Accountants Redcar: You'll discover that there are several benefits to be had by hiring a qualified accountant in Redcar, if you run a business or are self-empoyed in this area of North Yorkshire. By handling some mundane financial jobs like bookkeeping and tax returns you accountant should be able to free up more time for you to carry on with your main business operations. Start-ups will find that having access to this sort of expertise is extremely beneficial.

Redcar accountants are available in various forms. Therefore, it's vital that you choose one that suits your specific needs. Certain accountants work as part of an accountancy practice, while some work independently. Accounting companies will have specialists in each particular accounting sector. You will probably find accounting technicians, investment accountants, financial accountants, actuaries, auditors, cost accountants, bookkeepers, management accountants, chartered accountants, tax preparation accountants and forensic accountants in a good sized accounting company.

You would be best advised to find a fully qualified Redcar accountant to do your tax returns. Ask if they at least have an AAT qualification or higher. A certified Redcar accountant might be more costly than an untrained one, but should be worth the extra expense. The fees for completing your self-assessment tax return are a legitimate business expense and therefore qualify for a tax deduction. Redcar sole traders often opt to use bookkeeper rather than accountants for their tax returns.

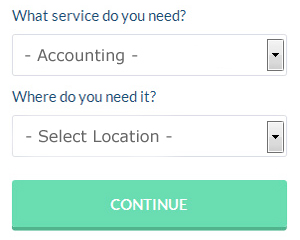

By using an online service such as Bark.com you could be put in touch with a number of local accountants. They provide an easy to fill in form that gives an overview of your requirements. Within a few hours you should hear from some local accountants who are willing to help you.

If you feel comfortable doing everything by post and email you might consider using one of the many online tax returns services. You might find that this is simpler and more convenient for you. Should you decide to go down this route, take care in choosing a legitimate company. There are resources online that will help you choose, such as review websites. Recommending any specific services is beyond the scope of this short article.

If you choose to do your own tax returns there is plenty of help available on the HMRC website. Software is also available to make doing your self-assessment even easier. Some of the best ones include Ajaccts, Xero, Nomisma, BTCSoftware, GoSimple, TaxCalc, Gbooks, Forbes, Taxshield, Capium, ACCTAX, Sage, Andica, Taxfiler, Ablegatio, 123 e-Filing, Absolute Topup, CalCal, Taxforward, Keytime and Basetax. Whichever service you use your tax returns will need to be in on time to avoid penalties.

Payroll Services Redcar

For any business in Redcar, from large scale organisations down to independent contractors, dealing with staff payrolls can be tricky. The laws relating to payroll for transparency and accuracy mean that processing a company's staff payroll can be a formidable task for those untrained in this discipline.

A small business might not have the advantage of its own financial specialist and the easiest way to deal with the issue of staff payrolls is to employ an independent accountant in Redcar. Your payroll accounting company will manage accurate BACS payments to your personnel, as well as working along with any pension providers that your business may have, and use current HMRC legislation for NI contributions and tax deductions.

It will also be a requirement for a payroll management company in Redcar to provide a P60 tax form for all workers after the end of the financial year (by May 31st). They'll also be responsible for providing P45 tax forms at the termination of an employee's contract with your company. (Tags: Payroll Outsourcing Redcar, Payroll Accountants Redcar, Payroll Services Redcar).

Small Business Accountants Redcar

Company accounting and bookkeeping can be a stressful experience for any small business owner in Redcar. Retaining a small business accountant in Redcar will allow you to operate your business knowing your VAT, annual accounts and tax returns, amongst many other business tax requirements, are being fully met.

A professional small business accountant in Redcar will regard it as their responsibility to help develop your business, and provide you with sound financial advice for security and peace of mind in your specific circumstances. A good accounting firm in Redcar should be able to give practical small business advice to optimise your tax efficiency while lowering expense; crucial in the sometimes shady world of business taxation.

It is vital that you explain the structure of your business, your plans for the future and your company's financial circumstances accurately to your small business accountant. (Tags: Small Business Accounting Redcar, Small Business Accountants Redcar, Small Business Accountant Redcar).

Actuaries Redcar

Actuaries and analysts are specialists in risk management. An actuary employs financial and statistical concepts to evaluate the possibility of a particular event transpiring and its potential monetary implications. An actuary uses math and statistics to determine the financial effect of uncertainties and help their customers reduce possible risks.

Redcar accountants will help with debt recovery, retirement advice, investment reviews, partnership registrations in Redcar, taxation accounting services, National Insurance numbers in Redcar, accounting support services Redcar, accounting services for buy to let landlords in Redcar, bookkeeping Redcar, payslips, company secretarial services, assurance services, monthly payroll, business outsourcing Redcar, sole traders, business start-ups Redcar, financial statements, contractor accounts, small business accounting Redcar, VAT returns, inheritance tax, PAYE, estate planning, VAT payer registration, mergers and acquisitions, charities in Redcar, tax preparation, HMRC submissions, capital gains tax, employment law, corporate finance, consultancy and systems advice and other forms of accounting in Redcar, North Yorkshire. Listed are just some of the tasks that are handled by nearby accountants. Redcar companies will tell you about their full range of accountancy services.

When searching for ideas and inspiration for self-assessment help, personal tax assistance, small business accounting and accounting & auditing, you won't really need to look much further than the world wide web to get everything you could possibly need. With so many diligently researched webpages and blog posts to pick from, you will quickly be deluged with new ideas for your project. The other day we stumbled across this engaging article detailing how to obtain an accountant to complete your tax return.

Redcar Accounting Services

- Redcar Tax Services

- Redcar Specialist Tax

- Redcar Forensic Accounting

- Redcar Self-Assessment

- Redcar Chartered Accountants

- Redcar Bookkeeping

- Redcar Financial Audits

- Redcar Audits

- Redcar Tax Planning

- Redcar Debt Recovery

- Redcar Payroll Services

- Redcar Personal Taxation

- Redcar Tax Refunds

- Redcar PAYE Healthchecks

Also find accountants in: Kearton, Burtersett, Westow, Wintringham, Ingleby Cross, Silpho, Theakston, New Earswick, Bishopthorpe, Galphay, Farlington, Low Bentham, Lythe, Grosmont, Settle, Oswaldkirk, Burnsall, Scackleton, Nunnington, Malham, Lower Dunsforth, Wistow, Old Byland, Airton, Londonderry, Gate Helmsley, Kirby Misperton, Drax, Shaw Mills, Risplith, Dunsley, Askham Richard, Farnley, Cawton, Killinghall and more.

Accountant Redcar

Accountant Redcar Accountants Near Redcar

Accountants Near Redcar Accountants Redcar

Accountants RedcarMore North Yorkshire Accountants: Thornaby, Yarm, Harrogate, Scarborough, Ripon, Skipton, Knaresborough, Northallerton, York, Redcar, Selby, Guisborough, Middlesbrough and Whitby.

TOP - Accountants Redcar - Financial Advisers

Self-Assessments Redcar - Investment Accounting Redcar - Tax Return Preparation Redcar - Small Business Accountant Redcar - Auditing Redcar - Tax Advice Redcar - Cheap Accountant Redcar - Chartered Accountants Redcar - Financial Accountants Redcar