Accountants Wallsend: Does filling out your self-assessment tax form give you a headache every year? Other sole traders and small businesses in the Wallsend area are faced with the same challenge. Is tracking down a local Wallsend accountant to accomplish this task for you a better option? If you find that doing your self-assessment tax return is too stressful, this may be the best resolution. You should expect to pay roughly two to three hundred pounds for the average small business accountant. If this seems like a lot to you, then think about using an online service.

There are plenty of accountants around, so you should not have too much trouble finding a decent one. Nowadays most people commence their search for an accountant or bookkeeping service on the net. Knowing exactly who you can trust is of course not quite as easy. The sad truth is that anybody in Wallsend can promote their services as an accountant. No accreditations or qualifications are required by law in the United Kingdom. Which does seem a bit crazy.

To get the job done correctly you should search for a local accountant in Wallsend who has the right qualifications. The recommended minimum qualification you should look for is an AAT. Even if you have to pay a bit more for the priviledge, you can be confident that your self-assessment form is being completed accurately. Accountants fees are tax deductable so make sure that details of these are included on your self-assessment form. Wallsend sole traders often opt to use bookkeeper rather than accountants for their tax returns.

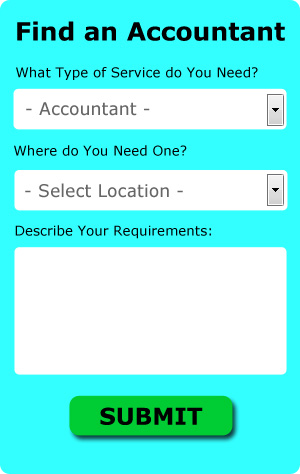

One online service which helps people like you find an accountant is Bark. It is just a case of ticking some boxes on a form. You should start getting responses from local Wallsend accountants within the next 24 hours. And the great thing about Bark is that it is completely free to use.

Apart from the cheapest option of completing your own self-assessment form, an online tax return service might be worth a try. This type of service is growing in popularity. There is no reason why this type of service will not prove to be as good as your average High Street accountant. A good method for doing this is to check out any available customer reviews and testimonials.

Maybe when you have looked all the options you will still decide to do your own tax returns. Available software that will also help includes Taxshield, Nomisma, Forbes, Ajaccts, Xero, ACCTAX, Sage, Taxfiler, Capium, Keytime, Taxforward, Ablegatio, Gbooks, Absolute Topup, GoSimple, CalCal, Basetax, Andica, TaxCalc, BTCSoftware and 123 e-Filing. You will get a penalty if your tax return isn't in on time.

Payroll Services Wallsend

For any company in Wallsend, from large scale organisations down to independent contractors, dealing with staff payrolls can be stressful. Controlling staff payrolls requires that all legal obligations in relation to their transparency, accuracy and timings are observed in all cases.

Using a professional accounting firm in Wallsend, to deal with your payroll is the easiest way to lessen the workload of yourself or your financial team. The payroll service will work along with HMRC and pension schemes, and oversee BACS payments to ensure timely and accurate wage payment to all personnel.

A decent payroll management accountant in Wallsend will also, in line with the current legislation, organise P60 tax forms after the end of the financial year for every one of your employees. They will also provide P45 tax forms at the termination of an employee's working contract.

Small Business Accountants Wallsend

Ensuring that your accounts are accurate and up-to-date can be a challenging job for any small business owner in Wallsend. If your accounts are getting on top of you and tax returns and VAT issues are causing you sleepless nights, it is a good idea to use a decent small business accountant in Wallsend.

Helping you grow your business, and providing sound financial advice for your particular circumstances, are just two of the ways that a small business accountant in Wallsend can benefit you. An accountancy firm in Wallsend will provide an allocated small business accountant and consultant who will clear the fog that veils the world of business taxation, in order to improve your tax efficiences.

A small business accountant, to do their job correctly, will need to know complete details regarding your current financial standing, company structure and any potential investments that you might be considering, or already have put in place. (Tags: Small Business Accountant Wallsend, Small Business Accounting Wallsend, Small Business Accountants Wallsend).

Wallsend accountants will help with partnership accounts, small business accounting, business disposal and acquisition Wallsend, company formations, accounting support services, workplace pensions, accounting services for start-ups, charities in Wallsend, corporate finance in Wallsend, partnership registration, assurance services, financial statements in Wallsend, bureau payroll services Wallsend, consulting services, contractor accounts Wallsend, year end accounts, debt recovery, employment law in Wallsend, VAT returns in Wallsend, HMRC liaison, HMRC submissions, taxation accounting services in Wallsend, inheritance tax, company secretarial services, accounting services for the construction industry, National Insurance numbers Wallsend, mergers and acquisitions, audit and compliance issues, limited company accounting in Wallsend, accounting services for buy to let landlords, business outsourcing, management accounts and other accounting related services in Wallsend, Tyne and Wear. Listed are just a selection of the tasks that are accomplished by local accountants. Wallsend specialists will let you know their whole range of accounting services.

Wallsend Accounting Services

- Wallsend Account Management

- Wallsend Tax Refunds

- Wallsend Tax Services

- Wallsend Tax Planning

- Wallsend Debt Recovery

- Wallsend Payroll Services

- Wallsend Tax Returns

- Wallsend Business Accounting

- Wallsend Bookkeepers

- Wallsend Business Planning

- Wallsend Forensic Accounting

- Wallsend Auditing Services

- Wallsend Bookkeeping Healthchecks

- Wallsend Personal Taxation

Also find accountants in: Ryton, Washington, Black Callerton, Shiney Row, Whitburn, East Rainton, Benton Square, Winlaton Mill, Felling, Willington, Monkton, Killingworth, Blakelaw, Boldon, Fence Houses, Monkseaton, Hetton Le Hole, Swalwell, Team Valley, Marley Hill, Chopwell, Heaton, Wallbottle, Fatfield, Coalburns, Wallsend, Herrington, Ryhope, Crawcrook, Callerton Lane End, West Boldon, Marsden, Dinnington, Stella, Newburn and more.

Accountant Wallsend

Accountant Wallsend Accountants Near Wallsend

Accountants Near Wallsend Accountants Wallsend

Accountants WallsendMore Tyne and Wear Accountants: Ryton, Newcastle, Washington, Jarrow, Whitley Bay, Hebburn, Tynemouth, Longbenton, Wallsend, Whickham, Gateshead, Hetton-le-Hole, Houghton-le-Spring, Sunderland, Blaydon and South Shields.

TOP - Accountants Wallsend - Financial Advisers

Affordable Accountant Wallsend - Bookkeeping Wallsend - Tax Return Preparation Wallsend - Investment Accountant Wallsend - Financial Advice Wallsend - Auditing Wallsend - Small Business Accountant Wallsend - Self-Assessments Wallsend - Tax Advice Wallsend