Accountants Hatfield: Completing your annual self-assessment form can certainly be a bit of a headache. This is an issue for you and numerous others in Hatfield. But is there an easy way to find a local Hatfield accountant to accomplish this task for you? Do you simply find self-assessment too challenging to do on your own? This should cost you around £200-£300 if you use the services of an average Hatfield accountant. By using one of the numerous online services you will be able to get a cheaper deal.

But which accounting service is best for your needs and how might you go about finding it? An internet search engine will pretty quickly provide a shortlist of potential candidates in Hatfield. However, which of these prospects can you put your trust in? Always bear in mind that virtually any individual in Hatfield can go into business as an accountant. There's no legal requirement that says they have to have specific qualifications or certifications. Crazy as this might seem.

You would be best advised to find a fully qualified Hatfield accountant to do your tax returns. For basic tax returns an AAT qualified accountant should be sufficient. Even if you have to pay a bit more for the priviledge, you can be confident that your self-assessment form is being completed accurately. The accountants fees will count as a tax deductable expense, saving you a percentage of the costs. Many qualified bookkeepers offer tax returns services for smaller businesses and sole traders.

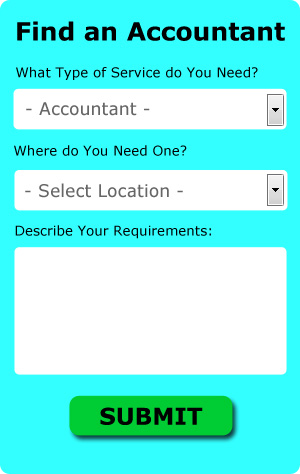

Not to be confused with online services who will do your tax returns for you, a company called Bark will assist you in finding a decent Hatfield accountant. You only need to answer a few basic questions and complete a straightforward form. Your details will be sent out to potential accountants and they will contact you directly with details and prices.

At the budget end of the spectrum, the online tax returns services might be adequate for your needs. This kind of service may not suit everyone but could be the answer for your needs. Make a short list of such companies and do your homework to find the most reputable. A good method for doing this is to check out any available customer reviews and testimonials. Sorry, but we cannot give any recommendations in this respect.

HMRC offers lots of help on completing tax returns, so you might even decide to do it yourself. To make life even easier there is some intuitive software that you can use. Including Keytime, Taxshield, Ajaccts, Taxfiler, Nomisma, Ablegatio, Forbes, Basetax, Xero, Taxforward, Sage, Capium, CalCal, BTCSoftware, 123 e-Filing, Absolute Topup, ACCTAX, Andica, TaxCalc, Gbooks and GoSimple. Getting your self-assessment form submitted on time is the most important thing. A £100 fine is levied for late self-assessments up to 3 months, more if later.

How Managing Your Money Better Makes You a Better Business Owner

For many people, starting their own business has many advantages. One of the advantages is that they get to be in charge of their income. They're able to control just how much money they make and how much money they spend. However, proper management of business finances isn't always easy, and many people tend to get overwhelmed with this aspect of the business. Fortunately, you can do some things that will make it so much easier on you to manage your business finances. Keep reading to learn how to be better at managing your money when you are in business for yourself.

Find yourself an accountant who's competent. This is a business expense that's really worth it because an accountant can help keep your books straight on a full time basis. An accountant can easily monitor your business cash flow, help you pay yourself, and even determine the right amount of taxes you should be paying and when. What's more, she'll deal with all of the paperwork that is associated with those things. You can then focus your attention towards the more profitable aspects of your business, such as increasing your customer base, creating new products, and such. You'll save yourself the trouble of having to figure out your business finances if you hire an accountant.

Give your clients the choice to pay in installments. Besides making it more appealing for potential clients to do business with you, this strategy will have money coming in on a regular basis. Having payments come in regularly even if they aren't in huge amounts is certainly so much better than getting big payments irregularly. Overall, you can properly manage your business finances when your income is a lot more reliable. It's because you can plan your budget, pay your bills on time, and basically keep your books up-to-date. If you're in control of your business finances, you'll feel more self-confident.

Keep a tight lid on your spending. When your business is steadily pulling in a nice income, you may be tempted to go on a buying spree and buy all those things you've always wanted to buy but couldn't afford. You should, however, spend money on things that will benefit your business. Also, it's better if you build your business savings. This way, should unexpected expenses crop up, you'll be able to deal with it in a timely manner. You'll also be able to save money on office supplies if you buy in bulk. For your office equipment, it's much better if you spend a little more on quality rather than on equipment that you will have to replace often. As for your entertainment expenses, you need to be smart about it as well.

Learning how to manage your finances properly will help not just your business but yourself as well. These are a few of the tips and tricks that will help you better keep track of your financial situation. You're much more likely to experience business and personal success when you have your finances under control.

Financial Actuaries Hatfield

An actuary is a business expert who deals with the measurement and managing of uncertainty and risk. They use their mathematical skills to measure the probability and risk of future happenings and to estimate their financial ramifications for a business and it's customers. An actuary uses mathematics and statistics to estimate the fiscal impact of uncertainties and help their customers minimize risks.

Payroll Services Hatfield

For any business in Hatfield, from large scale organisations down to independent contractors, staff payrolls can be stressful. The laws on payrolls and the legal obligations for openness and accuracy means that dealing with a company's payroll can be an intimidating task.

A small business may well not have the advantage of a dedicated financial specialist and a good way to deal with the issue of employee payrolls is to use an external accountant in Hatfield. A payroll accountant will work with HMRC, with pensions providers and oversee BACS payments to guarantee that your staff are paid promptly, and that all required deductions are correct.

A certified payroll management accountant in Hatfield will also, in accordance with the current legislation, provide P60 tax forms after the end of the financial year for every staff member. At the end of a staff member's contract with your business, the payroll company will also supply a current P45 form relating to the tax paid in the last financial period. (Tags: Payroll Services Hatfield, Payroll Accountants Hatfield, Payroll Outsourcing Hatfield).

Small Business Accountants Hatfield

Doing the accounts can be a stressful experience for any small business owner in Hatfield. Appointing a small business accountant in Hatfield will permit you to operate your business knowing your tax returns, VAT and annual accounts, and various other business tax requirements, are being met.

A good small business accountant will regard it as their responsibility to help your business improve, encouraging you with good advice, and providing you with peace of mind and security about your financial situation. The vagaries and complicated sphere of business taxation will be cleared and explained to you so as to lower your business expenses, while maximising tax efficiency.

You also ought to be supplied with an assigned accountancy manager who has a good understanding of your plans for the future, your business structure and your company's circumstances. (Tags: Small Business Accountants Hatfield, Small Business Accounting Hatfield, Small Business Accountant Hatfield).

Hatfield accountants will help with business acquisition and disposal, partnership registrations in Hatfield, corporation tax, small business accounting, mergers and acquisitions, personal tax, accounting services for media companies Hatfield, taxation accounting services, consulting services, consultancy and systems advice, debt recovery, VAT payer registration, employment law, self-employed registration, business start-ups, investment reviews in Hatfield, National Insurance numbers, audit and compliance reports, business support and planning, management accounts Hatfield, assurance services, charities in Hatfield, tax investigations Hatfield, litigation support, business outsourcing Hatfield, general accounting services, VAT returns in Hatfield, self-assessment tax returns, financial statements in Hatfield, company formations, HMRC liaison Hatfield, contractor accounts Hatfield and other kinds of accounting in Hatfield, Hertfordshire. These are just a handful of the duties that are handled by nearby accountants. Hatfield specialists will let you know their entire range of accountancy services.

When you're searching for inspiration and ideas for small business accounting, self-assessment help, accounting & auditing and personal tax assistance, you won't really need to look much further than the world wide web to find everything you could possibly need. With such a multitude of carefully researched blog posts and webpages at your fingertips, you will pretty quickly be knee-deep in great ideas for your planned project. The other day we stumbled across this informative article on how to find an accountant to fill out your yearly tax return.

Hatfield Accounting Services

- Hatfield VAT Returns

- Hatfield Forensic Accounting

- Hatfield PAYE Healthchecks

- Hatfield Self-Assessment

- Hatfield Business Accounting

- Hatfield Account Management

- Hatfield Debt Recovery

- Hatfield Payroll Services

- Hatfield Chartered Accountants

- Hatfield Financial Advice

- Hatfield Tax Returns

- Hatfield Tax Planning

- Hatfield Financial Audits

- Hatfield Tax Services

Also find accountants in: Rye Park, Ayot St Lawrence, High Cross, Graveley, Bushey Heath, Bucks Hill, Boxmoor, Colney Street, Therfield, Thorley Street, Datchworth, Tewin, Walsworth, Whitwell, Kings Langley, St Albans, Bayford, Shenley, Digswell, Little Hormead, Radwell, Aspenden, Bury Green, Newgate Street, Throcking, Clothall, Hay Street, Maple Cross, Ayot St Peter, Broadwater, Gaddesden Row, Croxley Green, Buckland, Potten End, Perry Green and more.

Accountant Hatfield

Accountant Hatfield Accountants Near Me

Accountants Near Me Accountants Hatfield

Accountants HatfieldMore Hertfordshire Accountants: Abbots Langley, Hemel Hempstead, Potters Bar, Bishops Stortford, Ware, Letchworth, Hertford, Borehamwood, Harpenden, Royston, Bushey, Welwyn Garden City, Hitchin, Stevenage, Berkhamsted, Rickmansworth, Tring, Broxbourne, Watford, Hoddesdon, Cheshunt, St Albans and Hatfield.

TOP - Accountants Hatfield - Financial Advisers

Online Accounting Hatfield - Auditors Hatfield - Chartered Accountant Hatfield - Tax Advice Hatfield - Investment Accounting Hatfield - Cheap Accountant Hatfield - Self-Assessments Hatfield - Bookkeeping Hatfield - Financial Advice Hatfield