Accountants Birchington-on-Sea: Do you seem to get little else but a headache when you complete your yearly self-assessment form? You're not alone in Birchington-on-Sea if this problem worries you every year. But how can you find a local accountant in Birchington-on-Sea to do this for you? This could be a better idea for you if you find self-assessment a bit too taxing. The average Birchington-on-Sea bookkeeper or accountant will charge about £200-£300 for completing your tax returns. Rather than using a local Birchington-on-Sea accountant you could try one of the currently available online self-assessment services which might offer a saving on cost.

You will quickly discover that there are various forms of accountant. A local accountant who perfectly matches your requirements is the one you should be looking for. You will come to realise that there are accountants who work solo and accountants who work for accounting firms. The benefit of accounting practices is that they have many areas of expertise in one place. The level of expertise within a practice might include tax accountants, forensic accountants, costing accountants, actuaries, management accountants, accounting technicians, auditors, investment accountants, chartered accountants, bookkeepers and financial accountants.

Find yourself a properly qualified one and don't take any chances. An accountant holding an AAT qualification should be perfectly capable of doing your self-assessments. The extra peace of mind should compensate for any higher costs. It should go without saying that accountants fees are tax deductable. Sole traders in Birchington-on-Sea may find that qualified bookkeepers are just as able to do their tax returns.

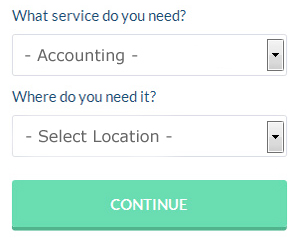

There is now a service available known as Bark, where you can look for local professionals including accountants. You just have to fill in a simple form and answer some basic questions. All you have to do then is wait for some responses.

If you prefer the cheaper option of using an online tax returns service there are several available. More accountants are offering this modern alternative. Make a short list of such companies and do your homework to find the most reputable. Study online reviews so that you can get an overview of the services available.

If you really want the best you could go with a chartered accountant. Their services are normally required by larger limited companies and big business. The choice, so they say, is all yours.

At the end of the day you could always do it yourself and it will cost you nothing but time. Software is also available to make doing your self-assessment even easier. Some of the best ones include 123 e-Filing, Andica, GoSimple, Taxfiler, Taxforward, BTCSoftware, Ajaccts, TaxCalc, Keytime, Taxshield, Basetax, Sage, Forbes, CalCal, Nomisma, ACCTAX, Ablegatio, Capium, Gbooks, Absolute Topup and Xero. The most important thing is that you get your self-assessment tax return to HMRC in good time to avoid a penalty. For being up to 3 months late you will be fined £100, and £10 per day thereafter.

Staying on Top of Your Finances When You're a Business Owner

For many people, starting their own business has many advantages. One of the advantages is that they get to be in charge of their income. They're able to control just how much money they make and how much money they spend. However, proper management of business finances isn't always easy, and many people tend to get overwhelmed with this aspect of the business. Luckily there are plenty of things that you can do to make it easier on yourself. In this article, we'll share with you some of these things.

Hire a good accountant. An accountant is well worth the business expense because she can manage your books for you full time. With an accountant on board, you can easily monitor your cash flow and more importantly pay the right amount of taxes you owe on time. The good news is that you don't have to tackle with the paperwork that goes with these things yourself. You can leave all that to your accountant. You can then focus your attention towards the more profitable aspects of your business, such as increasing your customer base, creating new products, and such. The expense of having a business accountant is nothing compared to how much you'll save trying to figure out your finances and keeping everything in order.

Set a salary and pay yourself on a regular basis even though you're running your own business and you may be the only "employee" you have This will actually help you organize and manage your business and personal finances better. All payments you get from selling goods or offering services should go straight to your business account. Every two weeks or every month, write yourself a paycheck and then deposit that to your personal account. How much should you pay yourself? It's up to you. You can set an hourly rate and then pay yourself the amount equivalent to how many hours you put into your business each month. You can also pay yourself based on how much income your business generated for that month.

Make sure you're prompt in paying your taxes. Generally, taxes must be paid quarterly by small business owners. It's crucial that you have the most current and accurate information when it comes to small business taxes. For this, it's best that you get your information from the IRS or from the local small business center. You can also work with a professional to set up payments and plans for ensuring that you are meeting all of your obligations and following the letter of the law. You wouldn't want the IRS to come knocking on your door because you were remiss in paying your taxes.

Even if you don't have your own business, you'll still benefit from learning how to manage your money properly. As a business owner, you're a lot more likely to succeed if you know how much money your business is generating, how much money you're spending, and basically what's happening with your money. So make sure you use the tips on proper money management that we mentioned in this article. Developing proper money management skills not only will help boost your business but boost your self-confidence as well.

Auditors Birchington-on-Sea

Auditors are specialists who assess the accounts of businesses and organisations to check the validity and legality of their financial records. They protect companies from fraud, discover discrepancies in accounting strategies and, every so often, work as consultants, helping firms to determine solutions to improve efficiency. To work as an auditor, a person has to be approved by the regulatory authority of auditing and accounting or have earned specified qualifications.

Actuary Birchington-on-Sea

An actuary offers advice on, manages and measures monetary and financial risks. They employ their mathematical expertise to gauge the risk and probability of future occurrences and to calculate their financial impact on a business. Actuaries provide reviews of fiscal security systems, with an emphasis on their mathematics, their mechanisms and their complexity. (Tags: Financial Actuaries Birchington-on-Sea, Actuaries Birchington-on-Sea, Actuary Birchington-on-Sea)

Payroll Services Birchington-on-Sea

Staff payrolls can be a stressful aspect of running a business in Birchington-on-Sea, no matter its size. Coping with staff payrolls requires that all legal requirements in relation to their exactness, timings and transparency are followed in all cases.

Using an experienced company in Birchington-on-Sea, to take care of your payroll is a easiest way to lessen the workload of yourself or your financial team. The payroll service will work along with HMRC and pension scheme administrators, and oversee BACS transfers to ensure timely and accurate wage payment to all staff.

It will also be a requirement for a payroll management company in Birchington-on-Sea to provide a P60 tax form for all staff members after the end of the financial year (by 31st May). At the end of an employee's contract, the payroll company should also provide a current P45 relating to the tax paid during the previous financial period.

Birchington-on-Sea accountants will help with business outsourcing in Birchington-on-Sea, business advisory, corporate tax, corporate finance, self-employed registration in Birchington-on-Sea, financial and accounting advice, company secretarial services, HMRC submissions, accounting services for start-ups, charities Birchington-on-Sea, VAT returns, litigation support, tax investigations, management accounts, general accounting services Birchington-on-Sea, consultancy and systems advice, taxation accounting services, workplace pensions, bureau payroll services, National Insurance numbers Birchington-on-Sea, debt recovery, sole traders, annual tax returns, payslips, bookkeeping in Birchington-on-Sea, small business accounting Birchington-on-Sea, accounting services for the construction industry Birchington-on-Sea, PAYE, investment reviews in Birchington-on-Sea, pension planning, partnership registration, assurance services and other accounting services in Birchington-on-Sea, Kent. These are just an example of the tasks that are undertaken by nearby accountants. Birchington-on-Sea companies will be happy to tell you about their whole range of accounting services.

Birchington-on-Sea Accounting Services

- Birchington-on-Sea VAT Returns

- Birchington-on-Sea Specialist Tax

- Birchington-on-Sea Account Management

- Birchington-on-Sea Auditing Services

- Birchington-on-Sea Personal Taxation

- Birchington-on-Sea Self-Assessment

- Birchington-on-Sea Taxation Advice

- Birchington-on-Sea Forensic Accounting

- Birchington-on-Sea Debt Recovery

- Birchington-on-Sea Payroll Management

- Birchington-on-Sea Financial Advice

- Birchington-on-Sea Bookkeeping

- Birchington-on-Sea PAYE Healthchecks

- Birchington-on-Sea Tax Refunds

Also find accountants in: Langley, New Barn, Densole, Ulcombe, Denton, Chiddingstone Causeway, St Marys Hoo, Hollingbourne, Royal British Legion Village, Chipstead, Knockholt, Tonbridge, Hadlow, Farthingloe, Saltwood, Sheerness, Sevenoaks, Wilmington, Tovil, Northfleet, Bramling, Cranbrook, Sellindge, Snave, Curtisden Green, Chart Corner, Lydden, Meopham Green, Harbledown, Easole Street, Sandgate, Beachborough, Snodland, Barfreston, Wallend and more.

Accountant Birchington-on-Sea

Accountant Birchington-on-Sea Accountants Near Birchington-on-Sea

Accountants Near Birchington-on-Sea Accountants Birchington-on-Sea

Accountants Birchington-on-SeaMore Kent Accountants: Maidstone, Tunbridge Wells, Westerham, Dover, Westgate-on-Sea, Margate, Edenbridge, Tenterden, Dartford, West Kingsdown, Hartley, Kingsnorth, Southborough, Whitstable, Rochester, Tonbridge, Meopham, Canterbury, Bearsted, Biggin Hill, Gillingham, Faversham, Walmer, Sittingbourne, Paddock Wood, Ramsgate, Aylesford, Cranbrook, Staplehurst, Snodland, Chatham, Pembury, Swanley, Birchington-on-Sea, East Malling, Boxley, Wilmington, Ashford, Folkestone, Sandwich, Northfleet, Sturry, Sheerness, Deal, New Romney, Herne Bay, Strood, Swanscombe, Broadstairs, Gravesend, Lydd, Sevenoaks and Minster.

TOP - Accountants Birchington-on-Sea - Financial Advisers

Chartered Accountants Birchington-on-Sea - Small Business Accountants Birchington-on-Sea - Tax Accountants Birchington-on-Sea - Investment Accounting Birchington-on-Sea - Financial Advice Birchington-on-Sea - Auditing Birchington-on-Sea - Financial Accountants Birchington-on-Sea - Tax Preparation Birchington-on-Sea - Cheap Accountant Birchington-on-Sea