Accountants Poole: Do you find that completing your annual self-assessment form gives you a headache? Lots of self-employed people in Poole feel much the same as you. Is it easy to track down a local professional in Poole to manage this for you? Do you find self-assessment just too taxing to tackle by yourself? The cost of completing and sending in your self-assessment form is approximately £200-£300 if done by a regular Poole accountant. Those who consider this too expensive have the added option of using an online tax return service.

So, how do you go about uncovering a reliable Poole accountant? A shortlist of potential Poole accountants may be identified with just a few seconds searching on the internet. However, it is difficult to spot the gems from the scoundrels. You shouldn't forget that advertising as an accountant or bookkeeper is something that almost anyone in Poole can do if they want. Incredibly, there isn't even a need for them to hold any form of qualification. Which seems a bit odd on the face of things.

It is best to find an accountant who can demostrate that he/she has the desired qualifications. For basic tax returns an AAT qualified accountant should be sufficient. If you want your self-assessment forms done properly it is worth paying extra for a qualified professional. It should go without saying that accountants fees are tax deductable. Poole sole traders often opt to use bookkeeper rather than accountants for their tax returns.

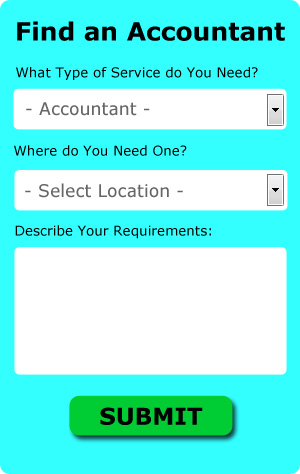

If you don't have the time to do a proper online search for local accountants, try using the Bark website. In no time at all you can fill out the job form and submit it with a single click. Your details will be sent out to potential accountants and they will contact you directly with details and prices.

You could always try an online tax returns service if your needs are fairly simple. More accountants are offering this modern alternative. You still need to do your homework to pick out a company you can trust. The easiest way to do this is by studying online reviews. We will not be recommending any individual online accounting service in this article.

The real professionals in the field are chartered accountants. Smaller businesses and sole traders will probably not need to aim quite this high. We have now outlined all of your available choices.

HMRC offers lots of help on completing tax returns, so you might even decide to do it yourself. To make life even easier there is some intuitive software that you can use. Including Taxshield, Forbes, GoSimple, Keytime, Ablegatio, Basetax, Capium, Xero, Gbooks, Absolute Topup, Andica, Nomisma, Taxfiler, CalCal, Ajaccts, Taxforward, ACCTAX, Sage, TaxCalc, 123 e-Filing and BTCSoftware. If you don't get your self-assessment in on time you will get fined by HMRC. Penalties start at £100 and rise considerably if you are more that 3 months late.

Improve Your Business and Yourself By Learning Better Money Management

Starting your own business is exciting, and this is true whether you are starting this business online or offline. You're your own boss and you're in control of how much you make. Well, you're basically in charge of everything! Now that can be a little scary! However, starting up a business of your own can also be very intimidating, especially during the initial stages when you're just getting your feet wet. Thus, it can be very helpful if you know a few self-improvement strategies like managing your finances properly. If you'd like to keep your finances in order, continue reading this article.

Avoid combining your business expenses and personal expenses in one account. It may be simple to keep track of everything in the beginning, but over time, you'll find it's so much easier to track your expenses if you have separate accounts. If you decide to use your personal account for running your business expenses, it can be a real challenge to prove your income. It will also be harder on you when it's time to file taxes because you'll need to identify which expenses were personal and which ones were related to your business. You'll be able to manage your finances better if you separate the business expenses from the personal expenses.

Consider offering clients payment plans. Not only will this drum up more business for you, this will ensure that money is coming in regularly. It's certainly a lot easier than having money coming in irregularly and you've got long, dry spells. Basically, you can easily make a budget and pay your bills promptly if you've got reliable income. If you're in control of your business finances, you'll feel more self-confident.

Make sure you deposit any money you receive at the end of the day if your business deals with cash on a fairly regular basis. This will help you eliminate the temptation of using money for non-business related things. It's so easy to take a couple of dollars here and there when you're short on cash and just say you'll put back in however much you took. When you do this, however, it's very possible that you'll forget all about the money you took out and then when you're doing your books, you're going to wonder why you're short. So when you close up shop at the end of each day, it's best if you deposit your cash to the bank each time.

Learning how to manage your finances properly will help not just your business but yourself as well. Try to implement these tips we've shared because you stand to benefit in the long run. When you have that under control, the sky is the limit!

Poole accountants will help with tax preparation, business outsourcing, financial planning, accounting services for media companies, litigation support, annual tax returns, personal tax, capital gains tax, double entry accounting, workplace pensions Poole, payslips, estate planning, accounting services for the construction sector Poole, consultancy and systems advice in Poole, sole traders in Poole, VAT payer registration, business start-ups, company secretarial services in Poole, charities, business advisory services, inheritance tax, monthly payroll Poole, HMRC submissions, management accounts, contractor accounts, company formations, VAT returns, corporation tax in Poole, compliance and audit reports, taxation accounting services, auditing and accounting, small business accounting Poole and other types of accounting in Poole, Dorset. These are just a handful of the duties that are accomplished by local accountants. Poole specialists will be happy to inform you of their full range of accounting services.

You do, of course have the best possible resource at your fingertips in the shape of the net. There's such a lot of information and inspiration readily available online for such things as personal tax assistance, accounting & auditing, small business accounting and self-assessment help, that you will pretty soon be deluged with suggestions for your accounting requirements. An example may be this enlightening article outlining how to uncover a top-notch accountant.

Poole Accounting Services

- Poole Payroll Management

- Poole Bookkeeping Healthchecks

- Poole Chartered Accountants

- Poole Tax Refunds

- Poole Auditing Services

- Poole Business Accounting

- Poole Forensic Accounting

- Poole Personal Taxation

- Poole Tax Planning

- Poole Debt Recovery

- Poole Tax Returns

- Poole PAYE Healthchecks

- Poole VAT Returns

- Poole Self-Assessment

Also find accountants in: Plush, Kings Stag, Symondsbury, Pilsdon, Wyke Regis, Parkstone, Chilfrome, Hazelbury Bryan, Glanvilles Wootton, Child Okeford, Southbourne, Uphall, Melbury Bubb, Sixpenny Handley, Puddletown, Hilton, Lytchett Matravers, Shipton Gorge, Stourton Caundle, Easton, Middlemarsh, Hinton Martell, Hammoon, Spetisbury, Gaunts Common, Margaret Marsh, Hampreston, Seatown, Mapperton, Wyke, East Lulworth, Witchampton, Winkton, Okeford Fitzpaine, Kingston and more.

Accountant Poole

Accountant Poole Accountants Near Me

Accountants Near Me Accountants Poole

Accountants PooleMore Dorset Accountants: Blandford Forum, Verwood, Corfe Mullen, Poole, Christchurch, Dorchester, Wareham, Bridport, Weymouth, Wimborne Minster, Ferndown, Sherborne, Bournemouth, Swanage and Shaftesbury.

TOP - Accountants Poole - Financial Advisers

Financial Accountants Poole - Auditors Poole - Chartered Accountants Poole - Bookkeeping Poole - Self-Assessments Poole - Financial Advice Poole - Online Accounting Poole - Investment Accounting Poole - Small Business Accountant Poole