Accountants Nantwich: For those of you who are self-employed or running a business in the Nantwich area, hiring the expert services of an accountant can have several benefits. Among the many benefits are the fact that you should have more time to focus your attention on core business activities whilst routine and time consuming bookkeeping can be confidently managed by your accountant. This type of financial assistance is vital for any business, but is particularly helpful for start-up businesses.

You will find various kinds of accountants in the Nantwich area. Choosing the right one for your company is essential. Certain accountants work as part of an accountancy practice, whilst some work as sole traders. Having several accounting experts together within a practice can have many benefits. Usually accountancy firms will employ: investment accountants, chartered accountants, cost accountants, accounting technicians, forensic accountants, actuaries, auditors, tax preparation accountants, management accountants, bookkeepers and financial accountants.

Finding an accountant in Nantwich who is qualified is generally advisable. Your minimum requirement should be an AAT qualified accountant. Even if you have to pay a bit more for the priviledge, you can be confident that your self-assessment form is being completed accurately. It should go without saying that accountants fees are tax deductable.

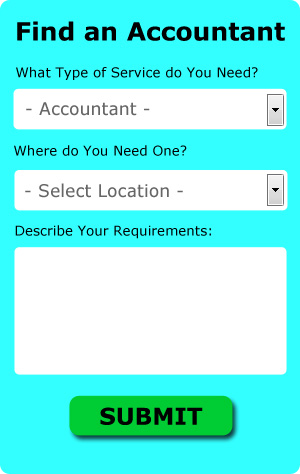

There is now a service available known as Bark, where you can look for local professionals including accountants. Little is required other than ticking a few boxes on the search form. Shortly you can expect to be contacted by suitable accountants who can help you with your self-assessment.

A more cost-effective solution for those with straightforward tax returns would be to use an online self-assessment service. It could be that this solution will be more appropriate for you. There is no reason why this type of service will not prove to be as good as your average High Street accountant. The easiest way to do this is by studying online reviews. We prefer not to recommend any particular online accounting company here.

While you shouldn't totally discount the idea of using a chartered accountant, the high level of charges might put you off. Larger limited companies must use a chartered accountant, smaller businesses do not need to. Having the best person for the job may appeal to many.

With the help of some HMRC tutorials and videos, it is not really that difficult to complete your own tax return, and it is of course free! These days there are plenty of software packages that make tax returns even easier to do yourself. Such programs include the likes of Basetax, Absolute Topup, BTCSoftware, Capium, Keytime, TaxCalc, Xero, Gbooks, Ablegatio, Forbes, Ajaccts, Sage, ACCTAX, CalCal, 123 e-Filing, Taxshield, Nomisma, Taxforward, Taxfiler, GoSimple and Andica. Whether you do it yourself or use an accountant, your self-assessment must be submitted on time.

Proper Money Management Tips for Small Business Owners

Are you thinking of going into business yourself? You'll find that many like being their own boss because they're in charge of how much they make and how much they get to spend. Of course, this can also be quite overwhelming, and even people who have managed to live by a budget in their personal lives have a difficult time managing their business finances. Luckily there are plenty of things that you can do to make it easier on yourself. If you'd like to be able to manage your business funds, keep reading.

Implement a numbering system for your invoices. This is something that a lot of business owners don't really think about but it can save you a lot of hassle down the road. When you've got your invoices numbered, you can easily track your transactions. You'll be able to easily track who has paid you and who still owes you. You'll have those times when a client will be insistent in saying he has already paid you and if you have your invoices numbered, you can easily look it up and resolve the matter. Remember, it is possible to make errors and numbering your invoices is a simple way to help find them when they happen.

Give your clients the choice to pay in installments. Doing this will encourage more people to do business with you and ensure that you've got money coming in on a regular basis. Steady, regular payments, even if they're small, is a lot better than big payments that come in sporadically and you don't know when exactly they're going to come. When you have reliable income, you're better able to budget, pay your bills, and manage your money overall. This is a great boost to your confidence.

Make sure you account for every penny your business brings in. Make sure that you write down the amount from every payment you receive that's business related. You know who has already paid and who hasn't. In addition, you know exactly how much money you've got at any given time. It also makes it easy to figure out what you owe in taxes and how much you should pay yourself for that week or month.

There are lots of ways to practice self improvement in your business. Managing your money is one of those things. Everybody wishes that they could be better with money. When you learn proper money management, your self-confidence can be helped a lot. Moreover, your business and personal lives will be more organized. Implement the tips we shared in this article and you're sure to see good results in the long run.

Small Business Accountants Nantwich

Making sure your accounts are accurate can be a demanding job for anyone running a small business in Nantwich. Hiring the services of a small business accountant in Nantwich will permit you to run your business with the knowledge that your VAT, annual accounts and tax returns, and various other business tax requirements, are being fully met.

A competent small business accountant in Nantwich will regard it as their responsibility to develop your business, and provide you with reliable financial guidance for security and peace of mind in your specific circumstances. A quality accounting firm in Nantwich will give proactive small business guidance to maximise your tax efficiency while minimising business expenditure; critical in the sometimes shadowy sphere of business taxation.

You also ought to be provided with a dedicated accountancy manager who understands your company's situation, your business structure and your future plans.

Financial Actuaries Nantwich

Analysts and actuaries are business professionals in risk management. Such risks can impact both sides of the balance sheet and require valuation, asset management and liability management skills. An actuary uses math and statistical concepts to assess the financial impact of uncertainties and help clients limit risks. (Tags: Actuaries Nantwich, Actuary Nantwich, Financial Actuary Nantwich)

Auditors Nantwich

An auditor is a person or a firm appointed by a company to execute an audit, which is an official assessment of an organisation's financial accounts, typically by an independent body. Auditors analyze the fiscal actions of the firm which employs them to ensure the steady operation of the business. Auditors need to be approved by the regulating authority for auditing and accounting and have the necessary accounting qualifications. (Tags: Auditing Nantwich, Auditors Nantwich, Auditor Nantwich)

Payroll Services Nantwich

Dealing with staff payrolls can be a stressful aspect of running a company in Nantwich, regardless of its size. Dealing with payrolls demands that all legal requirements regarding their timing, transparency and accuracy are observed in all cases.

Small businesses may not have the help that a dedicated financial specialist can provide, and the simplest way to manage employee payrolls is to hire an outside Nantwich payroll company. Your payroll company will provide accurate BACS payments to your employees, as well as working together with any pension schemes your company may have, and use current HMRC regulations for deductions and NI contributions.

It will also be a requirement for a payroll management service in Nantwich to prepare an accurate P60 tax form for each employee at the end of the financial year (by 31st May). They will also provide P45 tax forms at the termination of a staff member's contract. (Tags: Payroll Accountants Nantwich, Payroll Services Nantwich, Company Payrolls Nantwich).

Nantwich accountants will help with sole traders, tax preparation, business support and planning, business disposal and acquisition Nantwich, financial statements, bureau payroll services Nantwich, company secretarial services, management accounts, bookkeeping, debt recovery, payslips, cash flow, HMRC submissions in Nantwich, accounting support services, estate planning, corporate finance Nantwich, monthly payroll in Nantwich, compliance and audit reporting, litigation support, VAT payer registration, National Insurance numbers in Nantwich, accounting services for buy to let landlords, contractor accounts, charities, pension forecasts in Nantwich, partnership registrations, consultancy and systems advice, capital gains tax, partnership accounts, general accounting services Nantwich, tax investigations, employment law and other accounting related services in Nantwich, Cheshire. Listed are just some of the activities that are handled by local accountants. Nantwich providers will tell you about their full range of accountancy services.

You do, of course have the perfect resource right at your fingertips in the form of the net. There is such a lot of information and inspiration readily available online for stuff like accounting for small businesses, self-assessment help, accounting & auditing and personal tax assistance, that you'll pretty soon be deluged with ideas for your accounting needs. An example could be this informative article covering five tips for finding a quality accountant.

Nantwich Accounting Services

- Nantwich Tax Returns

- Nantwich Personal Taxation

- Nantwich Forensic Accounting

- Nantwich Tax Services

- Nantwich Debt Recovery

- Nantwich Bookkeeping Healthchecks

- Nantwich VAT Returns

- Nantwich Financial Advice

- Nantwich Audits

- Nantwich Taxation Advice

- Nantwich Business Planning

- Nantwich Tax Refunds

- Nantwich PAYE Healthchecks

- Nantwich Tax Planning

Also find accountants in: Mount Manisty, Beeston, Bradfield Green, Bulkeley, Hough, Pulford, Manley, Bickerton, Moore, Gatesheath, Frodsham, Burland, Saughall, High Legh, Church Minshull, Gawsworth, Risley, Ince, Butt Green, Ollerton, Hulme Walfield, Moulton, Dunham On The Hill, Elworth, Haslington, Ashley, Brownlow Heath, Mere, Birch Heath, Spen Green, Congleton, Whitby, Jodrell Bank, Cat And Fiddle Inn, Timbersbrook and more.

Accountant Nantwich

Accountant Nantwich Accountants Near Nantwich

Accountants Near Nantwich Accountants Nantwich

Accountants NantwichMore Cheshire Accountants: Middlewich, Warrington, Winsford, Congleton, Poynton, Sandbach, Macclesfield, Lymm, Chester, Neston, Wilmslow, Alsager, Crewe, Nantwich, Northwich, Ellesmere Port, Runcorn, Knutsford, Frodsham and Widnes.

TOP - Accountants Nantwich - Financial Advisers

Cheap Accountant Nantwich - Bookkeeping Nantwich - Financial Advice Nantwich - Small Business Accountants Nantwich - Tax Advice Nantwich - Tax Preparation Nantwich - Financial Accountants Nantwich - Investment Accountant Nantwich - Online Accounting Nantwich