Accountants Reading: Does completing your yearly self-assessment form give you nightmares? You and many others in Reading have to face this every year. Is it a better idea to get someone else to do this job for you? Perhaps it is simply the case that self-assessment is too complicated for you to do on your own. A regular accountant in Reading is liable to charge you around £200-£300 for the privilege. By utilizing an online service as opposed to a local Reading accountant you can save quite a bit of money.

But exactly what will you have to pay, what standard of service should you expect and where can you locate the right individual? Finding a few local Reading accountants should be fairly simple by doing a a swift search on the net. Yet, which accountants can you trust to do a decent job for you? The truth of the matter is that in the UK anyone can start up in business as an accountant or bookkeeper. Qualifications are not even a prerequisite.

Therefore you should check that your chosen Reading accountant has the appropriate qualifications to do the job competently. For basic tax returns an AAT qualified accountant should be sufficient. While it may be the case that hiring a qualified accountant is more costly, you can have more confidence in the service you are given. The costs for accounting services can be claimed back as a tax deduction which reduces the fee somewhat. Small businesses and sole traders can use a bookkeeper rather than an accountant.

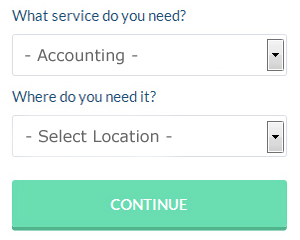

If you need a little help with your online search, there are numerous accountants who can be contacted through a website called Bark.com. All that is required is the ticking of a few boxes so that they can understand your exact needs. Sometimes in as little as a couple of hours you will hear from prospective Reading accountants who are keen to get to work for you. There is no fee for this service.

A more cost-effective solution for those with straightforward tax returns would be to use an online self-assessment service. Over the last few years many more of these services have been appearing. You still need to do your homework to pick out a company you can trust. Have a good look at customer testimonials and reviews both on the company website and on independent review websites.

Of course, completing and sending in your own self-assessment form is the cheapest solution. Available software that will also help includes Keytime, GoSimple, Forbes, TaxCalc, Basetax, Sage, 123 e-Filing, Gbooks, Andica, BTCSoftware, Nomisma, Taxfiler, Taxshield, Ablegatio, Absolute Topup, Xero, CalCal, ACCTAX, Capium, Ajaccts and Taxforward. The deadline for self-assessment is October 31st for paper returns and January 31st for online returns. The standard fine for being up to three months late is £100.

Auditors Reading

Auditors are experts who examine the fiscal accounts of organisations and companies to check the legality and validity of their financial reports. Auditors evaluate the fiscal actions of the company that employs them to make certain of the steady running of the business. Auditors should be certified by the regulating body for auditing and accounting and have the necessary qualifications.

Actuary Reading

Analysts and actuaries are experts in risk management. They use their comprehensive knowledge of business and economics, along with their expertise in statistics, probability theory and investment theory, to provide commercial, financial and strategic guidance. Actuaries supply assessments of financial security systems, with an emphasis on their complexity, their mathematics, and their mechanisms. (Tags: Actuary Reading, Actuaries Reading, Financial Actuaries Reading)

Payroll Services Reading

For any business in Reading, from independent contractors to large scale organisations, payrolls for staff can be complicated. Controlling company payrolls demands that all legal obligations regarding their transparency, timing and exactness are observed in all cases.

Using a professional company in Reading, to take care of your payroll requirements is the simple way to lessen the workload of your own financial team. Your payroll accounting company will manage accurate BACS payments to your personnel, as well as working along with any pension providers that your company might have, and follow the latest HMRC regulations for NI contributions and tax deductions.

It will also be necessary for a qualified payroll management accountant in Reading to provide an accurate P60 tax form for all staff members at the conclusion of the financial year (by 31st May). They will also provide P45 tax forms at the end of a staff member's contract.

Reading accountants will help with contractor accounts, cash flow, investment reviews in Reading, accounting support services, business start-ups, partnership accounts, accounting and financial advice in Reading, bookkeeping, taxation accounting services, debt recovery in Reading, estate planning, year end accounts, corporate finance, tax preparation Reading, self-employed registration Reading, employment law, pension forecasts, consultancy and systems advice, mergers and acquisitions, corporate tax, PAYE in Reading, charities, general accounting services, partnership registrations, consulting services, payslips Reading, financial statements in Reading, double entry accounting, limited company accounting Reading, financial planning, business advisory in Reading, audit and auditing and other types of accounting in Reading, Berkshire. These are just a few of the activities that are performed by local accountants. Reading companies will let you know their whole range of services.

You actually have the best resource right at your fingertips in the form of the world wide web. There's such a lot of information and inspiration available online for things like auditing & accounting, personal tax assistance, small business accounting and self-assessment help, that you'll very quickly be swamped with suggestions for your accounting needs. An illustration might be this illuminating article describing choosing the right accountant for your business.

Reading Accounting Services

- Reading Audits

- Reading Account Management

- Reading Specialist Tax

- Reading Personal Taxation

- Reading Debt Recovery

- Reading Bookkeeping Healthchecks

- Reading Financial Audits

- Reading Chartered Accountants

- Reading Tax Returns

- Reading Tax Refunds

- Reading Self-Assessment

- Reading Bookkeeping

- Reading Business Accounting

- Reading Tax Advice

Also find accountants in: Sulham, Beedon, East Garston, Purley On Thames, Holyport, Chaddleworth, Aldermaston, Spital, Bracknell, Chieveley, Aldworth, Winnersh, Bagnor, Arborfield Garrison, Donnington, Sheffield Bottom, Hurley, Greenham, Chapel Row, Bisham, Farnborough, Wash Common, Wickham, Hungerford Newtown, Ufton Nervet, Sulhamstead, Knowl Hill, Datchet, Stanford Dingley, Swallowfield, Farley Hill, Tidmarsh, East Ilsley, Crowthorne, Bradfield and more.

Accountant Reading

Accountant Reading Accountants Near Me

Accountants Near Me Accountants Reading

Accountants ReadingMore Berkshire Accountants: Crowthorne, Sunninghill, Twyford, Slough, Wokingham, Newbury, Thatcham, Winkfield, Woodley, Reading, Sandhurst, Maidenhead, Windsor, Tilehurst, Bracknell, Finchampstead and Ascot.

TOP - Accountants Reading - Financial Advisers

Financial Accountants Reading - Investment Accounting Reading - Online Accounting Reading - Self-Assessments Reading - Financial Advice Reading - Chartered Accountants Reading - Tax Advice Reading - Small Business Accountant Reading - Tax Preparation Reading