Accountants Hamilton: Having an accountant at hand can be very beneficial to anyone running a business or being self-employed in Hamilton. One of the principal advantages will be that with your accountant managing the routine paperwork and bookkeeping, you should have more free time to devote to what you do best, the actual operation of your core business. The importance of getting this sort of financial help can't be overstated, particularly for start-ups and fledgling businesses who are not established yet.

Different sorts of accountant will be promoting their services in Hamilton. So, it's essential that you choose one that suits your exact needs. Accountants sometimes work on their own and sometimes as part of a much larger practice. Within an accountancy practice there will be specialists in distinct disciplines of accounting. The level of specialization within a practice might include management accountants, investment accountants, actuaries, costing accountants, tax preparation accountants, accounting technicians, financial accountants, bookkeepers, chartered accountants, auditors and forensic accountants.

Therefore you should check that your chosen Hamilton accountant has the appropriate qualifications to do the job competently. Membership of the AAT shows that they hold the minimum recommended qualification. If you want your self-assessment forms done properly it is worth paying extra for a qualified professional. Your accounting fees can also be claimed as a business expense, thus reducing the cost by at least 20 percent.

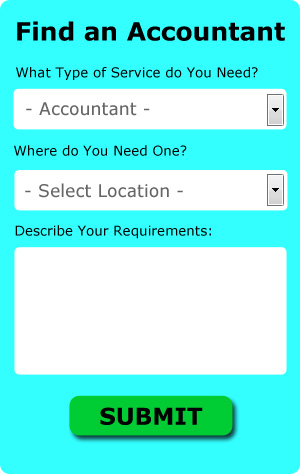

There is a unique online website called Bark which will actually find you a choice of accountants in the Hamilton area. All that is required is the ticking of a few boxes so that they can understand your exact needs. Accountants in your local area will be sent your details, and if they are interested in doing the work will contact you shortly. At the time of writing this service was totally free.

While using a qualified accountant is recommended, you could still opt for an online tax returns service which will be quite a bit cheaper. More accountants are offering this modern alternative. It would be advisable to investigate that any online company you use is reputable. Study online reviews so that you can get an overview of the services available. We are unable to advocate any individual accounting services on this site.

There is a series of You Tube videos, posted by HMRC, which will help if you decide to fill in your own form. The process can be simplified even further by the use of software such as Taxforward, Nomisma, Absolute Topup, Sage, ACCTAX, BTCSoftware, Xero, Keytime, Capium, CalCal, Ajaccts, GoSimple, Basetax, Ablegatio, Taxfiler, Taxshield, 123 e-Filing, Gbooks, Forbes, TaxCalc or Andica. Whichever service you use your tax returns will need to be in on time to avoid penalties.

Financial Actuaries Hamilton

An actuary measures, offers advice on and manages financial and monetary risks. An actuary employs statistical and financial practices to analyse the chance of a particular event happening and the possible monetary impact. Actuaries present judgements of financial security systems, with a focus on their complexity, mechanisms and mathematics.

Payroll Services Hamilton

An important element of any business enterprise in Hamilton, small or large, is having an effective payroll system for its staff. The laws relating to payroll requirements for openness and accuracy mean that running a company's staff payroll can be an intimidating task for those untrained in this discipline.

Using a professional accounting company in Hamilton, to deal with your payroll is the simple way to minimise the workload of yourself or your financial team. Your payroll company will manage accurate BACS payments to your personnel, as well as working together with any pension providers your company may have, and use current HMRC regulations for tax deductions and NI contributions.

It will also be a requirement for a payroll management company in Hamilton to prepare an accurate P60 tax form for all personnel after the end of the financial year (by 31st May). A P45 will also be presented to any employee who stops working for the business, in line with current legislation.

How Money Management Helps with Self Improvement and Business

If you're a new business owner, you'll discover that managing your money properly is one of those things you will struggle with sooner or later. Poor money management can be a real drag on your confidence, and when you are having money problems, you are more willing to take on any old job. This can cause you to not succeed in your business endeavor. Keep reading to learn a few tips you can use to help you manage your finances better.

In case you're paying many business expenses on a regular basis, you may find it easier to charge them on your credit card. Instead of having to pay many separate bills, you only have to pay your credit card bill each month. Of course, credit cards are tricky things, and if you let yourself carry a balance, the interest charges could make you pay a lot more money than you would have spent by simply paying the fees straight out of your bank account. Sure, you can keep putting your monthly expenditures on your credit card, but if you do, you should pay the balance in full each month. In addition to making it simpler for you to pay your expenses and avoid paying interest, you're building your credit rating.

Learn bookkeeping. Make sure you've got a system set up for your money, whether it's business or personal. You can either use basic spreadsheet or software such as QuickBooks. You could also try to use a personal budgeting tool like Mint.com. There are also many no-cost resources for those who own a small business to help them properly manage their bookkeeping. You'll know exactly what's happening to your business and personal finances when you've got your books in order. And if you simply can't afford to hire a bookkeeper at this time, you'll benefit from taking a basic bookkeeping and accounting class.

Don't throw away your receipt. For one, you'll need to have receipts because they're proof should the IRS want to know exactly what and where you have been spending your money on. They're also records of business related expenses. Keep them all in one central location. If you do this, you can easily track transactions or expenses. The best way to store your receipts is in an accordion file and then have this file in a drawer in your desk so you can easily go through your receipts if you need to.

When you're in business, there are plenty of opportunities for you to improve yourself in the process. For one, you can improve how you manage your money. Most people wish they were better money managers. When you learn proper money management, your self-confidence can be helped a lot. In addition, it becomes easier to organize most areas of your professional and personal life. There are many other money management tips out there that you can apply to your small business. Give the ones we provided here a try and you'll see yourself improving in your money management skills soon.

Hamilton accountants will help with litigation support in Hamilton, audit and compliance reporting in Hamilton, bureau payroll services, tax preparation, business disposal and acquisition, small business accounting, accounting services for the construction sector in Hamilton, monthly payroll in Hamilton, annual tax returns, business outsourcing in Hamilton, limited company accounting Hamilton, corporation tax in Hamilton, corporate finance, business support and planning, debt recovery, VAT returns, tax investigations, accounting services for start-ups, estate planning, consultancy and systems advice, consulting services, financial statements Hamilton, workplace pensions, inheritance tax in Hamilton, company formations Hamilton, employment law, PAYE in Hamilton, capital gains tax in Hamilton, accounting services for buy to let landlords, accounting support services, company secretarial services Hamilton, investment reviews in Hamilton and other professional accounting services in Hamilton, Scotland. Listed are just some of the duties that are handled by nearby accountants. Hamilton companies will be happy to tell you about their entire range of accounting services.

When you are hunting for inspiration and advice for personal tax assistance, self-assessment help, auditing & accounting and accounting for small businesses, you do not really need to look any further than the world wide web to get everything you could need. With such a diversity of diligently researched webpages and blog posts at your fingertips, you will quickly be overwhelmed with creative ideas for your forthcoming project. We recently stumbled on this engaging article on the subject of how to obtain an accountant to fill in your annual tax return.

Hamilton Accounting Services

- Hamilton Bookkeeping

- Hamilton Tax Returns

- Hamilton Taxation Advice

- Hamilton Personal Taxation

- Hamilton Chartered Accountants

- Hamilton Debt Recovery

- Hamilton Payroll Management

- Hamilton PAYE Healthchecks

- Hamilton Auditing

- Hamilton Tax Investigations

- Hamilton Tax Refunds

- Hamilton VAT Returns

- Hamilton Business Accounting

- Hamilton Account Management

Also find accountants in: Arbroath, Fraserburgh, Broxburn, Dunfermline, East Kilbride, Kintore, Kelso, Stonehaven, Port Glasgow, Grangemouth, Penicuik, Ellon, St Andrews, Peterhead, Clydebank, Airdrie, Kilmarnock, Irvine, Stirling, Inverurie, Bellshill, Bonnybridge, Johnstone, Elgin, Renfrew, Wishaw, Peebles, Motherwell, Kirkcaldy, Glenrothes, Falkirk, Bishopbriggs, Edinburgh, Livingston, Barrhead and more.

Accountant Hamilton

Accountant Hamilton Accountants Near Me

Accountants Near Me Accountants Hamilton

Accountants HamiltonMore Scotland Accountants: Stirling, Livingston, Kilmarnock, Coatbridge, Greenock, Airdrie, Falkirk, Aberdeen, Kirkcaldy, Ayr, Motherwell, Glasgow, Dunfermline, Dundee, Perth, Glenrothes, Dumfries, Cumbernauld, Paisley, Irvine, Hamilton, Inverness, East Kilbride and Edinburgh.

TOP - Accountants Hamilton - Financial Advisers

Small Business Accountant Hamilton - Self-Assessments Hamilton - Investment Accountant Hamilton - Financial Advice Hamilton - Tax Return Preparation Hamilton - Tax Advice Hamilton - Online Accounting Hamilton - Auditors Hamilton - Bookkeeping Hamilton