Accountants Sherborne: Any individual operating a small business in Sherborne, Dorset will pretty quickly realise that there are many advantages to having an accountant at the end of the phone. At the very minimum you can expect to have extra time freed up for your core business operations, while the accountant deals with the mundane paperwork. This type of help can be particularly crucial to small start-up businesses, and those who have not run a business previously. Having access to expert financial advice will help your Sherborne business to grow and prosper.

When looking for a nearby Sherborne accountant, you will find there are numerous different kinds on offer. Your goal is to choose one that meets your exact requirements. Some Sherborne accountants work alone, some within larger practices. Accounting firms will generally have different divisions each handling a certain discipline of accounting. You should be able to find an accountancy practice offering forensic accountants, accounting technicians, tax preparation accountants, investment accountants, actuaries, bookkeepers, cost accountants, chartered accountants, management accountants, financial accountants and auditors.

In order to have your tax returns done effectively, it's advisable to use an accountant who does have the appropriate qualifications. Basic self-assessment tax returns do not require the services of a chartered accountant and an AAT qualification should suffice. A certified Sherborne accountant might be more costly than an untrained one, but should be worth the extra expense. The accountants fees will count as a tax deductable expense, saving you a percentage of the costs. For smaller businesses in Sherborne, a qualified bookkeeper may well be adequate.

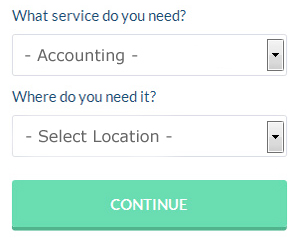

You could use an online service like Bark who will help you find an accountant. Little is required other than ticking a few boxes on the search form. All you have to do then is wait for some responses.

Utilizing an online tax returns service will be your other option. More accountants are offering this modern alternative. It would be advisable to investigate that any online company you use is reputable. It should be a simple task to find some online reviews to help you make your choice.

At the end of the day you could always do it yourself and it will cost you nothing but time. These days there are plenty of software packages that make tax returns even easier to do yourself. Such programs include the likes of Taxshield, ACCTAX, Keytime, Capium, TaxCalc, Taxforward, 123 e-Filing, Absolute Topup, Gbooks, Nomisma, CalCal, Ablegatio, Taxfiler, Ajaccts, GoSimple, Andica, BTCSoftware, Sage, Xero, Basetax and Forbes. The most important thing is that you get your self-assessment tax return to HMRC in good time to avoid a penalty.

Small Business Accountants Sherborne

Ensuring that your accounts are accurate can be a challenging job for any small business owner in Sherborne. Retaining a small business accountant in Sherborne will enable you to operate your business knowing that your annual accounts, tax returns and VAT, amongst many other business tax requirements, are being fully met.

A quality small business accountant will see it as their responsibility to help your business develop, supporting you with good advice, and providing you with security and peace of mind concerning your financial situation at all times. An effective accounting firm in Sherborne will give practical small business advice to optimise your tax efficiency while at the same time lowering costs; vital in the sometimes shadowy field of business taxation.

So as to do their job properly, a small business accountant in Sherborne will want to know exact details with regards to your current financial standing, company structure and any potential investment that you might be looking at, or have put in place. (Tags: Small Business Accountant Sherborne, Small Business Accounting Sherborne, Small Business Accountants Sherborne).

Forensic Accountant Sherborne

You could well run across the term "forensic accounting" when you're hunting for an accountant in Sherborne, and will possibly be wondering what is the distinction between standard accounting and forensic accounting. The clue for this is the word 'forensic', which essentially means "denoting or relating to the application of scientific techniques and methods to the investigation of crime." Also often known as 'forensic accountancy' or 'financial forensics', it uses auditing, accounting and investigative skills to identify discrepancies in financial accounts that have resulted in fraud or theft. There are even several larger accountants firms throughout Dorset who have got dedicated departments for forensic accounting, investigating insolvency, falsified insurance claims, tax fraud, money laundering, professional negligence, personal injury claims and bankruptcy.

Staying on Top of Your Finances When You're a Business Owner

It can be a very exciting thing to start your own business -- whether your business is online of offline. You are finally in charge of yourself, you are finally in charge of your income -- you are in charge of everything! Now that can be a little scary! In addition to the excitement of being your own boss, it can be a bit intimidating particularly if you have no business experience. It then pays to be aware of a few self-improvement strategies like knowing how to manage finances the proper way. If you'd like to keep your finances in order, continue reading this article.

Retain an accountant. This is a business expense that's really worth it because an accountant can help keep your books straight on a full time basis. An accountant can easily monitor your business cash flow, help you pay yourself, and even determine the right amount of taxes you should be paying and when. What's more, she'll deal with all of the paperwork that is associated with those things. You can then focus your attention towards the more profitable aspects of your business, such as increasing your customer base, creating new products, and such. You'll save yourself the trouble of having to figure out your business finances if you hire an accountant.

Learning a little bit about bookkeeping helps a lot. It's important that you have a system in place for your money -- both for your personal and business finances. You can do this simply by setting up a basic Excel spreadsheet or you could use bookkeeping software like Quicken or QuickBooks. Budgeting tools like Mint.com are also an option. The internet is full of free resources on how you can manage your small business bookkeeping. You'll know exactly what's happening to your business and personal finances when you've got your books in order. And if you simply can't afford to hire a bookkeeper at this time, you'll benefit from taking a basic bookkeeping and accounting class.

Make sure you account for every penny your business brings in. Each time you're paid by a client or customer for a service you provided or a product you sold them, record that amount. With this money management strategy, you can easily keep track of how much money you've got on hand, as well as who has already paid their dues and who hasn't. Tracking your income helps you figure out your taxes, how much to pay yourself, etc.

Not only does learning how to properly manage your money help you improve yourself, it helps improve your business too. These are a few of the tips and tricks that will help you better keep track of your financial situation. You're much more likely to experience business and personal success when you have your finances under control.

Auditors Sherborne

Auditors are experts who assess the fiscal accounts of organisations and businesses to verify the validity and legality of their financial reports. Auditors examine the financial activities of the company that hires them and make certain of the steady functioning of the business. Auditors must be authorised by the regulatory body for accounting and auditing and have the required accounting qualifications. (Tags: Auditors Sherborne, Auditing Sherborne, Auditor Sherborne)

Sherborne accountants will help with accounting services for landlords, accounting support services, investment reviews, charities, sole traders in Sherborne, accounting services for media companies Sherborne, bookkeeping, taxation accounting services, annual tax returns, limited company accounting, financial statements, VAT registrations, VAT returns, general accounting services, tax investigations, business start-ups Sherborne, accounting services for the construction industry in Sherborne, business outsourcing Sherborne, capital gains tax Sherborne, company secretarial services, National Insurance numbers Sherborne, audit and compliance reporting, year end accounts Sherborne, financial planning, HMRC liaison, financial and accounting advice in Sherborne, estate planning, bureau payroll services, company formations, management accounts, partnership registration, double entry accounting and other types of accounting in Sherborne, Dorset. Listed are just a small portion of the activities that are conducted by local accountants. Sherborne specialists will tell you about their whole range of accountancy services.

You do, in fact have the best resource right at your fingertips in the form of the web. There's so much inspiration and information available online for stuff like accounting & auditing, accounting for small businesses, personal tax assistance and self-assessment help, that you will very soon be deluged with suggestions for your accounting needs. An example could be this super article about choosing an accountant for your business.

Sherborne Accounting Services

- Sherborne Tax Planning

- Sherborne Forensic Accounting

- Sherborne Self-Assessment

- Sherborne Tax Returns

- Sherborne Business Accounting

- Sherborne Tax Advice

- Sherborne Financial Advice

- Sherborne Tax Services

- Sherborne Personal Taxation

- Sherborne Tax Refunds

- Sherborne VAT Returns

- Sherborne PAYE Healthchecks

- Sherborne Payroll Management

- Sherborne Specialist Tax

Also find accountants in: Monkton Up Wimborne, Pulham, East Stoke, Binghams Melcombe, Mapperton, Folly, Stoborough, Wimborne St Giles, Cerne Abbas, Owermoigne, Lydlinch, Hurn, Uphall, Chetnole, Ferndown, Melbury Osmond, Fifehead Neville, Stoke Wake, Preston, Broom Hill, Wallisdown, Manston, Litton Cheney, Shillingstone, Holditch, Stanbridge, Okeford Fitzpaine, East Stour, Fifehead Magdalen, North Wootton, Higher Ansty, Dottery, Rodden, Ryall, Tarrant Launceston and more.

Accountant Sherborne

Accountant Sherborne Accountants Near Me

Accountants Near Me Accountants Sherborne

Accountants SherborneMore Dorset Accountants: Poole, Sherborne, Ferndown, Bridport, Weymouth, Bournemouth, Christchurch, Swanage, Dorchester, Blandford Forum, Shaftesbury, Wimborne Minster, Corfe Mullen, Verwood and Wareham.

TOP - Accountants Sherborne - Financial Advisers

Tax Preparation Sherborne - Self-Assessments Sherborne - Financial Advice Sherborne - Investment Accountant Sherborne - Auditing Sherborne - Small Business Accountants Sherborne - Cheap Accountant Sherborne - Chartered Accountants Sherborne - Bookkeeping Sherborne