Accountants St Albans: It will come as no surprise if you're self-employed or running your own business in St Albans, that having your own accountant can pay big dividends. The very least you can expect is to gain a bit of extra time to devote to your core business, while financial concerns are sorted out by your accountant. Businesses of all sizes and types can benefit from an accountant's expertise but for newer businesses it can be even more vital.

Locating an accountant in St Albans isn't always that easy with various different kinds of accountants out there. A local accountant who perfectly matches your requirements is the one you should be looking for. You will come to realise that there are accountants who work independently and accountants who work for accountancy firms. Accounting practices will have specialists in each particular accounting sector. With an accountancy practice you'll have a pick of: financial accountants, tax preparation accountants, investment accountants, forensic accountants, chartered accountants, actuaries, auditors, bookkeepers, accounting technicians, management accountants and cost accountants.

For completing your self-assessment forms in St Albans you should find a properly qualified accountant. An AAT qualified accountant should be adequate for sole traders and small businesses. Whilst qualified accountants may cost slightly more than unqualified ones, the extra charges are justified. The fees for completing your self-assessment tax return are a legitimate business expense and therefore qualify for a tax deduction. Sole traders and smaller businesses might get away with using a bookkeeper.

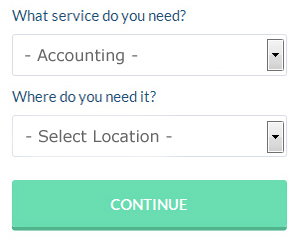

Similar to Rated People for tradesmen, an online website known as Bark will contact local accountants on your behalf. You just have to fill in a simple form and answer some basic questions. Shortly you can expect to be contacted by suitable accountants who can help you with your self-assessment. There are absolutely no charges for using this service.

Utilizing an online tax returns service will be your other option. More accountants are offering this modern alternative. There is no reason why this type of service will not prove to be as good as your average High Street accountant. Be sure to study customer reviews and testimonials.

While possibly a little over the top for a small business, using a chartered accountant is another option. Larger limited companies must use a chartered accountant, smaller businesses do not need to. The choice, so they say, is all yours.

The cheapest option of all is to do your own self-assessment form. It is also a good idea to make use of some self-assessment software such as CalCal, Xero, Capium, 123 e-Filing, GoSimple, Taxforward, Sage, ACCTAX, Basetax, Ablegatio, Ajaccts, Andica, Nomisma, Forbes, Keytime, Taxfiler, Absolute Topup, Taxshield, TaxCalc, Gbooks or BTCSoftware to simplify the process. Whether you do it yourself or use an accountant, your self-assessment must be submitted on time.

Actuaries St Albans

An actuary gives advice on, manages and measures financial risks. Actuaries employ their mathematical knowledge to assess the risk and probability of future happenings and to predict their effect on a business and their customers. To be an actuary it is vital to have a statistical, mathematical and economic consciousness of real-life situations in the world of business finance.

Forensic Accountant St Albans

When you happen to be on the lookout for an accountant in St Albans you will possibly come across the phrase "forensic accounting" and wonder what the differences are between a standard accountant and a forensic accountant. The clue for this is the actual word 'forensic', which basically means "appropriate for use in a law court." Sometimes also called 'financial forensics' or 'forensic accountancy', it uses accounting, auditing and investigative skills to dig through financial accounts in order to discover criminal activity and fraud. Some bigger accounting companies in the St Albans area may even have specialist forensic accounting divisions with forensic accountants targeting certain kinds of fraud, and could be dealing with tax fraud, insolvency, professional negligence, personal injury claims, bankruptcy, insurance claims and money laundering.

Be a Better Small Business Owner By Learning Proper Money Management

One of the hardest aspects of starting a business is learning the proper use of money management strategies. It can seem like money management is something anyone should be able to do already by the time they get their business up and running. The reality, however, is that budgeting and financial planning for your business is a lot different from budgeting and financial planning for your personal life. It does help a lot if you have some experience in the latter. Your self-confidence could very well take a huge dive should you accidentally ruin your business finances. There are many things you can do to properly manage business finances and we'll share just a few of them in this article.

Hire an accountant. This is a business expense that's really worth it because an accountant can help keep your books straight on a full time basis. Your accountant will be keeping track of the money that your business is bringing in and the money that goes on your expenditures. She will also help you figure out just how much you should pay yourself as well as how much money you need to pay for taxes. You won't need to deal with the paperwork associated with these things; your accountant will deal with that for you. As a result, you can put your energy towards making your business more profitable, such as creating new products, marketing, and increasing your customer base. You'll save yourself the trouble of having to figure out your business finances if you hire an accountant.

You may be your own boss, but it's still a good idea to give yourself a regular paycheck. This can make it easier to keep track of your accounting both in your personal life and your professional life. Your business account should be where all the payments you get for the sale of your products or services should go. Then on a weekly, bi-weekly, or monthly basis, you can pay yourself out of your business account. Just how much money you pay yourself is completely up to you. You can pay yourself by billable hours or a portion of your business income for that month.

Take control of your spending. It may be that you've got a lot of things you wished you could buy before and now that you have a steady stream of income coming in, you're tempted to finally buy them. It's best if you spend money on things that will benefit your business. Anything you don't spend, put in your business savings account so you know you've got money for those unexpected business expenses. When you need to purchase office supplies, purchase in bulk. For computing equipment, go for quality even if it's a little more expensive. This will actually save you more money because you'll get more years out of the equipment and you won't have to replace them as often. While it's a good idea to spend on your entertainment, be careful that you spend too much on it.

Whether you're a business owner or not, it's important that you learn proper money management. Knowing what you have coming in, what you have going out, and what exactly is going on with your money can be a huge boost to your confidence and success. So keep in mind the tips we've shared. When you take the time to learn how to properly manage money, you'll get the benefit of having a successful business and a higher confidence level.

St Albans accountants will help with investment reviews, HMRC submissions St Albans, inheritance tax, assurance services, employment law St Albans, company formations in St Albans, bookkeeping, financial planning St Albans, retirement advice St Albans, mergers and acquisitions, consulting services, personal tax, accounting services for media companies, estate planning, capital gains tax St Albans, accounting support services St Albans, VAT returns, partnership registration in St Albans, tax preparation, year end accounts, company secretarial services, VAT payer registration, business advisory services, sole traders, corporate tax in St Albans, workplace pensions in St Albans, partnership accounts, self-employed registrations in St Albans, accounting and financial advice, self-assessment tax returns, bureau payroll services, litigation support St Albans and other types of accounting in St Albans, Hertfordshire. These are just a handful of the activities that are accomplished by local accountants. St Albans providers will be happy to tell you about their whole range of accounting services.

St Albans Accounting Services

- St Albans Tax Planning

- St Albans Bookkeepers

- St Albans VAT Returns

- St Albans Personal Taxation

- St Albans Business Accounting

- St Albans Forensic Accounting

- St Albans Tax Services

- St Albans Tax Refunds

- St Albans Financial Advice

- St Albans Specialist Tax

- St Albans Business Planning

- St Albans PAYE Healthchecks

- St Albans Audits

- St Albans Chartered Accountants

Also find accountants in: Welham Green, Kinsbourne Green, Goffs Oak, Nasty, Wildhill, Stanstead Abbots, Apsley, Felden, Whelpley Hill, Hammond Street, Widford, Sawbridgeworth, Bovingdon, Leverstock Green, Aspenden, Hay Street, Codicote, Oaklands, Benington, Brookmans Park, Throcking, Haultwick, Breachwood Green, Cuffley, Hunsdon, Green Street, Cromer, Marshalls Heath, Gilston Park, Bushey, Smug Oak, Batchworth, Stevenage, Chipping, East End and more.

Accountant St Albans

Accountant St Albans Accountants Near St Albans

Accountants Near St Albans Accountants St Albans

Accountants St AlbansMore Hertfordshire Accountants: St Albans, Harpenden, Welwyn Garden City, Stevenage, Royston, Broxbourne, Rickmansworth, Letchworth, Tring, Watford, Bushey, Hoddesdon, Abbots Langley, Borehamwood, Hertford, Potters Bar, Ware, Hitchin, Bishops Stortford, Cheshunt, Berkhamsted, Hatfield and Hemel Hempstead.

TOP - Accountants St Albans - Financial Advisers

Small Business Accountants St Albans - Chartered Accountant St Albans - Tax Preparation St Albans - Self-Assessments St Albans - Financial Advice St Albans - Auditors St Albans - Financial Accountants St Albans - Bookkeeping St Albans - Investment Accounting St Albans