Accountants Oldham: Do you get nothing but a headache when you fill out your annual self-assessment form? This is a frequent predicament for many others in Oldham, Greater Manchester. But is there a simple way to find a local Oldham accountant to do it for you? If you find that doing your self-assessment tax return is too stressful, this might be the best solution. This kind of service will usually cost about £200-£300 if you use a High Street accountant in Oldham. If you don't have any issues with online services you'll be able to get it done for a lower price than this.

So, what kind of accounting service should you look for and how much should you pay? A substantial list of potential Oldham accountants can be found with one swift search on the web. But, are they all trustworthy? In the British Isles there aren't any legal restrictions on who can and can't offer accounting and bookkeeping services. They are able to offer bookkeeping and accounting services in Oldham whether they have qualifications or not. Which, when considering the importance of the job would seem a tad bizarre.

If you want your tax returns to be correct and error free it might be better to opt for a professional Oldham accountant who is appropriately qualified. An AAT qualified accountant should be adequate for sole traders and small businesses. Qualified accountants may come with higher costs but may also save you more tax. The fees for completing your self-assessment tax return are a legitimate business expense and therefore qualify for a tax deduction. A lot of smaller businesses in Oldham choose to use bookkeepers rather than accountants.

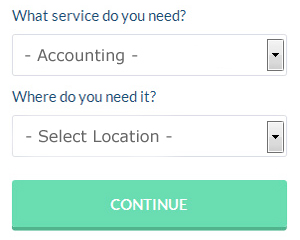

If you need a little help with your online search, there are numerous accountants who can be contacted through a website called Bark.com. You simply answer a few relevant questions so that they can find the most suitable person for your needs. Just sit back and wait for the responses to roll in. There is no fee for this service.

While using a qualified accountant is recommended, you could still opt for an online tax returns service which will be quite a bit cheaper. It could be that this solution will be more appropriate for you. You still need to do your homework to pick out a company you can trust. Check out some customer testimonials for companies you are considering.

If you are prepared to slash out and really get the best, you would be looking at using a chartered accountant for your finances. These high achievers will hold qualifications like an ACA or an ICAEW. The decision of who to use is of course up to you.

HMRC offers lots of help on completing tax returns, so you might even decide to do it yourself. A lot of software programs have been developed in recent years to help people do their own self assessment returns. Among the best known are 123 e-Filing, Ablegatio, Keytime, Gbooks, Basetax, Ajaccts, Taxshield, Xero, Absolute Topup, CalCal, Forbes, Capium, Taxfiler, BTCSoftware, Nomisma, Taxforward, ACCTAX, GoSimple, TaxCalc, Andica and Sage. Whether you do it yourself or use an accountant, your self-assessment must be submitted on time.

Small Business Accountants Oldham

Doing the accounts and bookkeeping can be a pretty stressful experience for any small business owner in Oldham. A decent small business accountant in Oldham will offer you a hassle-free means to keep your annual accounts, VAT and tax returns in perfect order.

Helping you expand your business, and offering sound financial advice relating to your specific circumstances, are just a couple of the ways that a small business accountant in Oldham can benefit you. The capricious and complex sphere of business taxation will be clearly laid out for you so as to reduce your business expenses, while at the same time maximising tax efficiency.

It is vital that you clarify your business structure, your company's situation and your future plans truthfully to your small business accountant.

Auditors Oldham

Auditors are specialists who evaluate the accounts of companies and organisations to check the legality and validity of their financial reports. Auditors examine the monetary procedures of the company that employs them and ensure the steady functioning of the organisation. Auditors need to be certified by the regulatory authority for accounting and auditing and also have the necessary accounting qualifications. (Tags: Auditing Oldham, Auditors Oldham, Auditor Oldham)

Payroll Services Oldham

For any business enterprise in Oldham, from large scale organisations down to independent contractors, payrolls for staff can be stressful. The legislation on payrolls and the legal obligations for accuracy and transparency means that dealing with a business's payroll can be an intimidating task.

Not all small businesses have the help that a dedicated financial expert can provide, and the best way to take care of employee pay is to use an external Oldham accountant. A payroll accountant will work along with HMRC, with pensions scheme administrators and deal with BACS payments to ensure that your employees are paid on time, and all mandatory deductions are accurate.

Following the current regulations, a qualified payroll accountant in Oldham will also provide every one of your workers with a P60 at the end of each fiscal year. Upon the termination of a staff member's contract with your company, the payroll accountant will also provide a current P45 form outlining what tax has been paid in the last financial period.

Self Improvement for Your Business Through Proper Money Management

Many business owners have discovered early on that it can be difficult to learn how to properly use money management techniques. Some people think that money management is a skill that should be already learned or mastered. However, there is a huge difference between managing your personal finances and managing your business finances, although it can help if you've got some experience in the former. Many business owners who have ruined their financial situation accidentally end up having no self-confidence at all. Continue reading if you want to know how you can better manage your business finances.

Avoid combining your business expenses and personal expenses in one account. You may not have problems in the beginning, but you can expect to have a hard time down the road. If you decide to use your personal account for running your business expenses, it can be a real challenge to prove your income. It will also be harder on you when it's time to file taxes because you'll need to identify which expenses were personal and which ones were related to your business. Streamline your process with two accounts.

You can help yourself by finding out how to keep your books. Having a system in place for your business and personal finance is crucial. You can do this simply by setting up a basic Excel spreadsheet or you could use bookkeeping software like Quicken or QuickBooks. In addition, you can make use of personal budgeting tools such as Mint.com. There are also many no-cost resources for those who own a small business to help them properly manage their bookkeeping. You'll know exactly what's happening to your business and personal finances when you've got your books in order. And if you simply can't afford to hire a bookkeeper at this time, you'll benefit from taking a basic bookkeeping and accounting class.

Fight the urge to spend unnecessarily. It is tempting, when you have money coming in, to start spending money on the things that you've wanted for a long time but couldn't afford. You should, however, spend money on things that will benefit your business. Anything you don't spend, put in your business savings account so you know you've got money for those unexpected business expenses. In addition, buying your office supplies in bulk will save you money. For your office equipment, it's much better if you spend a little more on quality rather than on equipment that you will have to replace often. As for your entertainment expenses, you need to be smart about it as well.

As a business owner, you can practice self-improvement in many ways. Having a business can help you hone your money management skills. Who doesn't wish they weren't better at managing their money? Your self-confidence can be given a huge boost when you learn how to manage your money properly. Most importantly, your business and personal life will become a lot easier to organize. Implement the tips we shared in this article and you're sure to see good results in the long run.

Oldham accountants will help with inheritance tax, accounting support services, self-employed registrations, annual tax returns, payslips, accounting and auditing, debt recovery, consulting services Oldham, small business accounting in Oldham, capital gains tax, HMRC submissions, financial planning, corporate finance, personal tax in Oldham, taxation accounting services, retirement planning, VAT returns, employment law, tax investigations, PAYE, VAT registration, National Insurance numbers, accounting services for media companies, accounting services for the construction industry, financial statements in Oldham, workplace pensions, management accounts, contractor accounts, company secretarial services, general accounting services Oldham, sole traders, accounting services for buy to let rentals Oldham and other kinds of accounting in Oldham, Greater Manchester. Listed are just a small portion of the activities that are conducted by local accountants. Oldham professionals will be happy to tell you about their whole range of accountancy services.

Using the world wide web as an unlimited resource it is quite simple to find a host of useful ideas and inspiration concerning personal tax assistance, accounting & auditing, self-assessment help and accounting for small businesses. To illustrate, with a quick search we found this compelling article on choosing an accountant for your business.

Oldham Accounting Services

- Oldham Tax Refunds

- Oldham Business Accounting

- Oldham Chartered Accountants

- Oldham Forensic Accounting

- Oldham Bookkeeping

- Oldham Tax Planning

- Oldham PAYE Healthchecks

- Oldham Tax Returns

- Oldham Financial Advice

- Oldham Tax Services

- Oldham Payroll Services

- Oldham Personal Taxation

- Oldham Financial Audits

- Oldham VAT Returns

Also find accountants in: Blackrod, Broadheath, Hollingworth, Halebarns, Ashton Under Lyne, Offerton, Heaviley, Dukinfield, Oldham, Grasscroft, Shuttleworth, Summerseat, Astley Green, Egerton, Red Rock, Heald Green, Tottington, Fishpool, Leigh, Prestolee, Haughton Green, Uppermill, Toppings, Bleak Hey Nook, Lane Head, Mellor, Orrell, Wingates, Kenyon, Diggle, Flixton, Harpurhey, Prestwich, Reddish, Cadishead and more.

Accountant Oldham

Accountant Oldham Accountants Near Me

Accountants Near Me Accountants Oldham

Accountants OldhamMore Greater Manchester Accountants: Walkden, Irlam, Whitefield, Sale, Dukinfield, Cheadle Hulme, Oldham, Denton, Romiley, Stockport, Chadderton, Atherton, Bolton, Eccles, Hyde, Farnworth, Manchester, Salford, Golborne, Rochdale, Stalybridge, Radcliffe, Gatley, Westhoughton, Altrincham, Bury, Droylsden, Ashton-under-Lyne, Wigan, Heywood, Urmston, Royton, Swinton, Leigh, Stretford, Ashton-in-Makerfield, Hindley, Middleton and Horwich.

TOP - Accountants Oldham - Financial Advisers

Investment Accounting Oldham - Cheap Accountant Oldham - Financial Advice Oldham - Online Accounting Oldham - Tax Advice Oldham - Financial Accountants Oldham - Bookkeeping Oldham - Small Business Accountant Oldham - Self-Assessments Oldham