Accountants Bridlington: Does it seem to you that the only reward for filling in your yearly self-assessment form a banging headache? Lots of other folks in Bridlington have to overcome this very problem. The obvious solution would be to pay a trustworthy Bridlington accountant to tackle this task instead. Maybe self-assessment is simply too challenging for you? You can normally get this done by regular Bridlington accountants for something like £200-£300. If this sounds like a lot to you, then look at using an online service.

Now you have to figure out where to locate an accountant, what to expect, and how much should you pay? Nowadays the most popular place for tracking down local services is the internet, and accountants are no exception, with plenty marketing their services online. But, how do you know who to trust? It is always worth considering that it's possible for practically any Bridlington individual to promote themselves as a bookkeeper or accountant. They are not required by law to hold any specific qualifications.

Finding an accountant in Bridlington who is qualified is generally advisable. Look for an AAT qualified accountant in the Bridlington area. Whilst qualified accountants may cost slightly more than unqualified ones, the extra charges are justified. Your accountant will add his/her fees as tax deductable. Small businesses and sole traders can use a bookkeeper rather than an accountant.

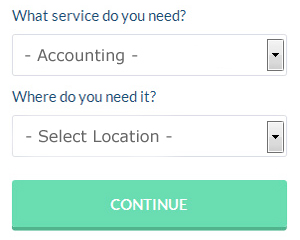

There is a unique online website called Bark which will actually find you a choice of accountants in the Bridlington area. You just have to fill in a simple form and answer some basic questions. Your details will be sent out to potential accountants and they will contact you directly with details and prices.

If you feel comfortable doing everything by post and email you might consider using one of the many online tax returns services. This type of service is growing in popularity. Do some homework to single out a company with a good reputation. The easiest way to do this is by studying online reviews. Sorry, but we cannot give any recommendations in this respect.

At the other extreme of the accounting spectrum are chartered accountants, these highly trained professional are at the top of their game. These powerhouses know all the ins and out of the financial world and generally represent large large companies and conglomerates. With a chartered accountant you will certainly have the best on your side.

At the end of the day you could always do it yourself and it will cost you nothing but time. Available software that will also help includes 123 e-Filing, Ablegatio, Ajaccts, Capium, Absolute Topup, BTCSoftware, Andica, Xero, Keytime, Taxforward, Forbes, CalCal, Sage, ACCTAX, Gbooks, GoSimple, TaxCalc, Taxshield, Taxfiler, Basetax and Nomisma. The most important thing is to make sure your self-assessment is sent in promptly.

Financial Actuaries Bridlington

Actuaries work with organisations, companies and government departments, to help them anticipate long-term investment risks and fiscal costs. These risks can affect both sides of the balance sheet and require expert asset management, valuation and liability management skills. To work as an actuary it's important to possess a statistical, economic and mathematical knowledge of day to day situations in the world of business finance. (Tags: Financial Actuary Bridlington, Actuary Bridlington, Actuaries Bridlington)

You can Improve Yourself and Your Business by Learning How to Manage Your Money Better

If you're a new business owner, you'll discover that managing your money properly is one of those things you will struggle with sooner or later. When you're managing your finances poorly, your confidence in yourself might go down, especially when your business isn't being as profitable as you'd hope. This could actually make you feel like giving up and returning to your old job. When this happens, it stops you from achieving the kind of success you want for yourself and your business. Use the following tips to help you manage your money better.

You shouldn't wait for the due date to pay your taxes. It may be that you won't have the funds you need to pay your taxes if your money management skills are poor. Try saving a portion of your daily or even weekly earnings and depositing it in a separate bank account. This is a good strategy because when your taxes come due every quarter, you've already got money set aside and you won't be forced to take money out from your current earnings. As a business owner, you'll be able to breathe easily each time knowing that you're able to pay your taxes fully and promptly.

Make it a habit to balance your books every week. However, if you have a traditional store where you have cash registers or you've got many payments from different people coming in, you may have to do the book balancing at the end of each day. Balance your books every day or every week to make sure that your numbers are the same as the numbers reflected in your bank account or cash you have on hand. This will save you the trouble of tracking down discrepancies each month or each quarter. Besides, you will only need to devote a few minutes of your time to balancing your books if you do it regularly as opposed to doing it once in a while, which could take hours.

f your business deals with cash all the time, you're better off depositing money to your bank account at the end of each business day. Doing so will help you avoid being tempted to use any cash you have on hand for unnecessary expenses. If you know you have cash available, you're a lot more likely to dip into your money pool for unexpected expenses and just promise yourself you'll return the money back in a couple of days. You're bound to forget about it, though, and this will only mess your accounting and bookkeeping. So avoid this problem altogether by depositing your cash in the bank at the end of each business day.

When it comes to properly managing your business finances, you'll find that there are a lot of things that go into doing so. Proper money management isn't really a simple or basic skill you can master over the weekend. It's something you have to constantly learn over time, particularly if you have a small business. Make sure that you use the suggestions we've provided to help you track and manage your finances better. It's crucial that you stay on top of your business finances.

Auditors Bridlington

Auditors are experts who assess the accounts of organisations and businesses to ensure the legality and validity of their financial reports. They may also act as consultants to encourage possible the prevention of risk and the application of cost savings. Auditors must be authorised by the regulatory authority for auditing and accounting and have the required accounting qualifications. (Tags: Auditing Bridlington, Auditors Bridlington, Auditor Bridlington)

Forensic Accounting Bridlington

When you're looking for an accountant in Bridlington you will possibly encounter the phrase "forensic accounting" and be curious about what the difference is between a standard accountant and a forensic accountant. The word 'forensic' is the thing that gives you an idea, meaning "suitable for use in a law court." Occasionally also referred to as 'financial forensics' or 'forensic accountancy', it uses investigative skills, accounting and auditing to inspect financial accounts in order to identify fraud and criminal activity. Some of the larger accounting companies in the Bridlington area may even have specialist forensic accounting departments with forensic accountants targeting certain sorts of fraud, and could be dealing with tax fraud, insolvency, personal injury claims, professional negligence, bankruptcy, false insurance claims and money laundering.

Small Business Accountants Bridlington

Doing the yearly accounts can be a fairly stress-filled experience for any owner of a small business in Bridlington. If your accounts are getting you down and tax returns and VAT issues are causing you sleepless nights, it would be wise to use a small business accountant in Bridlington.

Helping you to expand your business, and giving financial advice for your specific situation, are just a couple of the ways that a small business accountant in Bridlington can benefit you. The capricious and often complicated sphere of business taxation will be cleared and explained to you so as to minimise your business costs, while maximising tax efficiency.

A small business accountant, to do their job properly, will need to know accurate details with regards to your current financial situation, business structure and any possible investment that you might be looking at, or have set up.

Bridlington accountants will help with bookkeeping, investment reviews, tax returns, accounting services for buy to let rentals Bridlington, business advisory in Bridlington, accounting services for the construction industry, compliance and audit reporting, mergers and acquisitions, partnership accounts, PAYE, general accounting services in Bridlington, charities, litigation support, business acquisition and disposal, business outsourcing, employment law, accounting support services, VAT payer registration Bridlington, National Insurance numbers, limited company accounting, taxation accounting services, tax investigations, VAT returns, corporate finance Bridlington, management accounts, contractor accounts, consultancy and systems advice, personal tax, estate planning Bridlington, financial and accounting advice in Bridlington, retirement planning in Bridlington, financial planning and other kinds of accounting in Bridlington, East Yorkshire. These are just a selection of the activities that are accomplished by local accountants. Bridlington companies will inform you of their whole range of services.

Bridlington Accounting Services

- Bridlington Business Accounting

- Bridlington Tax Advice

- Bridlington Tax Returns

- Bridlington Forensic Accounting

- Bridlington Tax Refunds

- Bridlington Bookkeeping Healthchecks

- Bridlington Tax Planning

- Bridlington Chartered Accountants

- Bridlington PAYE Healthchecks

- Bridlington VAT Returns

- Bridlington Bookkeeping

- Bridlington Debt Recovery

- Bridlington Self-Assessment

- Bridlington Tax Investigations

Also find accountants in: Rawcliffe, Cowlam Manor, Thearne, Lelley, Ruston Parva, Carnaby, Burton Fleming, South Skirlaugh, Asselby, Gardham, Adlingfleet, Bessingby, Foggathorpe, Sigglesthorne, Fordon, Brantingham, Bursea, Ottringham, Skerne, Holme On Spalding Moor, Garton, Newport, Wilberfoss, Patrington, Londesborough, Elmswell, Old Hall, Mappleton, Rimswell, High Hunsley, Swinefleet, Easington, Weeton, Keyingham, Gribthorpe and more.

Accountant Bridlington

Accountant Bridlington Accountants Near Bridlington

Accountants Near Bridlington Accountants Bridlington

Accountants BridlingtonMore East Yorkshire Accountants: Hull, Goole, Hessle, Bridlington, Beverley, Driffield and Cottingham.

TOP - Accountants Bridlington - Financial Advisers

Online Accounting Bridlington - Auditing Bridlington - Tax Accountants Bridlington - Self-Assessments Bridlington - Financial Accountants Bridlington - Financial Advice Bridlington - Small Business Accountants Bridlington - Bookkeeping Bridlington - Affordable Accountant Bridlington