Accountants Washington: Filling out your yearly self-assessment form can certainly be a bit of a headache. Lots of self-employed people in Washington feel much the same as you. But how simple is it to obtain a local Washington professional who can do this on your behalf? Do you just find self-assessment too challenging to do on your own? You should expect to pay about £200-£300 when using the services of a regular Washington accountant or bookkeeper. Rather than using a local Washington accountant you could try one of the readily available online self-assessment services which may offer a saving on cost.

When hunting for a nearby Washington accountant, you'll find there are numerous different types available. Check that any potential Washington accountant is suitable for what you need. Some Washington accountants work within a larger accounting business, whilst others work independently. The various accounting disciplines can be better covered by an accountancy company with several experts under one roof. The level of expertise within a practice might include forensic accountants, management accountants, auditors, cost accountants, actuaries, bookkeepers, chartered accountants, tax accountants, investment accountants, accounting technicians and financial accountants.

You should take care to find a properly qualified accountant in Washington to complete your self-assessment forms correctly and professionally. Look for an AAT qualified accountant in the Washington area. You can then be sure your tax returns are done correctly. The accountants fees will count as a tax deductable expense, saving you a percentage of the costs.

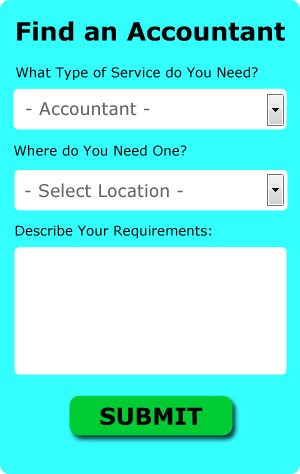

Though you may not have heard of them before there is an online service called Bark who can help you in your search. You only need to answer a few basic questions and complete a straightforward form. Sometimes in as little as a couple of hours you will hear from prospective Washington accountants who are keen to get to work for you. Why not give Bark a try since there is no charge for this useful service.

Making use of an online tax returns service is worth a try if your accounting needs are relatively simple. Services like this are convenient and cost effective. Some of these companies are more reputable than others. Reading through reviews for any potential online services is a good way to get a feel for what is out there. This is something you need to do yourself as we do not wish to favour any particular service here.

If you want to use the most qualified person to deal with your finances, a chartered accountant would be the choice. Their expertise is better suited to high finance and bigger businesses. Having the best person for the job may appeal to many.

If you choose to do your own tax returns there is plenty of help available on the HMRC website. There are a number of software programs which can be used in conjuction with the HMRC site to make doing self-assessment yourself easier. For example BTCSoftware, Keytime, Taxfiler, Gbooks, Ajaccts, ACCTAX, Taxshield, Capium, Ablegatio, 123 e-Filing, GoSimple, CalCal, Basetax, TaxCalc, Andica, Sage, Forbes, Taxforward, Xero, Absolute Topup and Nomisma. The most important thing is that you get your self-assessment tax return to HMRC in good time to avoid a penalty. You will receive a fine of £100 if you are up to three months late with your tax return.

Payroll Services Washington

A crucial component of any company in Washington, small or large, is having a reliable payroll system for its personnel. Coping with staff payrolls demands that all legal obligations regarding their exactness, timings and transparency are followed in all cases.

All small businesses don't have the help that a dedicated financial expert can provide, and an easy way to deal with employee pay is to use an independent Washington accounting company. The payroll management service will work alongside HMRC and pension scheme administrators, and oversee BACS payments to ensure accurate and timely payment to all personnel.

It will also be a requirement for a payroll management company in Washington to provide a P60 tax form for each worker at the conclusion of the financial year (by 31st May). Upon the termination of an employee's contract with your business, the payroll accountant should also provide an updated P45 outlining what tax has been paid in the last financial period. (Tags: Payroll Services Washington, Payroll Outsourcing Washington, Payroll Accountant Washington).

Actuaries Washington

Actuaries and analysts are business professionals in risk management. Actuaries apply their mathematical knowledge to estimate the risk and probability of future occurrences and to predict their financial impact on a business. To work as an actuary it's important to possess a mathematical, economic and statistical understanding of real-life situations in the world of business finance. (Tags: Actuary Washington, Actuaries Washington, Financial Actuary Washington)

Auditors Washington

An auditor is an individual or company brought in by a firm or organisation to complete an audit, which is an official inspection of the financial accounts, typically by an unbiased entity. Auditors analyze the monetary procedures of the firm that employs them to make certain of the steady running of the business. To work as an auditor, an individual should be certified by the regulating authority for accounting and auditing and have achieved specified qualifications.

Forensic Accounting Washington

When you are trying to find an accountant in Washington you will doubtless run into the phrase "forensic accounting" and be curious about what the difference is between a forensic accountant and a normal accountant. The actual word 'forensic' is the thing that gives a clue, meaning basically "suitable for use in a court of law." Using accounting, investigative skills and auditing to identify irregularities in financial accounts that have lead to theft or fraud, it's also sometimes referred to as 'forensic accountancy' or 'financial forensics'. Some of the bigger accountancy firms in and around Washington even have specialist sections investigating personal injury claims, tax fraud, professional negligence, insolvency, bankruptcy, money laundering and insurance claims. (Tags: Forensic Accountant Washington, Forensic Accountants Washington, Forensic Accounting Washington)

Washington accountants will help with HMRC liaison, inheritance tax, management accounts Washington, corporate finance Washington, audit and auditing, accounting services for media companies Washington, accounting services for the construction industry, self-employed registrations in Washington, taxation accounting services, employment law, cash flow in Washington, tax investigations, tax returns, general accounting services in Washington, double entry accounting, HMRC submissions, payslips, litigation support, corporate tax, business outsourcing, business support and planning, VAT returns, bookkeeping, financial statements in Washington, accounting services for buy to let rentals, payroll accounting, workplace pensions, financial and accounting advice, financial planning, company secretarial services, partnership registration Washington, business advisory Washington and other kinds of accounting in Washington, Tyne and Wear. Listed are just some of the activities that are conducted by local accountants. Washington professionals will inform you of their whole range of accounting services.

Washington Accounting Services

- Washington Specialist Tax

- Washington Personal Taxation

- Washington Payroll Management

- Washington VAT Returns

- Washington Debt Recovery

- Washington Chartered Accountants

- Washington Bookkeeping

- Washington Forensic Accounting

- Washington Tax Services

- Washington Account Management

- Washington Tax Returns

- Washington Financial Advice

- Washington PAYE Healthchecks

- Washington Business Planning

Also find accountants in: East Rainton, Hazlerigg, Ryhope, Byker, Ryton, Benton Square, South Hylton, Earsdon, Colliery Row, Felling, Heaton, New York, Kibblesworth, Marsden, Southwick, Coalburns, Callerton Lane End, Chopwell, Whickham, Rowlands Gill, Willington, Longbenton, Swalwell, Blaydon, Silksworth, Backworth, Hebburn, Roker, Newburn, East Boldon, Preston, Seaton Burn, Fatfield, Easington Lane, New Silksworth and more.

Accountant Washington

Accountant Washington Accountants Near Me

Accountants Near Me Accountants Washington

Accountants WashingtonMore Tyne and Wear Accountants: Whickham, Hetton-le-Hole, Gateshead, Longbenton, Jarrow, Wallsend, Whitley Bay, Tynemouth, Blaydon, Houghton-le-Spring, South Shields, Ryton, Sunderland, Newcastle, Hebburn and Washington.

TOP - Accountants Washington - Financial Advisers

Financial Accountants Washington - Bookkeeping Washington - Auditors Washington - Financial Advice Washington - Tax Return Preparation Washington - Small Business Accountants Washington - Online Accounting Washington - Investment Accountant Washington - Chartered Accountants Washington