your accountant as a tax deduction.

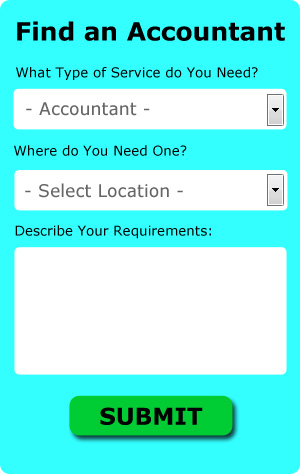

Similar to Rated People for tradesmen, an online website known as Bark will contact local accountants on your behalf. A couple of minutes is all that is needed to complete their simple and straighforward search form. It is then simply a case of waiting for some suitable responses.

Utilizing an online tax returns service will be your other option. Over the last few years many more of these services have been appearing. You still need to pick out a company offering a reliable and professional service. Reading through reviews for any potential online services is a good way to get a feel for what is out there. Sorry but we cannot recommend any individual service on this website.

In the final analysis you may decide to do your own tax returns. HMRC is also happy for you to use one of the many available software programs to make life even easier. Acceptable ones are CalCal, ACCTAX, Absolute Topup, Andica, BTCSoftware, Nomisma, Taxforward, Keytime, Gbooks, Capium, Ablegatio, Forbes, TaxCalc, Basetax, 123 e-Filing, Xero, Sage, Ajaccts, Taxshield, Taxfiler and GoSimple. Don't leave your self-assessment until the last minute, allow yourself plenty of time. You can expect a fine of £100 if your assessment is in even 1 day late.

Payroll Services Fleet

For any company in Fleet, from large scale organisations down to independent contractors, payrolls for staff can be challenging. The laws relating to payroll requirements for openness and accuracy mean that processing a company's staff payroll can be a daunting task for the uninitiated.

Small businesses may not have their own in-house financial experts, and the best way to deal with employee pay is to retain the services of an outside Fleet accountant. The payroll service will work with HMRC and pension providers, and take care of BACS payments to ensure timely and accurate wage payment to all personnel.

A decent payroll accountant in Fleet will also, in accordance with current legislations, organise P60 tax forms at the conclusion of the financial year for every one of your employees. Upon the termination of an employee's contract, the payroll service will also supply a current P45 form relating to the tax paid during the previous financial period.

Small Business Accountants Fleet

Doing the yearly accounts can be a pretty stressful experience for anybody running a small business in Fleet. If your annual accounts are getting on top of you and tax returns and VAT issues are causing you sleepless nights, it would be advisable to employ a small business accountant in Fleet.

A qualified small business accountant in Fleet will regard it as their responsibility to help develop your business, and provide you with reliable financial guidance for peace of mind and security in your particular circumstances. A responsible accounting firm in Fleet will offer proactive small business guidance to optimise your tax efficiency while lowering costs; crucial in the sometimes shadowy sphere of business taxation.

You should also be supplied with a dedicated accountancy manager who has a deep understanding of the structure of your business, your company's situation and your plans for the future. (Tags: Small Business Accountants Fleet, Small Business Accounting Fleet, Small Business Accountant Fleet).

How Managing Your Money Better Makes You a Better Business Owner

It can be a very exciting thing to start your own business -- whether your business is online of offline. When you're your own boss, you get to be in charge of basically everything. It can be kind of scary, can't it? While putting up your own business is indeed exciting, it's also intimidating, especially when you're only getting started. This is where you'll find it very helpful to know a few self-improvement techniques such as properly managing your finances. Keep reading this article to learn how to correctly manage your money.

Retain an accountant. This is one of those expenses that is absolutely worth it, as an accountant will manage your books full time. With an accountant on board, you can easily monitor your cash flow and more importantly pay the right amount of taxes you owe on time. What's more, she'll deal with all of the paperwork that is associated with those things. As a result, you can put your energy towards making your business more profitable, such as creating new products, marketing, and increasing your customer base. The expense of having a business accountant is nothing compared to how much you'll save trying to figure out your finances and keeping everything in order.

Set a salary and pay yourself on a regular basis even though you're running your own business and you may be the only "employee" you have This can make it easier to keep track of your accounting both in your personal life and your professional life. Here's what you can do: all monies that come in from selling your products or services should be deposited to your business account. Next, decide whether you want to pay yourself on a weekly, bi-weekly, or monthly basis. If you decide on a bi-weekly payout schedule, say every 15th and 30th of the month, simply pay yourself from your business account on those times. Just how much money you pay yourself is completely up to you. Your salary can be a portion of how much your business brought in for the month or it can be based on how many hours you worked.

Don't be late in paying your taxes. Generally, taxes must be paid quarterly by small business owners. It's not that easy to navigate through all the tax laws you need to follow, especially when you're a small business owner, so you're better off getting in touch with the IRS or your local small business center for the most current information. You can also seek the help of an accountant who specializes in small business accounting. He or she can ensure that you're following all the taxation laws as they relate to small businesses and that you're paying the right amount of taxes on time. Having the IRS at your doorstep isn't something you'd want, believe me!

When it comes to properly managing your business finances, you'll find that there are a lot of things that go into doing so. You might assume that proper money management is a skill that isn't hard to acquire, but the reality is that it's a complicated process, especially when you're a small business owner. Keep in mind the tips we've mentioned in this article so you can properly keep track of your finances. Learning how to stay on top of your finances is one of the things you should do if you want your business to succeed.

Fleet accountants will help with personal tax, tax investigations, accounting and auditing, corporation tax Fleet, investment reviews, cash flow, VAT payer registration Fleet, partnership registration in Fleet, HMRC submissions, employment law Fleet, management accounts, capital gains tax in Fleet, corporate finance in Fleet, business start-ups, accounting support services, business outsourcing, taxation accounting services in Fleet, workplace pensions, compliance and audit reporting, estate planning Fleet, self-employed registration, sole traders, limited company accounting, year end accounts, accounting and financial advice in Fleet, VAT returns, contractor accounts, partnership accounts in Fleet, pension forecasts, National Insurance numbers, company secretarial services, bookkeeping in Fleet and other forms of accounting in Fleet, Hampshire. These are just a few of the duties that are handled by local accountants. Fleet companies will let you know their whole range of services.

Fleet Accounting Services

- Fleet Business Accounting

- Fleet Tax Advice

- Fleet Self-Assessment

- Fleet Bookkeeping

- Fleet Financial Audits

- Fleet PAYE Healthchecks

- Fleet Auditing Services

- Fleet Payroll Management

- Fleet Chartered Accountants

- Fleet Forensic Accounting

- Fleet Personal Taxation

- Fleet Tax Refunds

- Fleet Tax Services

- Fleet Tax Returns

Also find accountants in: Ramsdell, Pitt, Bassett, Michelmersh, High Cross, Thedden Grange, Martyr Worthy, Chilbolton, Smannell, Hawkley, Clanfield, Houghton, Sparsholt, Wildhern, Headley, Plastow Green, Portmore, Hambledon, Pamber End, Bisterne, Ewshot, Colbury, Selborne, Canada, Beech, Phoenix Green, Sarisbury, Lymington, Hundred Acres, Hatherden, Littleton, Steepmarsh, Faccombe, Compton, Winchfield and more.

Accountant Fleet

Accountant Fleet Accountants Near Me

Accountants Near Me Accountants Fleet

Accountants FleetMore Hampshire Accountants: Fareham, Winchester, Aldershot, Gosport, Emsworth, Waterlooville, Andover, Farnborough, Hythe, Horndean, Southsea, Portsmouth, Eastleigh, Alton, Southampton, Fleet, Stubbington, Basingstoke, Havant, Totton, New Milton, Yateley and Hedge End.

TOP - Accountants Fleet - Financial Advisers

Small Business Accountants Fleet - Chartered Accountant Fleet - Affordable Accountant Fleet - Tax Return Preparation Fleet - Self-Assessments Fleet - Auditors Fleet - Financial Accountants Fleet - Financial Advice Fleet - Tax Advice Fleet