Accountants Keynsham: Do you seem to get nothing but a headache when you're filling out your annual self-assessment form? Many folks in Keynsham are in the same predicament as you. Is it easy to find a local professional in Keynsham to handle this for you? This might be the best option if you consider self-assessment just too taxing. The cost of completing and submitting your self-assessment form is approximately £200-£300 if carried out by a regular Keynsham accountant. If this sounds like a lot to you, then look at using an online service.

Locating an accountant in Keynsham isn't always that easy with various kinds of accountants out there. Finding one that dovetails neatly with your business is vital. It isn't unusual for Keynsham accountants to operate independently, others favour being part of a larger accountancy company. The various accounting fields can be better covered by an accounting firm with several experts. The principal positions that will be covered by an accountancy company include: forensic accountants, bookkeepers, financial accountants, management accountants, tax accountants, costing accountants, accounting technicians, chartered accountants, auditors, investment accountants and actuaries.

It is advisable for you to find an accountant in Keynsham who is properly qualified. Look for an AAT qualified accountant in the Keynsham area. It is worth paying a little more for that extra peace of mind. Make sure that you include the accountants fees in your expenses, because these are tax deductable.

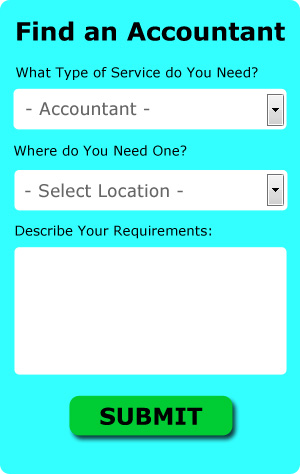

If you don't have the time to do a proper online search for local accountants, try using the Bark website. You only need to answer a few basic questions and complete a straightforward form. As soon as this form is submitted, your requirements will be forwarded to local accountants.

At the budget end of the spectrum, the online tax returns services might be adequate for your needs. This may save time and be more cost-effective for self-employed people in Keynsham. Some of these companies are more reputable than others. Study reviews and customer feedback. Recommending any specific services is beyond the scope of this short article.

Self-assessment really isn't as difficult as most people think it is, so why not try doing it yourself? These days there are plenty of software packages that make tax returns even easier to do yourself. Such programs include the likes of Xero, Keytime, Basetax, Sage, Capium, Forbes, Ablegatio, Gbooks, Absolute Topup, 123 e-Filing, TaxCalc, Nomisma, CalCal, ACCTAX, GoSimple, BTCSoftware, Taxshield, Taxfiler, Andica, Ajaccts and Taxforward. The most important thing is to make sure your self-assessment is sent in promptly.

Learn How to Manage Your Business Budget Properly

The fact that you get to be completely in charge of your income is one of the good reasons to put up your own business. At the same time, however, many people get overwhelmed when it comes to managing the funds for their business. Still, this shouldn't deter you from going into business for yourself. You've got a number of things that can help you successfully manage the financial side of your business. Continue reading if you'd like to know how you can be a better money manager for your own business.

If you have a lot of regular expenditures, such as hosting account bills, recurring membership dues, etc, you might be tempted to put them all on a credit card. This can certainly help your memory because you only have one payment to make each month instead of several. But then again, there's a risk to using credit cards because you'll end up paying interest if you don't pay the balance off in full every month. To avoid this, make sure you pay your credit card balance in full every month. Not only will this help you deal with just one payment and not have to pay interest charges, this will help boost your credit score as well.

Each week, balance your books. However, you should balance your books at the end of business day every day if what you have is a traditional store with cash registers or takes in multiple payments throughout the day every day. Balance your books every day or every week to make sure that your numbers are the same as the numbers reflected in your bank account or cash you have on hand. When you do this, at the end of the month or every quarter, you're going to save yourself a lot of time and trouble trying to find where the discrepancies are if the numbers don't match up. Besides, it will only take you a few minutes if you balance your books regularly, whereas if you balance your books once a month, that would take you hours to do.

Keep a tight lid on your spending. It may be that you've got a lot of things you wished you could buy before and now that you have a steady stream of income coming in, you're tempted to finally buy them. It's best if you spend money on things that will benefit your business. Also, it's better if you build your business savings. This way, should unexpected expenses crop up, you'll be able to deal with it in a timely manner. You should also try buying your business supplies in bulk. When it comes to your business equipment, you will save more by investing in quality machines even if they may require a huge cash outlay from you in the beginning. The savings will come in the form of not having to buy a new one or replace parts frequently. Avoid spending too much on your entertainment as well; be moderate instead.

When it comes to managing your money properly, there are so many things that go into it. It's more than making a list of things you spent on, how much, and when. When it comes to your business finances, you have many things to keep track of. With the tips above, you'll have an easier time tracking your money. Continue learning proper money management and you can expect improvement in yourself and in your business.

Auditors Keynsham

Auditors are specialists who review the accounts of organisations and businesses to confirm the validity and legality of their financial reports. They offer companies from fraud, illustrate discrepancies in accounting techniques and, sometimes, work on a consultancy basis, helping organisations to identify solutions to maximize operational efficiency. Auditors need to be accredited by the regulating authority for accounting and auditing and have the required accounting qualifications.

Forensic Accounting Keynsham

You could well run into the term "forensic accounting" when you are trying to find an accountant in Keynsham, and will perhaps be interested to know about the distinction between forensic accounting and standard accounting. The actual word 'forensic' is the thing that gives it away, meaning literally "denoting or relating to the application of scientific techniques and methods to the investigation of criminal activity." Also referred to as 'financial forensics' or 'forensic accountancy', it uses auditing, investigative skills and accounting to identify inaccuracies in financial accounts that have lead to theft or fraud. There are some larger accountants firms in Somerset who've got dedicated divisions for forensic accounting, addressing tax fraud, insurance claims, personal injury claims, money laundering, bankruptcy, insolvency and professional negligence. (Tags: Forensic Accountants Keynsham, Forensic Accounting Keynsham, Forensic Accountant Keynsham)

Financial Actuaries Keynsham

An actuary offers advice on, manages and evaluates finance related risks. They employ their in-depth knowledge of economics and business, in conjunction with their skills in probability theory, statistics and investment theory, to provide financial, strategic and commercial advice. An actuary uses mathematics and statistics to estimate the fiscal impact of uncertainties and help their customers cut down on possible risks. (Tags: Financial Actuaries Keynsham, Actuary Keynsham, Actuaries Keynsham)

Keynsham accountants will help with cashflow projections, bookkeeping, partnership registration, company formations, monthly payroll, payslips Keynsham, accounting services for buy to let rentals Keynsham, year end accounts, VAT registrations, PAYE, litigation support, debt recovery, financial planning Keynsham, general accounting services, investment reviews, self-employed registrations, assurance services, consulting services, mergers and acquisitions, company secretarial services, business support and planning, estate planning, capital gains tax in Keynsham, limited company accounting, accounting support services in Keynsham, partnership accounts in Keynsham, HMRC submissions, accounting services for the construction industry, audit and compliance reporting, small business accounting Keynsham, management accounts, tax preparation Keynsham and other accounting services in Keynsham, Somerset. These are just a handful of the activities that are carried out by local accountants. Keynsham specialists will be happy to tell you about their entire range of accounting services.

When you are hunting for inspiration and ideas for self-assessment help, accounting & auditing, personal tax assistance and small business accounting, you will not need to look much further than the world wide web to get everything you could possibly need. With so many carefully researched blog posts and webpages to pick from, you will very shortly be overwhelmed with ideas and concepts for your planned project. Just recently we stumbled across this informative article on the subject of how to track down an accountant to complete your annual tax return.

Keynsham Accounting Services

- Keynsham Account Management

- Keynsham Bookkeeping Healthchecks

- Keynsham Bookkeepers

- Keynsham Tax Refunds

- Keynsham Taxation Advice

- Keynsham Chartered Accountants

- Keynsham VAT Returns

- Keynsham Payroll Management

- Keynsham Auditing Services

- Keynsham Self-Assessment

- Keynsham Forensic Accounting

- Keynsham Tax Returns

- Keynsham Business Accounting

- Keynsham Tax Services

Also find accountants in: Trull, Beckington, Tarnock, Redcliff Bay, Hardway, West Lambrook, Puckington, Henstridge Ash, St Audries, Thorngrove, Pitney, Bowlish, Lower Godney, Rumwell, Ford Street, Holwell, South Barrow, Nether Stowey, Cloford, Draycott, Exton, Heathfield, Dundry, Marston Magna, Misterton, Evercreech, Inglesbatch, Stretcholt, Nunnington Park, Sheepway, Bury, Washford, Christon, Limpley Stoke, Fulford and more.

Accountant Keynsham

Accountant Keynsham Accountants Near Me

Accountants Near Me Accountants Keynsham

Accountants KeynshamMore Somerset Accountants: Clevedon, Nailsea, Bristol, Yeovil, Bath, Frome, Keynsham, Burnham-on-Sea, Portishead, Bridgwater, Weston-super-Mare and Taunton.

TOP - Accountants Keynsham - Financial Advisers

Small Business Accountant Keynsham - Chartered Accountant Keynsham - Cheap Accountant Keynsham - Auditing Keynsham - Financial Accountants Keynsham - Financial Advice Keynsham - Tax Accountants Keynsham - Tax Preparation Keynsham - Bookkeeping Keynsham