Accountants Kendal: For Kendal individuals who are running a business or self-employed, there are many benefits to be had from using the professional services of an accountant. At the minimum your accountant can handle important tasks like completing your tax returns and keeping your books up to date, giving you more hours to concentrate on your business. The benefits of this sort of professional help far outweighs the additional costs involved. You might find that you need this help more as your Kendal business grows.

So, how do you go about acquiring an honest Kendal accountant? The internet is definitely the "in" place to look these days, so that would be an excellent place to begin. Yet, how do you identify which of these accountants are trustworthy? You shouldn't forget that advertising as a bookkeeper or accountant is something that virtually anyone in Kendal can do. It is not even neccessary for them to have any qualifications. Which, when considering the importance of the job would seem a tad strange.

It is advisable for you to find an accountant in Kendal who is properly qualified. For basic tax returns an AAT qualified accountant should be sufficient. Qualified Kendal accountants might charge a bit more but they may also get you the maximum tax savings. Your accounting fees can also be claimed as a business expense, thus reducing the cost by at least 20 percent.

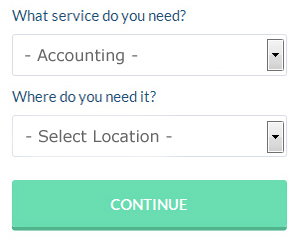

There is an online company called Bark who will do much of the work for you in finding an accountant in Kendal. You only need to answer a few basic questions and complete a straightforward form. All you have to do then is wait for some responses. This service is free of charge.

While using a qualified accountant is recommended, you could still opt for an online tax returns service which will be quite a bit cheaper. This type of service is growing in popularity. Make a short list of such companies and do your homework to find the most reputable. It should be a simple task to find some online reviews to help you make your choice.

If you really want the best you could go with a chartered accountant. These people are financial experts and are more commonly used by bigger companies. The decision of who to use is of course up to you.

It is actually not that difficult to do your own tax return, HMRC even has a series of You Tube videos to help you. There is also lots of software available to help you with your returns. These include Ajaccts, GoSimple, Nomisma, Taxfiler, BTCSoftware, ACCTAX, 123 e-Filing, Xero, Taxforward, Taxshield, Andica, Forbes, Keytime, Absolute Topup, Capium, CalCal, Sage, Ablegatio, Gbooks, Basetax and TaxCalc. The deadline for self-assessment is October 31st for paper returns and January 31st for online returns. You�ll get a penalty of £100 if your tax return is up to 3 months late.

Actuaries Kendal

An actuary gives advice on, measures and manages monetary and financial risks. Actuaries employ their mathematical expertise to evaluate the risk and probability of future occurrences and to predict their ramifications for a business and it's clients. Actuaries present reviews of financial security systems, with a focus on their mechanisms, their complexity and their mathematics. (Tags: Actuary Kendal, Actuaries Kendal, Financial Actuaries Kendal)

Staying on Top of Your Finances When You're a Business Owner

Want to put up your own business? Making the decision is quite easy. However, knowing exactly how to start it is a different matter altogether, and actually getting the business up and running can be a huge challenge. For many new business owners, it's hardest to make their business profitable mainly because of the things that can happen during the process that can adversely impact the business and their self-confidence. If you don't properly manage your money, for example, you and your business will suffer. During the initial stages of your business, managing your money may be a simple task. But as you grow your business, the money management aspect is only going to become more complex so it's a good idea to keep the following tips in mind.

Make sure you are numbering your invoices. You may not think that this simple tactic of keeping your invoices numbered is a big deal but wait till your business has grown. If you have an invoicing system, it won't be hard to track of them. This way you can find out quickly who still hasn't paid you and who has already. There are going to come times when a client will insist that he has paid you and having a numbered invoice to look up can be very helpful in that situation. Remember, it is possible to make errors and numbering your invoices is a simple way to help find them when they happen.

Set a salary and pay yourself on a regular basis even though you're running your own business and you may be the only "employee" you have This can make it easier to keep track of your accounting both in your personal life and your professional life. So how do you do this exactly? First, any payments you get from the sale of your products or services should go to your business account. Next, decide how often you want to receive a salary. Let's say you want to pay yourself once every month, such as on the 15th. When the 15th comes around, write yourself a check. You can decide how much you should pay yourself. You can set an hourly rate and then pay yourself the amount equivalent to how many hours you put into your business each month. You can also pay yourself based on how much income your business generated for that month.

Be a prompt tax payer. Typically, small businesses must pay taxes every quarter. Taxes are among the most confusing things, so it's best if you check with the IRS or the small business center in your area to get accurate information. You also have the option of working with a professional who can set up payment plans for you so you're sure that you're abiding by taxation laws and regulations. Having the IRS at your doorstep isn't something you'd want, believe me!

Whether you're a business owner or not, it's important that you learn proper money management. Your confidence and your business will sure be given a huge boost if you become skilled at managing your finances properly. Use the tips in this article to help you get started. Developing proper money management skills not only will help boost your business but boost your self-confidence as well.

Kendal accountants will help with audit and auditing, partnership accounts Kendal, financial statements Kendal, sole traders, accounting services for the construction industry in Kendal, general accounting services, self-employed registration in Kendal, bookkeeping, payroll accounting in Kendal, VAT returns, year end accounts Kendal, accounting support services, double entry accounting, personal tax in Kendal, debt recovery, employment law, estate planning, financial planning, mergers and acquisitions Kendal, company formations, annual tax returns, business outsourcing, business disposal and acquisition, corporation tax, partnership registration Kendal, tax preparation, tax investigations, corporate finance, pension forecasts, company secretarial services, accounting services for start-ups in Kendal, charities Kendal and other accounting services in Kendal, Cumbria. Listed are just a small portion of the tasks that are handled by local accountants. Kendal providers will be happy to tell you about their whole range of accountancy services.

Kendal Accounting Services

- Kendal Financial Advice

- Kendal Tax Planning

- Kendal Debt Recovery

- Kendal Tax Services

- Kendal Self-Assessment

- Kendal Chartered Accountants

- Kendal Bookkeeping Healthchecks

- Kendal Business Accounting

- Kendal VAT Returns

- Kendal Financial Audits

- Kendal PAYE Healthchecks

- Kendal Payroll Services

- Kendal Personal Taxation

- Kendal Forensic Accounting

Also find accountants in: Cliburn, Bassenthwaite, Penrith, Greenholme, Kirkby Stephen, Roadhead, Ponsonby, Parkend, Thwaite Head, Kents Bank, Newbiggin On Lune, Seaton, Silecroft, Cartmel, Stockdalewath, Low, Dundraw, Langrigg, Branthwaite, Drumburgh, Tindale, Keld, Durdar, Motherby, Hunsonby, Roa Island, Laversdale, Aikton, Winton, Moor Row, Rusland, Sleagill, Warwick Bridge, Blencogo, Beetham and more.

Accountant Kendal

Accountant Kendal Accountants Near Me

Accountants Near Me Accountants Kendal

Accountants KendalMore Cumbria Accountants: Kendal, Carlisle, Ulverston, Penrith, Maryport, Barrow-in-Furness, Workington and Whitehaven.

TOP - Accountants Kendal - Financial Advisers

Financial Advice Kendal - Financial Accountants Kendal - Tax Advice Kendal - Auditors Kendal - Chartered Accountant Kendal - Investment Accountant Kendal - Cheap Accountant Kendal - Small Business Accountant Kendal - Self-Assessments Kendal