Accountants Ashford: Completing your self-assessment form year after year can really give you a headache. You, along with plenty of others who are self-employed in Ashford, face this annual trauma. Is it a much better idea to get someone else to accomplish this task for you? If you find that doing your self-assessment tax return is too stressful, this may be the best alternative. Regular small business accountants in Ashford will probably charge about two to three hundred pounds for this service. You'll be able to get it done at a reduced rate by using one of the many online accounting services.

So, what should you expect to pay for this service and what do you get for your money? The internet seems to be the "in" place to look these days, so that would definitely be an excellent place to begin. Though, ensuring that you pick out an accountant you can trust might not be as straightforward. The fact that almost anyone in Ashford can claim to be an accountant is something you need to bear in mind. It's not even neccessary for them to have any qualifications.

For completing your self-assessment forms in Ashford you should find a properly qualified accountant. An accountant holding an AAT qualification should be perfectly capable of doing your self-assessments. It is worth paying a little more for that extra peace of mind. Remember that a percentage of your accounting costs can be claimed back on the tax return. Sole traders in Ashford may find that qualified bookkeepers are just as able to do their tax returns.

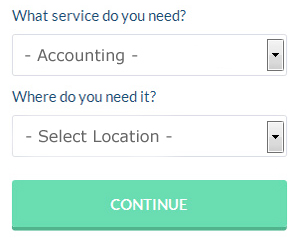

There is an online company called Bark who will do much of the work for you in finding an accountant in Ashford. A couple of minutes is all that is needed to complete their simple and straighforward search form. You should start getting responses from local Ashford accountants within the next 24 hours. You can use Bark to find accountants and other similar services.

If your accounting needs are pretty basic, you could consider using one of the cheaper online tax returns providers. For many self-employed people this is a convenient and time-effective solution. Some of these companies are more reputable than others. There are resources online that will help you choose, such as review websites.

It is actually not that difficult to do your own tax return, HMRC even has a series of You Tube videos to help you. A lot of software programs have been developed in recent years to help people do their own self assessment returns. Among the best known are CalCal, Ajaccts, Taxforward, Ablegatio, Forbes, TaxCalc, 123 e-Filing, Keytime, Gbooks, Absolute Topup, Taxfiler, Taxshield, Xero, ACCTAX, Basetax, Sage, BTCSoftware, Nomisma, GoSimple, Andica and Capium. Make sure your tax returns are sent off promptly to avoid getting a penalty fine. You can expect a fine of £100 if your assessment is in even 1 day late.

Proper Money Management Tips for Small Business Owners

Making a decision to put up your business is not hard, but knowing exactly how to start it is, and actually getting it up and running is much harder. It is most difficult to make your business profitable because there are so many things that can take place along the way that will not just negatively affect your business but your confidence level as well. Take for example your finances. If you don't learn proper money management, you and your business will be facing tough times. Many business owners disregard the important of money management because it's an easy and simple task during the beginning stages of a business. But as you grow your business, the money management aspect is only going to become more complex so it's a good idea to keep the following tips in mind.

Have an account that's just for your business expenses and another for your personal expenses. Sure, it may seem easy to manage your finances, personal and business, if you just have one account right now, but when your business really takes off, you're going to wish you had a separate account. And here's the thing -- if you run your business expenses through your personal account, it'll be a lot harder to prove your income. In addition, it will be difficult to sort through your financial record when tax season comes and figure out which expenses are business related and which expenses were personal in nature. Having separate accounts for your personal and business finances will save you a lot of headaches in the long run.

It's a good idea to do a weekly balancing of your books. However, if you have a traditional store where you have cash registers or you've got many payments from different people coming in, you may have to do the book balancing at the end of each day. Balance your books every day or every week to make sure that your numbers are the same as the numbers reflected in your bank account or cash you have on hand. This way at the end of each month or every quarter, you lessen your load of having to trace back where the discrepancies are in your accounting. If you regularly balance your books, you won't need to spend too long a time doing it. If you do it every once in a while, though, it can take hours.

Keep all of your receipts. These receipts are going to be heaven-sent if the IRS ever come knocking at your door demanding to see proof of what you've been spending and where you've been spending your money on. For another, they act as a record of all of your expenditures. It's better if you keep all your receipts in one drawer. This way, if you're wondering why your bank account is showing an expenditure for a certain amount, and you forgot to write it down, you can go through your receipts to find evidence of the purchase. Get yourself a small accordion file and keep your receipt there. Have this file easily accessible too.

A lot of things go into proper money management. You might assume that proper money management is a skill that isn't hard to acquire, but the reality is that it's a complicated process, especially when you're a small business owner. Make sure that you use the suggestions we've provided to help you track and manage your finances better. If you want your business to be profitable, you need to stay on top of your finances.

Ashford accountants will help with mergers and acquisitions in Ashford, National Insurance numbers, bureau payroll services, business start-ups Ashford, partnership accounts, litigation support, company formations, accounting services for buy to let property rentals, workplace pensions in Ashford, bookkeeping, PAYE, tax preparation, limited company accounting, business support and planning Ashford, accounting support services, accounting services for media companies in Ashford, auditing and accounting, HMRC liaison, personal tax, investment reviews, partnership registration in Ashford, contractor accounts in Ashford, employment law in Ashford, double entry accounting, payslips, inheritance tax, financial planning in Ashford, taxation accounting services, VAT returns, accounting and financial advice, cash flow, corporate finance and other accounting related services in Ashford, Kent. Listed are just an example of the activities that are conducted by local accountants. Ashford companies will inform you of their full range of services.

When hunting for inspiration and advice for personal tax assistance, accounting & auditing, accounting for small businesses and self-assessment help, you will not really need to look much further than the internet to get all of the guidance that you need. With such a diversity of skillfully written blog posts and webpages to select from, you will soon be brimming with amazing ideas for your upcoming project. The other day we stumbled on this article outlining five tips for selecting a quality accountant.

Ashford Accounting Services

- Ashford Tax Advice

- Ashford Chartered Accountants

- Ashford Payroll Management

- Ashford Tax Refunds

- Ashford Financial Audits

- Ashford Bookkeeping Healthchecks

- Ashford Auditing Services

- Ashford Tax Returns

- Ashford Self-Assessment

- Ashford Tax Planning

- Ashford Debt Recovery

- Ashford Business Accounting

- Ashford Specialist Tax

- Ashford Forensic Accounting

Also find accountants in: Otterden Place, Riverhead, St Leonards Street, Chattenden, Chipstead, Boughton Malherbe, Pean Hill, West Farleigh, Queenborough, Hook Green, Birchington, St Michaels, Tonbridge, Green Street Green, Higham, Detling, Coopers Corner, Tudeley, Staplehurst, Bonnington, Milebush, Shalmsford Street, Three Chimneys, Littlebourne, Ridley, Pluckley, Dartford, Stone, Boughton Aluph, Westmarsh, Blean, Dymchurch, Four Elms, Acrise Place, Warren Street and more.

Accountant Ashford

Accountant Ashford Accountants Near Me

Accountants Near Me Accountants Ashford

Accountants AshfordMore Kent Accountants: Biggin Hill, Folkestone, Sheerness, Strood, West Kingsdown, Ashford, Minster, Dartford, Northfleet, Canterbury, Lydd, Tenterden, Walmer, Edenbridge, Boxley, Rochester, Cranbrook, Meopham, Tonbridge, Broadstairs, Birchington-on-Sea, Westgate-on-Sea, Kingsnorth, Swanley, Pembury, Margate, Whitstable, Sandwich, Swanscombe, Faversham, East Malling, Sittingbourne, Gravesend, Chatham, Dover, Tunbridge Wells, Staplehurst, Southborough, Westerham, Sevenoaks, Snodland, Herne Bay, Gillingham, Deal, Ramsgate, Paddock Wood, Sturry, Aylesford, New Romney, Bearsted, Hartley, Maidstone and Wilmington.

TOP - Accountants Ashford - Financial Advisers

Online Accounting Ashford - Auditing Ashford - Self-Assessments Ashford - Small Business Accountants Ashford - Chartered Accountants Ashford - Investment Accountant Ashford - Financial Accountants Ashford - Tax Preparation Ashford - Affordable Accountant Ashford