Accountants Winsford: Do you get little else but a headache when completing your yearly tax self-assessment form? This is a common problem for lots of others in Winsford, Cheshire. But how can you find a local accountant in Winsford to do it for you? Perhaps it is simply the case that self-assessment is too complex for you to do by yourself. A regular Winsford accountant will probably charge about £200-£300 for filling out these forms. You'll be able to get it done more cheaply by making use of one of the many online accounting services.

So, precisely what should you be looking for in an accountant and how much should you pay for this kind of service? In this modern high-tech world the first port of call is the internet when hunting for any local service, including bookkeepers and accountants. Yet, which of these accountants can you trust to do the best job for you? The fact that almost anyone in Winsford can call themselves an accountant is something you need to keep in mind. It is not even neccessary for them to have any qualifications. This can result in inexperienced individuals entering the profession.

Finding an accountant in Winsford who is qualified is generally advisable. An AAT qualified accountant should be adequate for sole traders and small businesses. A qualified accountant may cost a little more but in return give you peace of mind. Accountants fees are tax deductable so make sure that details of these are included on your self-assessment form. Small businesses and sole traders can use a bookkeeper rather than an accountant.

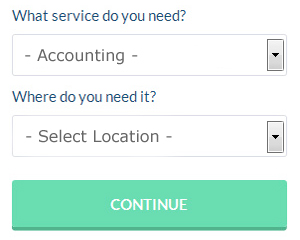

You could use an online service like Bark who will help you find an accountant. Filling in a clear and simple form is all that you need to do to set the process in motion. Shortly you can expect to be contacted by suitable accountants who can help you with your self-assessment. Why not give Bark a try since there is no charge for this useful service.

Utilizing an online tax returns service will be your other option. Over the last few years many more of these services have been appearing. Do a bit of research to find a reputable company. A good method for doing this is to check out any available customer reviews and testimonials. Sorry, but we cannot give any recommendations in this respect.

It is actually not that difficult to do your own tax return, HMRC even has a series of You Tube videos to help you. Software is also available to make doing your self-assessment even easier. Some of the best ones include ACCTAX, Taxfiler, CalCal, Capium, Ajaccts, Sage, 123 e-Filing, TaxCalc, GoSimple, Forbes, Basetax, Gbooks, Absolute Topup, Keytime, Taxforward, Andica, Nomisma, Ablegatio, BTCSoftware, Taxshield and Xero. Whichever service you use your tax returns will need to be in on time to avoid penalties. The fine for late submissions (up to 3 months) is £100.

Forensic Accountant Winsford

During your search for a professional accountant in Winsford there's a fair chance that you will happen on the phrase "forensic accounting" and be curious about what it is, and how it is different from standard accounting. The word 'forensic' is the thing that gives a clue, meaning "suitable for use in a law court." Sometimes also referred to as 'forensic accountancy' or 'financial forensics', it uses investigative skills, auditing and accounting to dig through financial accounts so as to discover fraud and criminal activity. There are even several larger accountants firms throughout Cheshire who have specialist sections for forensic accounting, investigating personal injury claims, tax fraud, money laundering, professional negligence, insolvency, insurance claims and bankruptcy. (Tags: Forensic Accountant Winsford, Forensic Accountants Winsford, Forensic Accounting Winsford)

Auditors Winsford

An auditor is an individual or a firm appointed by an organisation or company to complete an audit, which is the official assessment of the accounts, usually by an independent body. They offer businesses from fraud, highlight inconsistencies in accounting procedures and, every so often, work as consultants, helping firms to find ways to maximize efficiency. For anybody to become an auditor they have to have certain specific qualifications and be certified by the regulatory body for accounting and auditing. (Tags: Auditor Winsford, Auditing Winsford, Auditors Winsford)

Small Business Accountants Winsford

Ensuring that your accounts are accurate and up-to-date can be a stressful job for any small business owner in Winsford. If your annual accounts are getting the better of you and VAT and tax return issues are causing you sleepless nights, it is a good idea to hire a dedicated small business accountant in Winsford.

Helping you to expand your business, and providing sound financial advice for your specific circumstances, are just two of the ways that a small business accountant in Winsford can be of benefit to you. A good accounting firm in Winsford will be able to offer practical small business advice to maximise your tax efficiency while at the same time minimising costs; crucial in the sometimes shadowy world of business taxation.

You also ought to be offered an assigned accountancy manager who has a deep understanding of your company's circumstances, the structure of your business and your plans for the future. (Tags: Small Business Accountants Winsford, Small Business Accountant Winsford, Small Business Accounting Winsford).

How Money Management Helps with Self Improvement and Business

Many new business owners have a hard time managing money the right away, especially when they're still trying to figure out most of the things they need to do to run a business. When you're managing your finances poorly, your confidence in yourself might go down, especially when your business isn't being as profitable as you'd hope. This could actually make you feel like giving up and returning to your old job. This, believe it or not, can keep you from reaching the level of success that you want to reach. Keep reading to learn a few tips you can use to help you manage your finances better.

Number your invoices. You may not think that this simple tactic of keeping your invoices numbered is a big deal but wait till your business has grown. It makes it easy to track invoices if you have them numbered. It doesn't just help you track who owes you what, it helps you track who has paid you what as well. There will be times when a client will tell you that his invoice is all paid up and this can be easily resolved if you have a numbered invoice. Remember, it is possible to make errors and numbering your invoices is a simple way to help find them when they happen.

Track both your personal and business expenses down to the last penny. It's actually helpful when you know where each penny is being spent. When you actually write down where you spend your money, it helps you keep track of your spending habits. No one likes to have that feeling of "I'm making decent money, but where is it?" When you write all your personal and business expenditures, you won't ever have to wonder where your money is going. And when you're creating a budget, you can pinpoint those places where you're spending unnecessarily, cut back on them, and save yourself money in the process. It will also help you streamline things when you need to fill out your tax forms.

Be a responsible business owner by paying your taxes when they're due. Typically, small businesses must pay taxes every quarter. It's crucial that you have the most current and accurate information when it comes to small business taxes. For this, it's best that you get your information from the IRS or from the local small business center. There are also professionals you can work with who can set you up with payments and plans to make sure you're paying your taxes on time. You wouldn't want the IRS to come knocking on your door because you were remiss in paying your taxes.

There are many things involved in the proper management of your money. It doesn't just involve listing the amount you spent and when you spent it. As a business owner, you've got numerous things you need to keep track of when it comes to your money. Tracking your money will become a lot easier for you if you apply the tips we've shared in this article. Continue learning proper money management and you can expect improvement in yourself and in your business.

Payroll Services Winsford

Staff payrolls can be a complicated aspect of running a company in Winsford, regardless of its size. The legislation relating to payroll for openness and accuracy mean that running a company's payroll can be a daunting task.

Using a professional company in Winsford, to handle your payroll is the easiest way to minimise the workload of your own financial department. A managed payroll service accountant will work with HMRC, with pensions schemes and set up BACS payments to guarantee that your personnel are paid promptly, and all required deductions are accurate.

Abiding by current regulations, a dedicated payroll management accountant in Winsford will also provide every one of your staff members with a P60 tax form at the end of each financial year. Upon the termination of an employee's contract with your business, the payroll company will also supply an updated P45 relating to the tax paid during the previous financial period. (Tags: Payroll Outsourcing Winsford, Payroll Services Winsford, Payroll Accountant Winsford).

Actuaries Winsford

An actuary is a professional who studies the measurement and managing of uncertainty and risk. These risks can impact both sides of the balance sheet and require expert valuation, liability management and asset management skills. An actuary uses statistics and mathematical concepts to determine the fiscal effect of uncertainties and help their clients minimise possible risks.

Winsford accountants will help with financial statements, small business accounting, management accounts, auditing and accounting in Winsford, estate planning, tax investigations, corporation tax, workplace pensions, annual tax returns, VAT returns, payroll accounting, HMRC submissions, accounting services for media companies, business start-ups Winsford, VAT registration, charities, National Insurance numbers Winsford, partnership accounts in Winsford, self-employed registration, general accounting services, HMRC liaison, compliance and audit reports in Winsford, inheritance tax Winsford, business disposal and acquisition, accounting services for property rentals in Winsford, payslips in Winsford, contractor accounts, cashflow projections, bookkeeping, financial and accounting advice, company formations, partnership registration in Winsford and other accounting services in Winsford, Cheshire. Listed are just an example of the activities that are undertaken by local accountants. Winsford professionals will be happy to tell you about their entire range of services.

Winsford Accounting Services

- Winsford Financial Advice

- Winsford VAT Returns

- Winsford Tax Returns

- Winsford Debt Recovery

- Winsford PAYE Healthchecks

- Winsford Business Accounting

- Winsford Forensic Accounting

- Winsford Auditing

- Winsford Bookkeeping

- Winsford Bookkeeping Healthchecks

- Winsford Payroll Management

- Winsford Tax Planning

- Winsford Personal Taxation

- Winsford Tax Services

Also find accountants in: Jodrell Bank, Capenhurst, Beambridge, Norbury, Newtown, Winsford, Handley, Alsager, Little Budworth, Spen Green, Acton Bridge, Puddington, Frodsham, Fullers Moor, Stretton, Bickerton, Gatesheath, Gawsworth, Moore, Warrington, Spurstow, Byley, Mere, Dutton, Thelwall, Burwardsley, Radway Green, Hightown, Siddington, Pickmere, Widnes, Tiverton, Sutton Weaver, Chester, Hampton Heath and more.

Accountant Winsford

Accountant Winsford Accountants Near Me

Accountants Near Me Accountants Winsford

Accountants WinsfordMore Cheshire Accountants: Frodsham, Poynton, Congleton, Macclesfield, Ellesmere Port, Wilmslow, Chester, Northwich, Sandbach, Winsford, Crewe, Warrington, Knutsford, Alsager, Middlewich, Runcorn, Nantwich, Lymm, Neston and Widnes.

TOP - Accountants Winsford - Financial Advisers

Self-Assessments Winsford - Auditing Winsford - Chartered Accountant Winsford - Bookkeeping Winsford - Financial Advice Winsford - Investment Accounting Winsford - Affordable Accountant Winsford - Financial Accountants Winsford - Online Accounting Winsford