Accountants Ilkeston: There are numerous benefits to be gained from hiring the services of an accountant if you're running a business or are self-employed in the Ilkeston area. By managing your bookkeeping and self-assessment tax returns your accountant can free up a bit of time so that you can focus on what you do best. The importance of getting this type of financial help cannot be overstated, especially for start-ups and fledgling businesses who are not yet established. As you grow, you'll need increasingly more help.

So, precisely what should you be expecting to pay for this service and what should you get for your money? Finding a shortlist of local Ilkeston accountants should be quite simple with a swift search on the internet. However, how do you know which ones can be trusted with your paperwork? The sad fact is that anybody in Ilkeston can promote their services as an accountant. They do not even need to have any qualifications.

If you want your tax returns to be correct and error free it might be better to opt for a professional Ilkeston accountant who is appropriately qualified. At the very least you should look for somebody with an AAT qualification. A qualified accountant may cost a little more but in return give you peace of mind. You will be able to claim the cost of your accountant as a tax deduction. Small businesses and sole traders can use a bookkeeper rather than an accountant.

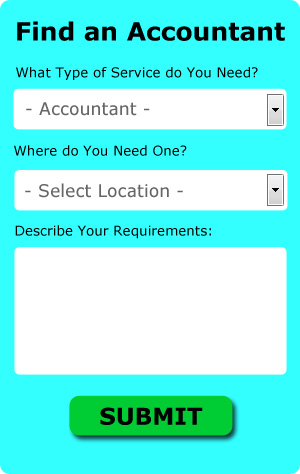

Not to be confused with online services who will do your tax returns for you, a company called Bark will assist you in finding a decent Ilkeston accountant. Tick a few boxes on their form and submit it in minutes. It is then simply a case of waiting for some suitable responses.

At the budget end of the spectrum, the online tax returns services might be adequate for your needs. For many self-employed people this is a convenient and time-effective solution. Picking a reputable company is important if you choose to go with this option. Have a good look at customer testimonials and reviews both on the company website and on independent review websites. We cannot endorse or recommend any of the available services here.

The very best in this profession are chartered accountants, they will also be the most expensive. However, as a sole trader or smaller business in Ilkeston using one of these specialists may be a bit of overkill. Hiring the services of a chartered accountant means you will have the best that money can buy.

The cheapest option of all is to do your own self-assessment form. You could even use a software program like Ablegatio, Andica, Taxforward, TaxCalc, Taxfiler, Absolute Topup, GoSimple, 123 e-Filing, Taxshield, Xero, CalCal, BTCSoftware, Capium, Basetax, Nomisma, Ajaccts, Gbooks, ACCTAX, Sage, Keytime or Forbes to make life even easier. The most important thing is that you get your self-assessment tax return to HMRC in good time to avoid a penalty.

Small Business Accountants Ilkeston

Making certain that your accounts are accurate can be a challenging job for anyone running a small business in Ilkeston. If your accounts are getting on top of you and VAT and tax return issues are causing you sleepless nights, it is a good idea to employ a small business accountant in Ilkeston.

Offering guidance, making sure that your business follows best fiscal practices and providing ways to help your business to achieve its full potential, are just some of the responsibilities of a reputable small business accountant in Ilkeston. The fluctuating and often complex sphere of business taxation will be cleared and explained to you in order to reduce your business costs, while at the same time maximising tax efficiency.

To be able to do their job effectively, a small business accountant in Ilkeston will have to know complete details regarding your present financial situation, company structure and any future investments that you may be considering, or already have put in place.

Forensic Accounting Ilkeston

While engaged on your search for a certified accountant in Ilkeston there is a good likelihood that you'll happen on the expression "forensic accounting" and be curious about what that is, and how it differs from regular accounting. The clue for this is the actual word 'forensic', which basically means "relating to or denoting the application of scientific methods and techniques to the investigation of crime." Also often known as 'forensic accountancy' or 'financial forensics', it uses accounting, auditing and investigative skills to detect inaccuracies in financial accounts which have contributed to fraud or theft. There are even some larger accountants firms throughout Derbyshire who have got specialised divisions for forensic accounting, investigating professional negligence, personal injury claims, bankruptcy, tax fraud, false insurance claims, insolvency and money laundering. (Tags: Forensic Accounting Ilkeston, Forensic Accountants Ilkeston, Forensic Accountant Ilkeston)

Auditors Ilkeston

An auditor is a company or individual appointed to assess and verify the correctness of financial records and make certain that businesses or organisations observe tax laws. They protect companies from fraud, highlight irregularities in accounting procedures and, occasionally, operate on a consultancy basis, helping organisations to find ways to boost efficiency. For anyone to start working as an auditor they should have certain specific qualifications and be certified by the regulatory authority for accounting and auditing.

Financial Actuaries Ilkeston

Actuaries work with organisations, government departments and companies, to help them forecast long-term fiscal expenditure and investment risks. An actuary employs financial and statistical theories to measure the odds of a particular event occurring and the possible monetary implications. To be an actuary it is important to have a statistical, mathematical and economic knowledge of everyday scenarios in the financial world. (Tags: Actuary Ilkeston, Financial Actuary Ilkeston, Actuaries Ilkeston)

Be a Better Small Business Owner By Learning Proper Money Management

Proper money management is something that many small business owners have to struggle with, especially when they are still trying to get their feet wet as a business owner. Your confidence can plummet if you fail to manage your money properly. If your business experience cash flow problems, you might find yourself thinking about throwing in the towel and going back to your old job. This is going to keep you from succeeding in your business. Keep reading to learn a few tips you can use to help you manage your finances better.

It's best if you have separate account for your personal expenses and business expenses. This will help minimize confusion. Sure, it may seem easy to manage your finances, personal and business, if you just have one account right now, but when your business really takes off, you're going to wish you had a separate account. And here's the thing -- if you run your business expenses through your personal account, it'll be a lot harder to prove your income. In addition, it will be difficult to sort through your financial record when tax season comes and figure out which expenses are business related and which expenses were personal in nature. Make it easy on yourself (or your accountant) by having an account for your business and another for your personal expenses.

Set a salary and pay yourself on a regular basis even though you're running your own business and you may be the only "employee" you have This will actually help you organize and manage your business and personal finances better. Your business account should be where all the payments you get for the sale of your products or services should go. Then on a weekly, bi-weekly, or monthly basis, you can pay yourself out of your business account. Just how much money you pay yourself is completely up to you. You can set an hourly rate and then pay yourself the amount equivalent to how many hours you put into your business each month. You can also pay yourself based on how much income your business generated for that month.

Do you receive cash payments regularly in your business? It may be a good idea to deposit money at the end of the day or as soon as possible. This will minimize the temptation of having money available that you can easily spend. It's so easy to take a couple of dollars here and there when you're short on cash and just say you'll put back in however much you took. But with cash, it is easy to forget about things like that, so remove the temptation to screw up your book keeping and accounting. So when you close up shop at the end of each day, it's best if you deposit your cash to the bank each time.

When it comes to managing your money properly, there are so many things that go into it. It's not only about keeping a record of when you spent what. As a business owner, you've got numerous things you need to keep track of when it comes to your money. We've shared some things in this article that should make tracking your money easier for you to do. Continue learning proper money management and you can expect improvement in yourself and in your business.

Ilkeston accountants will help with PAYE, personal tax, employment law in Ilkeston, corporate tax Ilkeston, business outsourcing, National Insurance numbers, limited company accounting, accounting services for media companies, cashflow projections Ilkeston, tax investigations, VAT payer registration Ilkeston, inheritance tax, company secretarial services, business start-ups, accounting support services in Ilkeston, tax returns in Ilkeston, bookkeeping, VAT returns, mergers and acquisitions Ilkeston, assurance services Ilkeston, business advisory, sole traders in Ilkeston, financial and accounting advice, capital gains tax, financial statements, workplace pensions, small business accounting, company formations Ilkeston, business acquisition and disposal in Ilkeston, audit and auditing, corporate finance, consultancy and systems advice and other types of accounting in Ilkeston, Derbyshire. Listed are just a selection of the tasks that are conducted by nearby accountants. Ilkeston professionals will be happy to tell you about their entire range of services.

Ilkeston Accounting Services

- Ilkeston Chartered Accountants

- Ilkeston Personal Taxation

- Ilkeston Business Accounting

- Ilkeston Payroll Management

- Ilkeston Tax Services

- Ilkeston Account Management

- Ilkeston Bookkeeping Healthchecks

- Ilkeston Tax Refunds

- Ilkeston Bookkeepers

- Ilkeston Tax Advice

- Ilkeston Audits

- Ilkeston Debt Recovery

- Ilkeston PAYE Healthchecks

- Ilkeston Specialist Tax

Also find accountants in: Bradley, Brassington, Alton, Bakewell, Draycott, Fernilee, Duffield, Hilton, Shardlow, Ashover, Risley, Dronfield, Short Heath, Whaley, Over End, Somersal Herbert, Castle Donington, Furness Vale, Loscoe, Low Leighton, Allestree, Stanton By Bridge, Birch Vale, Fenny Bentley, Burnaston, Long Duckmanton, Coplow Dale, Radbourne, Slackhall, Hopton, Belper, Old Glossop, Idridgehay, Fallgate, Bolehill and more.

Accountant Ilkeston

Accountant Ilkeston Accountants Near Me

Accountants Near Me Accountants Ilkeston

Accountants IlkestonMore Derbyshire Accountants: Staveley, Ripley, Ilkeston, Belper, Derby, Swadlincote, Dronfield, Long Eaton, Buxton, Glossop and Chesterfield.

TOP - Accountants Ilkeston - Financial Advisers

Chartered Accountants Ilkeston - Self-Assessments Ilkeston - Cheap Accountant Ilkeston - Auditing Ilkeston - Financial Advice Ilkeston - Online Accounting Ilkeston - Small Business Accountant Ilkeston - Tax Return Preparation Ilkeston - Investment Accounting Ilkeston