Accountants Christchurch: There are numerous benefits to be gained from hiring the services of an accountant if you're running a business or are self-employed in the Christchurch area. More importantly you'll have more time to concentrate on your core business operations, while your accountant deals with such things as annual tax returns and bookkeeping. The benefits of this kind of professional help far outweighs the extra costs involved.

When hunting for an accountant in Christchurch, you will notice that there are different kinds. Take the time to track down an accountant that matches your specific needs. It is possible that you may prefer to work with an accountant who's working within a local Christchurch accounting firm, rather than one that works by himself/herself. Having several accounting experts together within a single office can have many advantages. With an accounting company you'll have a choice of: actuaries, auditors, investment accountants, forensic accountants, management accountants, bookkeepers, accounting technicians, chartered accountants, tax accountants, financial accountants and cost accountants.

You should take care to find a properly qualified accountant in Christchurch to complete your self-assessment forms correctly and professionally. Ask if they at least have an AAT qualification or higher. You might find that a qualified accountant is slightly more expensive but could find you additional tax savings to compensate. The cost of preparing your self-assessment form can be claimed back as a business expense.

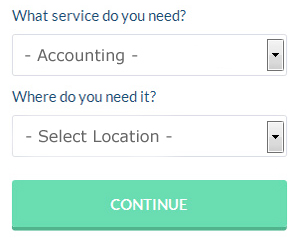

One online service which helps people like you find an accountant is Bark. It is just a case of ticking some boxes on a form. Then you just have to wait for some prospective accountants to contact you. Bark do not charge people looking for services.

Apart from the cheapest option of completing your own self-assessment form, an online tax return service might be worth a try. Services like this are convenient and cost effective. Should you decide to go down this route, take care in choosing a legitimate company. A quick browse through some reviews online should give you an idea of the best and worse services. We will not be recommending any individual online accounting service in this article.

The most qualified of all are chartered accountants, they have the most training and the most expertise. These high achievers will hold qualifications like an ACA or an ICAEW. The choice, so they say, is all yours.

The most cost effective method of all is to do it yourself. Using accounting software like Taxforward, 123 e-Filing, BTCSoftware, Basetax, Nomisma, Taxfiler, Xero, Keytime, CalCal, Forbes, Andica, ACCTAX, TaxCalc, Taxshield, GoSimple, Ajaccts, Absolute Topup, Sage, Gbooks, Capium or Ablegatio will make it even simpler to do yourself. If you don't get your self-assessment in on time you will get fined by HMRC. You�ll get a penalty of £100 if your tax return is up to 3 months late.

Tips to Help You Manage Your Money Better

Whether you're starting up an online or offline business, it can be one of the most exciting things you'd ever do. When you're your own boss, you get to be in charge of basically everything. That sounds a little scary, doesn't it? Truly, while exhilarating, starting your own business is also quite intimidating because it can be quite difficult to find your feet. It then pays to be aware of a few self-improvement strategies like knowing how to manage finances the proper way. If you'd like to keep your finances in order, continue reading this article.

It could be that you use your credit card to pay many of your regular expenditures like web hosting, recurring membership fees, advertising accounts, and so on. This can make your life easier because each month, you just make one payment to your credit card company instead of making out payments to several different companies. Of course, credit cards are tricky things, and if you let yourself carry a balance, the interest charges could make you pay a lot more money than you would have spent by simply paying the fees straight out of your bank account. This isn't to say you shouldn't use your credit card, but if you do, it's best if you pay it all off every month. With this money management strategy, you only have to keep track of one consolidated payment, not pay any interest, and build your credit rating.

You may be a sole proprietor, but that doesn't mean you can't give yourself a regular paycheck. This way, you won't have a hard time keeping track of your business and personal finances. So how do you do this exactly? First, any payments you get from the sale of your products or services should go to your business account. Next, decide how often you want to receive a salary. Let's say you want to pay yourself once every month, such as on the 15th. When the 15th comes around, write yourself a check. It's up to you how much salary you want to give yourself. You can pay yourself by billable hours or a portion of your business income for that month.

Don't be late in paying your taxes. Small businesses typically pay file taxes quarterly. Taxes can be quite confusing so you might want to make an appointment with your local small business center or even at the IRS so you can get accurate information. There are also professionals you can work with who can set you up with payments and plans to make sure you're paying your taxes on time. Having the IRS at your doorstep isn't something you'd want, believe me!

You can improve yourself in many ways when you're managing your own business. For one, you can learn how to manage your finances better. Everyone can use help in learning how to manage money better. Your confidence stands to gain a lot when you get better at managing your finances. It also helps you organize many areas of your life both personally and professionally. Keep in mind the money management tips we shared in this article. Keep applying them to your business and you'll soon see much success.

Auditors Christchurch

Auditors are experts who examine the accounts of organisations and businesses to ascertain the legality and validity of their financial records. They protect companies from fraud, find irregularities in accounting strategies and, on occasion, work as consultants, helping firms to find ways to boost operational efficiency. To act as an auditor, a person must be authorised by the regulatory authority of auditing and accounting or have earned certain specific qualifications. (Tags: Auditor Christchurch, Auditors Christchurch, Auditing Christchurch)

Financial Actuaries Christchurch

An actuary assesses, manages and advises on financial and monetary risks. An actuary applies statistical and financial hypotheses to assess the chances of a specific event taking place and its possible monetary impact. An actuary uses statistics and math to appraise the fiscal impact of uncertainties and help clients minimise risks.

Christchurch accountants will help with management accounts, company formations Christchurch, accounting services for media companies, HMRC submissions, business disposal and acquisition Christchurch, inheritance tax, personal tax in Christchurch, self-employed registrations in Christchurch, charities, taxation accounting services in Christchurch, business outsourcing in Christchurch, PAYE, VAT returns, consultancy and systems advice, capital gains tax, business support and planning, payslips, self-assessment tax returns in Christchurch, year end accounts in Christchurch, employment law Christchurch, financial planning, VAT registrations in Christchurch, monthly payroll Christchurch, double entry accounting, consulting services, accounting services for buy to let property rentals, tax preparation, bookkeeping, accounting services for the construction industry in Christchurch, partnership accounts, litigation support, sole traders and other forms of accounting in Christchurch, Dorset. These are just a few of the activities that are performed by nearby accountants. Christchurch specialists will be happy to tell you about their full range of services.

By using the internet as a useful resource it is amazingly easy to uncover a whole host of invaluable ideas and inspiration concerning personal tax assistance, small business accounting, accounting & auditing and self-assessment help. For example, with a very quick search we came across this compelling article about choosing the right accountant for your business.

Christchurch Accounting Services

- Christchurch Tax Services

- Christchurch Tax Refunds

- Christchurch Specialist Tax

- Christchurch Bookkeeping

- Christchurch Debt Recovery

- Christchurch Financial Advice

- Christchurch Tax Returns

- Christchurch Business Accounting

- Christchurch Tax Advice

- Christchurch Self-Assessment

- Christchurch Bookkeeping Healthchecks

- Christchurch Auditing Services

- Christchurch Tax Planning

- Christchurch VAT Returns

Also find accountants in: Whetley Cross, Holdenhurst, Winterborne Zelston, Gillingham, Shapwick, Wyke, Tarrant Monkton, Poole, Nettlecombe, Sutton Waldron, Maiden Newton, Broadstone, Hermitage, Thornicombe, Turnworth, Allweston, Winton, White Lackington, Portesham, Lyme Regis, Fishpond Bottom, Beer Hackett, Lower Kingcombe, Langton Herring, Blackdown, West Chelborough, Alton Pancras, Stokeford, Corfe Mullen, Chalmington, Grove, Nether Cerne, Preston, Chalbury Common, Wallisdown and more.

Accountant Christchurch

Accountant Christchurch Accountants Near Me

Accountants Near Me Accountants Christchurch

Accountants ChristchurchMore Dorset Accountants: Dorchester, Christchurch, Wimborne Minster, Poole, Sherborne, Swanage, Ferndown, Corfe Mullen, Bournemouth, Weymouth, Wareham, Bridport, Shaftesbury, Blandford Forum and Verwood.

TOP - Accountants Christchurch - Financial Advisers

Online Accounting Christchurch - Bookkeeping Christchurch - Investment Accountant Christchurch - Tax Advice Christchurch - Cheap Accountant Christchurch - Financial Accountants Christchurch - Small Business Accountants Christchurch - Self-Assessments Christchurch - Auditors Christchurch