Accountants Worcester: Do you get little else but a spinning head when filling in your annual tax self-assessment form? Lots of other folks in Worcester have to deal with this very predicament. The obvious answer would be to pay a reliable Worcester accountant to tackle this task instead. Maybe self-assessment is simply too challenging for you? This type of service will typically cost about £200-£300 if you use a regular accountant in Worcester. You will be able to get it done more cheaply by making use of one of the many online accounting services.

You'll find many different types of accountants in the Worcester area. So, it is vital to find an accountant who can fulfil your requirements. It's not unusual for Worcester accountants to operate independently, others prefer being part of a larger accountancy company. Having several accounting experts together within a single office can have many advantages. Accountancy practices will usually offer the services of management accountants, bookkeepers, chartered accountants, costing accountants, actuaries, auditors, accounting technicians, investment accountants, tax preparation accountants, financial accountants and forensic accountants.

You would be best advised to find a fully qualified Worcester accountant to do your tax returns. You don't need a chartered accountant but should get one who is at least AAT qualified. You might find that a qualified accountant is slightly more expensive but could find you additional tax savings to compensate. Accountants fees are tax deductable so make sure that details of these are included on your self-assessment form.

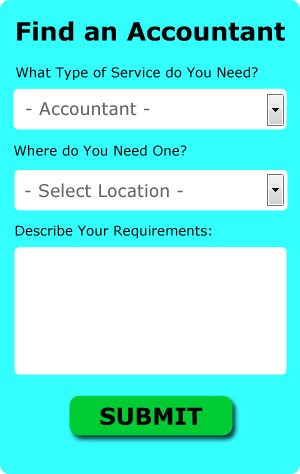

You could use an online service like Bark who will help you find an accountant. Tick a few boxes on their form and submit it in minutes. Within a few hours you should hear from some local accountants who are willing to help you. This service is free of charge.

You could always try an online tax returns service if your needs are fairly simple. Nowadays more and more people are using this kind of service. Some of these companies are more reputable than others. Check out some customer testimonials for companies you are considering. Sorry, but we cannot give any recommendations in this respect.

Although filling in your own tax return may seem too complicated, it is not actually that hard. You can take much of the hard graft out of this procedure by using a software program such as BTCSoftware, Forbes, Basetax, ACCTAX, Taxfiler, Sage, Andica, Ablegatio, Absolute Topup, Keytime, 123 e-Filing, Ajaccts, Capium, TaxCalc, Gbooks, CalCal, Xero, GoSimple, Taxforward, Nomisma or Taxshield. Whatever happens you need to get your self-assessment form in on time. Self-assessment submissions up to three months late receive a £100 fine, with further fines for extended periods.

Auditors Worcester

Auditors are professionals who evaluate the fiscal accounts of companies and organisations to check the validity and legality of their current financial reports. They offer companies from fraud, illustrate irregularities in accounting strategies and, every so often, work as consultants, helping organisations to determine solutions to increase efficiency. Auditors need to be certified by the regulatory body for accounting and auditing and have the necessary accounting qualifications.

Small Business Accountants Worcester

Company accounting can be a pretty stressful experience for anyone running a small business in Worcester. If your accounts are getting you down and VAT and tax return issues are causing you sleepless nights, it would be advisable to hire a small business accountant in Worcester.

A responsible small business accountant will regard it as their duty to help your business to expand, encouraging you with sound guidance, and giving you security and peace of mind about your financial situation. An effective accounting firm in Worcester should be able to offer practical small business advice to maximise your tax efficiency while reducing costs; critical in the sometimes shadowy world of business taxation.

You should also be supplied with an assigned accountancy manager who understands your company's circumstances, the structure of your business and your plans for the future.

Forensic Accounting Worcester

You could well notice the phrase "forensic accounting" when you're hunting for an accountant in Worcester, and will perhaps be interested to know about the distinction between forensic accounting and normal accounting. The actual word 'forensic' is the thing that gives you an idea, meaning literally "denoting or relating to the application of scientific methods and techniques for the investigation of a crime." Using auditing, investigative skills and accounting to discover inconsistencies in financial accounts that have been involved in theft or fraud, it's also occasionally called 'financial forensics' or 'forensic accountancy'. Some bigger accounting companies in the Worcester area may have independent forensic accounting departments with forensic accountants targeting specific sorts of fraud, and may be dealing with professional negligence, personal injury claims, bankruptcy, tax fraud, insurance claims, insolvency and money laundering. (Tags: Forensic Accountant Worcester, Forensic Accounting Worcester, Forensic Accountants Worcester)

How Money Management Helps with Self Improvement and Business

Are you thinking of going into business yourself? You'll find that many like being their own boss because they're in charge of how much they make and how much they get to spend. Then again, managing business finances isn't exactly a simple matter. In fact, even those who've successfully lived by sticking to a budget in their personal lives can have a tough time managing the finances of their business. Still, this shouldn't deter you from going into business for yourself. You've got a number of things that can help you successfully manage the financial side of your business. Today, we'll discuss a few tips on how you can be better at managing the money for your business.

It's certainly tempting to wait until the last minute to pay your taxes, but you're actually playing with fire here, especially if you're not good at money management. When your taxes are due, you may not have any money to actually pay them. To avoid this problem, it's a good idea to set aside a portion of every payment you get into a savings count. When you do this, you're going to have the money needed to pay your taxes for the quarter. It sounds lame, but it can be really satisfying to be able to pay your taxes in full and on time.

Each week, balance your books. However, if you have a traditional store where you have cash registers or you've got many payments from different people coming in, you may have to do the book balancing at the end of each day. You need to record all of the payments you receive and make. At the end of the day or week, you need to make sure that the amount you have on hand and in the bank tallies with the amount you have in your records. This way at the end of each month or every quarter, you lessen your load of having to trace back where the discrepancies are in your accounting. If you regularly balance your books, you won't need to spend too long a time doing it. If you do it every once in a while, though, it can take hours.

Make sure you account for every penny your business brings in. Every single time you receive a payment, write down that you have been paid and how much. Doing this will help you know how much money you've got and know exactly who has already paid you. This money management strategy also makes it a lot easier on you to determine the amount of money you owe in taxes and even how much money you should pay yourself.

Proper money management is a skill that every adult needs to develop. When you know exactly what's happening with your money -- where you're spending it, how much is coming in, and so on -- it can be a big boost to your self-confidence and increases the chances of your business becoming profitable. So keep in mind the tips we've shared. Developing proper money management skills not only will help boost your business but boost your self-confidence as well.

Worcester accountants will help with management accounts, partnership accounts, small business accounting, tax preparation, company formations in Worcester, accounting services for the construction sector in Worcester, inheritance tax, accounting support services, VAT returns Worcester, payslips, accounting services for start-ups, cashflow projections Worcester, capital gains tax, financial statements, business disposal and acquisition Worcester, VAT registrations, sole traders in Worcester, accounting services for media companies Worcester, company secretarial services, double entry accounting, workplace pensions, partnership registration, compliance and audit issues, employment law, assurance services, corporate finance Worcester, accounting services for buy to let property rentals, consulting services, financial and accounting advice in Worcester, business outsourcing, National Insurance numbers, PAYE and other kinds of accounting in Worcester, Worcestershire. Listed are just a small portion of the activities that are performed by nearby accountants. Worcester specialists will inform you of their entire range of services.

When you're hunting for inspiration and ideas for personal tax assistance, accounting for small businesses, self-assessment help and accounting & auditing, you won't really need to look any further than the world wide web to find all of the guidance that you need. With so many diligently researched webpages and blog posts to pick from, you will quickly be deluged with new ideas for your planned project. Just recently we stumbled on this thought provoking article on 5 tips for finding a first-rate accountant.

Worcester Accounting Services

- Worcester Tax Advice

- Worcester PAYE Healthchecks

- Worcester Specialist Tax

- Worcester Audits

- Worcester Business Accounting

- Worcester Forensic Accounting

- Worcester Chartered Accountants

- Worcester VAT Returns

- Worcester Account Management

- Worcester Bookkeepers

- Worcester Payroll Management

- Worcester Self-Assessment

- Worcester Tax Planning

- Worcester Financial Advice

Also find accountants in: Poolbrook, Wychbold, Sankyns Green, Bretforton, Hopwood, Aston Somerville, Churchill, Far Forest, Fernhill Heath, Bournheath, Church Lench, Shelsley Walsh, Apes Dale, Great Witley, High Green, Bell End, Whittington, Bushley, Severn Stoke, Bank Street, Tibberton, Worcester, Offenham, Wyre Piddle, Caunsall, Fairfield, Cookley, Blackwell, Alfreds Well, Pensham, Bowling Green, Eardiston, Broadwas, Lulsley, Madresfield and more.

Accountant Worcester

Accountant Worcester Accountants Near Worcester

Accountants Near Worcester Accountants Worcester

Accountants WorcesterMore Worcestershire Accountants: Malvern, Kidderminster, Evesham, Stourport-on-Severn, Bewdley, Redditch, Bromsgrove, Droitwich, Wythall and Worcester.

TOP - Accountants Worcester - Financial Advisers

Online Accounting Worcester - Chartered Accountant Worcester - Bookkeeping Worcester - Affordable Accountant Worcester - Auditing Worcester - Self-Assessments Worcester - Tax Return Preparation Worcester - Tax Advice Worcester - Small Business Accountants Worcester