Accountants Stafford: Does filling in your self-assessment tax form cause you problems every year? Other small businesses and sole traders in the Stafford area face the same predicament. But how can you find a local accountant in Stafford to accomplish this task for you? This could be the best option if you consider self-assessment just too taxing. You should expect to pay about £200-£300 when retaining the services of a regular Stafford accountant or bookkeeper. Instead of using a local Stafford accountant you could try one of the currently available online self-assessment services which may offer a saving on cost.

But exactly what will you need to pay, what level of service should you expect to receive and where can you uncover the best person? In the past the local newspaper or Yellow Pages would have been the first place to head, but these days the internet is much more popular. However, which of these Stafford accountants is the best choice for you and which can be trusted? In the United Kingdom there are no restrictions on who can offer accounting and bookkeeping services. They do not need to have any specific qualifications. Which does seem a bit crazy.

It is advisable for you to find an accountant in Stafford who is properly qualified. At the very least you should look for somebody with an AAT qualification. Whilst qualified accountants may cost slightly more than unqualified ones, the extra charges are justified. Your accountant will add his/her fees as tax deductable.

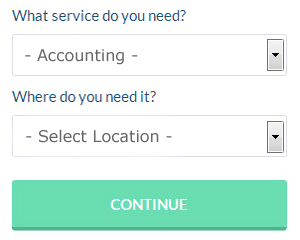

If you don't have the time to do a proper online search for local accountants, try using the Bark website. With Bark it is simply a process of ticking a few boxes and submitting a form. Your requirements will be distributed to accountants in the Stafford area and they will be in touch with you directly. Why not give Bark a try since there is no charge for this useful service.

If you think your needs are comparatively simple, using an online tax returns service will be your cheapest option. It could be that this solution will be more appropriate for you. Do some homework to single out a company with a good reputation. A quick browse through some reviews online should give you an idea of the best and worse services.

Although filling in your own tax return may seem too complicated, it is not actually that hard. To make life even easier there is some intuitive software that you can use. Including Taxshield, Gbooks, Nomisma, Forbes, BTCSoftware, Keytime, Ajaccts, CalCal, Capium, Taxfiler, Andica, 123 e-Filing, GoSimple, Absolute Topup, Ablegatio, Sage, Xero, Basetax, Taxforward, ACCTAX and TaxCalc. If you don't get your self-assessment in on time you will get fined by HMRC.

Small Business Accountants Stafford

Running a small business in Stafford is pretty stress-filled, without needing to fret about your accounts and other similar bookkeeping chores. A dedicated small business accountant in Stafford will provide you with a hassle-free solution to keep your tax returns, VAT and annual accounts in perfect order.

Offering guidance, ensuring that your business adheres to the optimum financial practices and suggesting techniques to help your business achieve its full potential, are just some of the duties of an experienced small business accountant in Stafford. A responsible accounting firm in Stafford should be able to give practical small business advice to optimise your tax efficiency while at the same time minimising expense; essential in the sometimes murky world of business taxation.

It is also essential that you clarify your company's financial circumstances, the structure of your business and your future plans accurately to your small business accountant.

Payroll Services Stafford

Staff payrolls can be a challenging aspect of running a business enterprise in Stafford, no matter its size. The legislation relating to payroll for accuracy and openness mean that running a business's payroll can be an intimidating task for the uninitiated.

Small businesses may not have the help that a dedicated financial expert can provide, and an easy way to take care of employee payrolls is to use an outside Stafford accounting company. Working with HMRC and pension schemes, a payroll service accountant will also manage BACS payments to personnel, making certain that they are paid on time each month, and that all required deductions are done accurately.

It will also be necessary for a qualified payroll management accountant in Stafford to provide an accurate P60 declaration for all workers at the end of the financial year (by 31st May). At the end of an employee's contract with your company, the payroll company will provide an updated P45 form relating to the tax paid in the previous financial period. (Tags: Payroll Outsourcing Stafford, Payroll Services Stafford, Payroll Accountants Stafford).

Developing Better Money Management Skills for Improving Yourself and Your Business

One of the most difficult parts of starting your own business is learning how to use proper money management techniques. Some people think that money management is a skill that should be already learned or mastered. The reality, however, is that budgeting and financial planning for your business is a lot different from budgeting and financial planning for your personal life. It does help a lot if you have some experience in the latter. Many business owners who have ruined their financial situation accidentally end up having no self-confidence at all. There are many things you can do to properly manage business finances and we'll share just a few of them in this article.

You shouldn't wait for the due date to pay your taxes. It may be that you won't have the funds you need to pay your taxes if your money management skills are poor. Here's what you can do: every day or every week, take a portion of the payments you receive and then put that in a separate account. When you do this, you're going to have the money needed to pay your taxes for the quarter. As a business owner, you'll be able to breathe easily each time knowing that you're able to pay your taxes fully and promptly.

Track your expenditures to the penny, and do this in both your personal and professional life. Yes, it is a pain to track every little thing you buy, but it is quite helpful. With this money management strategy, you can have a clear picture of just what your spending habits are. You wouldn't want to be like those people who wonder where their money went. If you keep a record of all your expenditures, you know exactly where you're spending your money. If your budget is a little too tight, you'll be able to identify expenditures that you can cut back on to save money. It will also help you streamline things when you need to fill out your tax forms.

Keep a complete accounting of how much business you generate down to the last penny. Each time you're paid by a client or customer for a service you provided or a product you sold them, record that amount. Doing this will help you know how much money you've got and know exactly who has already paid you. When you know what your income is, you'll also be able to figure out how much taxes you can expect to pay and even how much money you should pay yourself.

Learning how to manage your finances properly will help not just your business but yourself as well. The ones we've mentioned in this article are only a few of many other proper money management tips out there that will help you in keeping track of your finances better. You're in a much better position for business and personal success when you know how to manage your finances better.

Forensic Accountant Stafford

When you're looking to find an accountant in Stafford you'll possibly run into the phrase "forensic accounting" and be curious about what the differences are between a normal accountant and a forensic accountant. The clue for this is the word 'forensic', which basically means "relating to or denoting the application of scientific techniques and methods to the investigation of crime." Occasionally also referred to as 'forensic accountancy' or 'financial forensics', it uses accounting, investigative skills and auditing to inspect financial accounts so as to discover criminal activity and fraud. A few of the larger accounting firms in the Stafford area could even have independent forensic accounting divisions with forensic accountants targeting certain sorts of fraud, and might be dealing with insolvency, bankruptcy, professional negligence, tax fraud, insurance claims, personal injury claims and money laundering.

Stafford accountants will help with consultancy and systems advice, VAT registration, contractor accounts, charities, employment law, tax preparation Stafford, cash flow, business advisory services, year end accounts, investment reviews, payslips Stafford, company secretarial services, corporate finance Stafford, auditing and accounting, tax investigations, financial statements in Stafford, business outsourcing, financial and accounting advice, inheritance tax, PAYE, accounting services for the construction sector Stafford, small business accounting, assurance services, financial planning Stafford, payroll accounting in Stafford, estate planning in Stafford, corporate tax Stafford, management accounts in Stafford, retirement advice Stafford, general accounting services, business support and planning, mergers and acquisitions and other accounting services in Stafford, Staffordshire. Listed are just a selection of the tasks that are performed by local accountants. Stafford providers will keep you informed about their entire range of services.

Stafford Accounting Services

- Stafford Audits

- Stafford Bookkeeping Healthchecks

- Stafford PAYE Healthchecks

- Stafford Tax Services

- Stafford Financial Audits

- Stafford Business Accounting

- Stafford Tax Refunds

- Stafford Self-Assessment

- Stafford Tax Advice

- Stafford Tax Returns

- Stafford Chartered Accountants

- Stafford Specialist Tax

- Stafford Forensic Accounting

- Stafford Personal Taxation

Also find accountants in: Bonehill, Barlaston, Hazelslade, Stoke On Trent, Hanchurch, Gospel End, Thorpe Constantine, Bishops Offley, Codsall, Little Aston, Dunstall, Hilderstone, Cresswell, Standeford, Marchington Woodlands, Wootton, Hatherton, Little Bridgeford, Great Wyrley, Chesterton, Gnosall Heath, Cellarhead, Slindon, Knighton, Bridgtown, Alton, Edial, Sutton, Blithbury, Caverswall, Shenstone Woodend, Wombourne, Goldenhill, Gnosall, Dosthill and more.

Accountant Stafford

Accountant Stafford Accountants Near Me

Accountants Near Me Accountants Stafford

Accountants StaffordMore Staffordshire Accountants: Burslem, Longton, Leek, Lichfield, Fenton, Burntwood, Tamworth, Heath Hayes, Stafford, Hanley, Burton-upon-Trent, Wombourne, Rugeley, Stone, Biddulph, Uttoxeter, Hednesford, Stoke-on-Trent, Kidsgrove, Newcastle-under-Lyme and Cannock.

TOP - Accountants Stafford - Financial Advisers

Financial Accountants Stafford - Small Business Accountant Stafford - Bookkeeping Stafford - Self-Assessments Stafford - Financial Advice Stafford - Auditing Stafford - Chartered Accountant Stafford - Tax Accountants Stafford - Investment Accountant Stafford